5 Months To $50? XRP’s ‘Alignment’ Has Traders On Edge

According to veteran investor Pumpius, who says he has watched crypto since 2013, XRP may be poised for a sharp move higher. He outlines nine catalysts that he believes could push the price toward double digits, and even as high as $50, all within the next five months.

ETF Approvals Could Unlock Institutional Flows

Reports have disclosed that the SEC has sped up ETF reviews, and several crypto funds already list XRP, including Grayscale’s Multi-Asset Fund.

Pumpius says a standalone XRP spot ETF is likely to arrive soon because deadlines are closing in. He argues that when ETFs go live, institutional money will pour in, raising liquidity and lifting prices quickly.

Ripple’s Global Deals Add Use Case Pressure

Ripple’s push into banking corridors is being pointed to as another engine for demand. Based on reports, the firm has deals with banks like BNY, SBI in Japan, and Santander.

Pumpius says these partnerships create real-world need for liquidity, which could increase XRP use. The acquisition of Hidden Road, a prime broker, is also highlighted as a bridge to traditional finance that could make it easier for big players to access XRP liquidity pools.

Legal Ruling Draws Clearer LinesAccording to Pumpius, the legal picture for XRP has improved after Ripple and the SEC dropped appeals and a court sided with XRP’s non-security status. He calls this legal clarity a major positive and claims XRP now stands on firmer ground than many peers in the US.

That view is shared by several in the community, though some analysts remain cautious and ask for further regulatory signals before calling it settled.

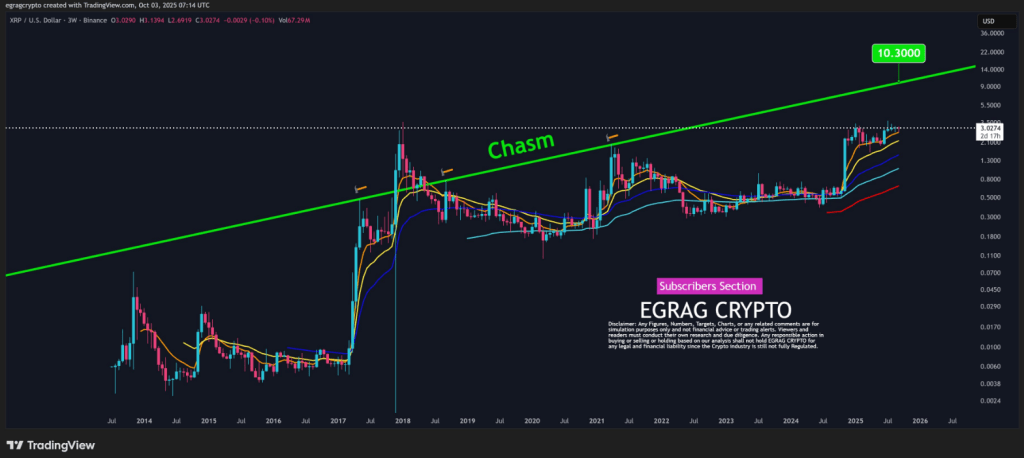

Market structure is cited as a trigger. Reports say order book liquidity has tightened and price action shows compression. Pumpius likens it to a spring that could uncoil with volatility once big orders hit.

Bitcoin’s recovery to about $122,000 is also being watched for its influence on alt momentum. XRP trades around $3.02 as of the latest reports.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

ArtGis Finance Partners with MetaXR to Expand its DeFi Offerings in the Metaverse