Makina Finance Suffers $4.2M Exploit as Hacker Drains Curve Pool

The post Makina Finance Suffers $4.2M Exploit as Hacker Drains Curve Pool appeared first on Coinpedia Fintech News

Makina Finance, a non-custodial DeFi execution platform, has been hit by a major exploit that resulted in losses of roughly 1,299 ETH, valued at around $4.2 million.

The attack drained a key CurveStable pool, which triggered concerns about fund safety. As of now, there is no update from Makina Finance regarding the hack.

Makina Finance Exploit Drains Curve Pool Funds

According to blockchainsecurity firm PeckShieldAlert, Makina Finance’s DUSD/USDC CurveStable pool was drained through an exploit. The attack targeted the non-custodial DeFi execution engine and led to losses of roughly 1,299 ETH, worth about $4.13 million at the time.

After draining the pool, the attacker quickly converted the stolen tokens into ETH, which offers higher liquidity and easier movement across wallets and the Ethereum network.

This step is commonly seen in DeFi exploits, especially when attackers plan to move large sums without causing immediate alerts.

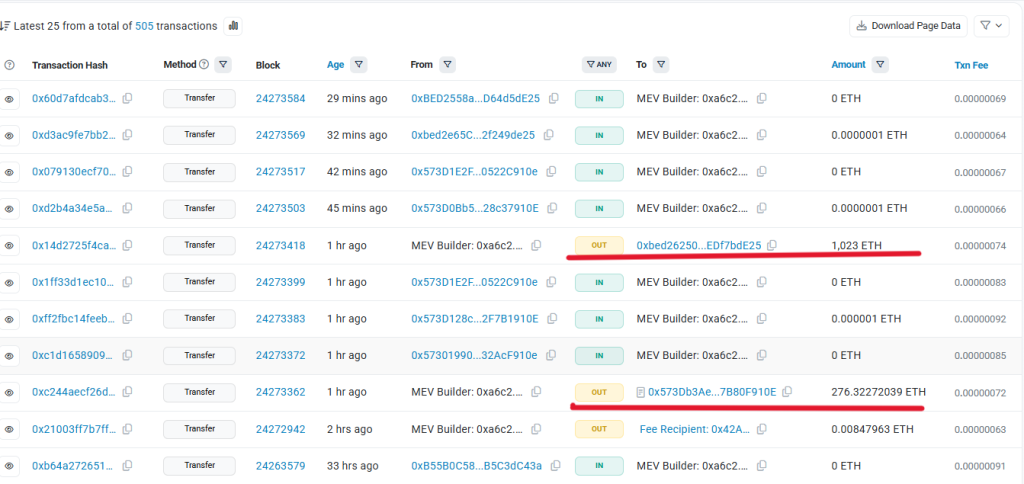

MEV Builder Used to Hide Transaction Trail

Further on-chain data shows that the hacker routed the ETH through an MEV builder address. This method helps hide transaction paths and makes tracking more difficult, due to blurred transaction patterns.

Following the MEV routing, the ETH was split into two main wallets. One wallet (0xbed….bdE25) currently holds 1,023 ETH, worth around $3.3 million, while a second wallet (0x573….F910E) contains 276 ETH, valued near $880,000.

Meanwhile, the stolen fund is kept in these two wallet, as of now, there is no evidence of funds being sent to exchanges.

No Update From Makina Finance

Until now their is no update from Makina Finance regarding the hack. There has been no confirmation about user impact, recovery efforts, or planned security fixes.

The lack of communication has added to user uncertainty, while investigators continue to monitor wallet activity and track any further movement of the stolen funds.

You May Also Like

The Channel Factories We’ve Been Waiting For

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC