ETH Price Dips 3.15% Toward $3,200—Why Ethereum Could Be Setting Up For A Strong Rebound

The post ETH Price Dips 3.15% Toward $3,200—Why Ethereum Could Be Setting Up For A Strong Rebound appeared first on Coinpedia Fintech News

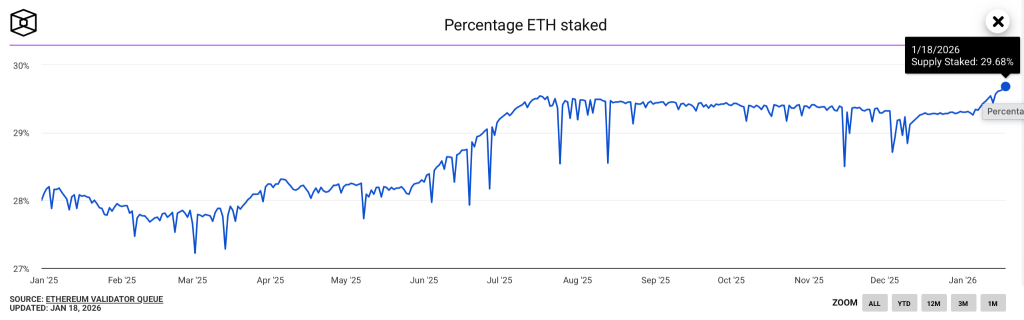

The crypto markets seem to have been engulfed by the bearish forces as the ETH Price slid dropped below $3300. Despite this, the Ethereum price is showing fresh signs of tightening supply as staking-related metrics heat up again. On-chain dashboards tracking Beacon Chain flows and validator activity indicate a renewed appetite for locking ETH into network security, even as the price consolidates near a critical support band.

Data shows Ethereum’s Proof-of-Stake ecosystem is entering 2026 with elevated deposits, a climbing validator entry queue, and a sharp rise in new addresses. This combination can support the “reduced liquid float” narrative. Regardless of these bullish factors, the ETH price continues to accumulate below the threshold. This raises questions about when the token will trigger a breakout beyond the consolidated phase.

Ethereum Stakings SkyRockets

Ethereum has been displaying a stable upswing since the beginning. Besides, the ETH staking that began before the Merger has reached a peak. A huge section of the circulating supply is staked, which is a massive bullish signal for the crypto.

Staked ETH has risen to a record ~36 million ETH, which is roughly ~30% of the circulating supply. Meanwhile, Ethereum’s deposit contract balance has been reported at roughly 77.85M ETH, representing about 46.6% of the total supply in some trackers. In other words, staking is at an all-time high, but “half locked” is better described as a high concentration of ETH held in the PoS deposit contract.

A 30% staked circulating supply suggests strong long-term belief, reduced immediate sell pressure, and favourable conditions for upside, but price action and demand catalysts ultimately determine whether that bullish structure turns into a breakout. On the other hand, a large number of validators want to stake ETH as the validators’ waiting queue to start staking has risen sharply to 2.5 million, the highest in history.

On the contrary, the exit queue or the validators who want to withdraw have reached almost zero, signalling low sell pressure from them.

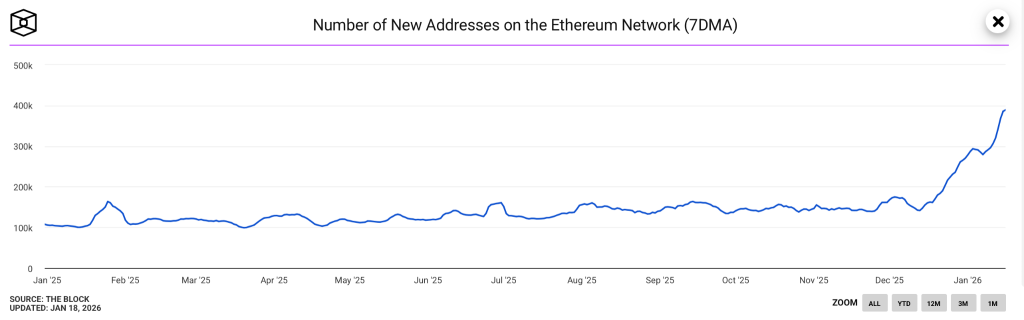

New Ethereum Addresses Surge Into January: Activity Is Picking Up

After a long flat trend, the Ethereum network activity has risen strongly. Ethereum’s 7-day moving average of new addresses has climbed sharply into January 2026, pushing to the highest levels on the chart.

Currently, the ETH addresses are hovering between 110K and 160K per day, reflecting a steady baseline adoption even in times of consolidation. In late December and earlier this month, the metric broke out aggressively towards 400K addresses. It can be considered as an early bull market signal, as historically sharp increases in active addresses lead to a confirmed breakout.

When Will the ETH Price Break the Barrier at $3500?

After the latest pullback, the Ethereum price is trading within a strong resistance and support zone. Both the bulls and bears appear to have been extremely active, which has kept the trade between $3,150 and $3,300. The current chart dynamics suggest the consolidation is expected to continue, as the rally is yet to reach the apex of a decisive pattern.

The price is trading within the demand and support zone, which appears to be pretty strong. The RSI is also rising within the parallel channel and is testing the lower support of the channel. Therefore, the level is expected to flip, which may prevent the price from plunging below the $3,050 range. However, with this, the RSI is expected to enter the overbought zone, flashing some bearish signals for the crypto. Therefore, unless the price continues to accumulate strength between $3,280 and $3,220, the bullish momentum may prevail.

The volatility across the platform is dropping, which is compressing the price action. Excess compression could eventually lead to a larger breakout and push the Ethereum (ETH) price towards $3500 by the end of the month.

You May Also Like

Vitalik Buterin Supports Native Rollup Integration on Ethereum

NEAR Price Prediction: Testing Critical $1.88 Resistance with $2.10-$2.35 Targets by February 2026