Will Ethereum Continue Its Bullish Streak As Tom Lee’s BitMine Adds $65M In ETH?

Ethereum has shown signs of renewed momentum, climbing 6.7% over the past week and briefly reclaiming the $3,400 level on Wednesday, January 14. As of early January 17 (around 2:30 a.m. EST), the price has pulled back slightly to $3,291, with 24-hour trading volume dropping 21% to $20.5 billion suggesting a quieter day of activity amid consolidation.

This recent uptick comes against a backdrop of sustained institutional interest in the asset, which could help fuel further gains in the near term.

Ethereum Sees Significant Institutional, ETF Inflows

Ethereum continues to attract strong interest from institutional investors, with spot Ethereum exchange-traded funds (ETFs) seeing nearly $500 million in inflows in the last week, according to Coinglass data.

Wednesday alone brought in $175.1 million, marking the biggest single-day ETF inflow of 2026 and the highest since December 2025.

While weekly and daily trading volumes take a plunge, some firms, like Bitmine, led by Wall Street Strategist Tom Lee, are still adding ETH to their holdings.

The most recent purchase by Bitmine was $65 million worth of Ethereum, which highlights growing institutional confidence in the cryptocurrency.

This move by Tom Lee’s crypto infrastructure firm underscores Ethereum’s growing appeal beyond its smart contract capabilities, as it gains traction across DeFi, NFTs, and tokenized assets.

Moreover, the acquisition reflects a broader trend of institutional interest in the king of altcoins, which is seen as a versatile asset with potential for scalability improvements and future demand from a possible spot ETH ETF.

Such institutional activity could bolster Ethereum’s price stability, especially in volatile market conditions.

Will Ethereum Surge Again From Here?

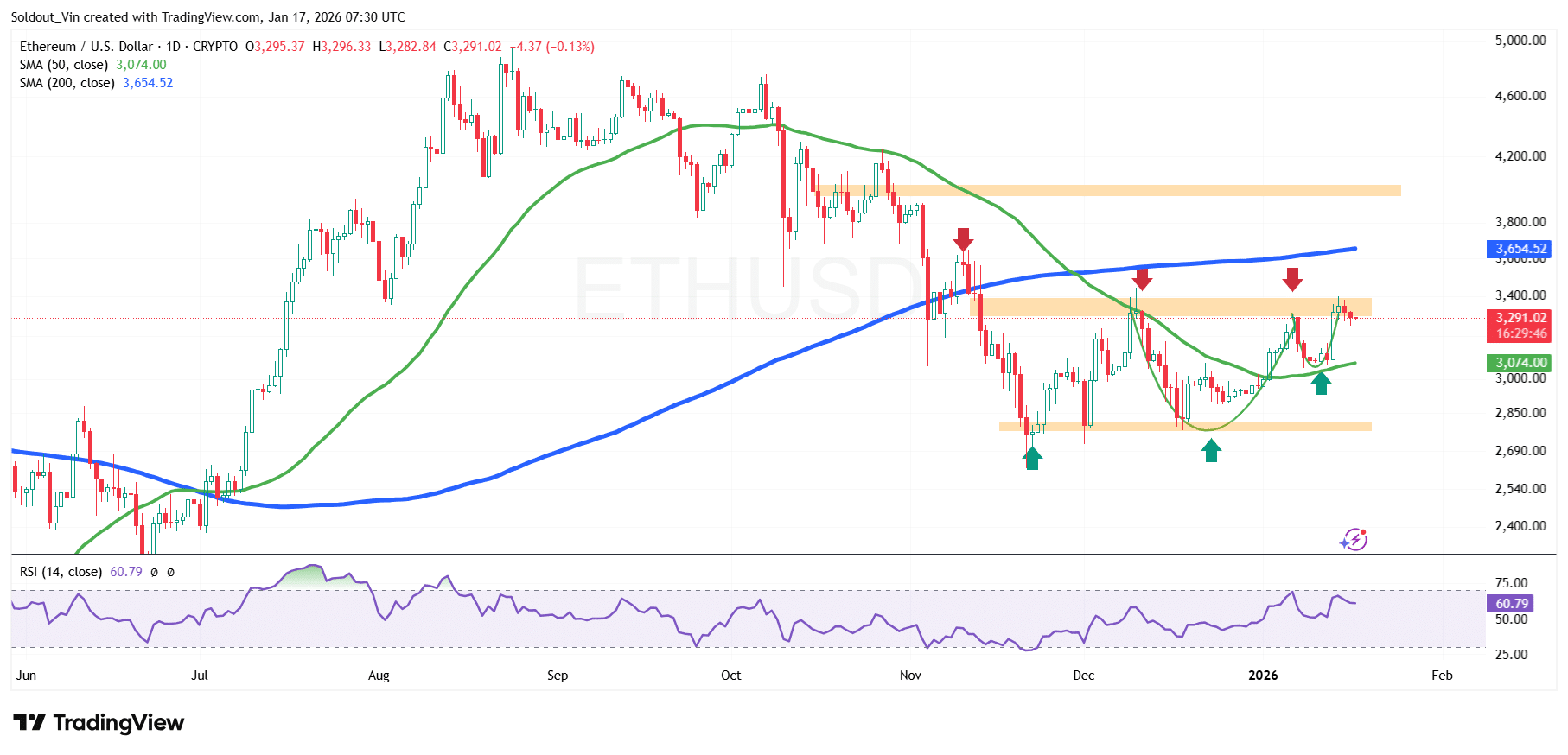

Ethereum price is currently consolidating above the $3,070 support zone, which aligns closely with the 50-day Simple Moving Average (SMA). The recent rebound from the $2,750–$2,850 demand area indicates that buyers are actively defending this region, forming a higher low on the daily chart.

As a result, ETH has successfully reclaimed the 50-day SMA at $3,074, which supports a short-term bullish outlook. However, the 200-day SMA at $3,654 remains a key overhead resistance. Multiple rejections near this level suggest that sellers are still active, making it a critical barrier for trend continuation.

Ethereum’s Relative Strength Index (RSI) is currently around 60.79, which is above the neutral 50 level but below overbought conditions. This indicates that bullish momentum is building while still leaving room for further upside before the market becomes overheated.

At the same time, the price structure shows a rounded bottom formation and improving momentum, signaling a potential trend transition phase rather than a confirmed breakout.

ETH/USD Chart Analysis: TradingView

ETH/USD Chart Analysis: TradingView

The 1-day ETH/USD chart analysis suggests that Ethereum could attempt a move toward the $3,350–$3,450 resistance zone, which previously acted as support. A daily close above this area could open the door for a retest of the 200-day SMA near $3,650, marking the next major upside target.

On the downside, if the price of ETH fails to hold above the 50-day SMA, short-term profit-taking could push the price back toward the $2,850 support zone, where buyers have previously stepped.

Overall, Ethereum is showing early signs of recovery, but a confirmed bullish continuation will require a clean break and acceptance above the 200-day SMA.

Related News:

You May Also Like

Tom Lee, 2026’yı “Ethereum Yılı” İlan Etti: Fiyat Tahminini Paylaştı!

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings