Crypto companies can’t afford inexperienced marketers in a regulated era | Opinion

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

The crypto industry is hiring the wrong marketers, and it’s costing the market real money. The sector’s post-exchange-traded fund visibility has vaulted crypto into mainstream finance, but many teams still staff marketing like a hackathon. It’s all junior hires, celebrity tie-ins, and virality over compliance and craft.

- Crypto marketing has outgrown hackathon culture — junior, viral-first, celebrity-driven strategies are now dangerous in a regulated environment and are leading directly to fines, bans, and reputational damage.

- Marketing is now a compliance function as much as a growth function — firms must prioritize experienced, regulation-literate leaders and treat distribution channels like financial infrastructure, not social media stunts.

- The winning strategy is senior talent plus structured education — hire from regulated finance, pair with crypto-native voices, and invest in deep onboarding to build durable, trusted distribution.

That model was already risky when crypto lived at the fringe, but it’s clearly untenable now that regulated products sit in retirement accounts and on brokerage screens. So, here’s the argument some will dislike: Digital asset companies that prioritize experienced and regulation-literate marketing leaders will stay afloat. They should consider funding structured education for each and every new hire, even if that slows headcount growth and raises salary costs.

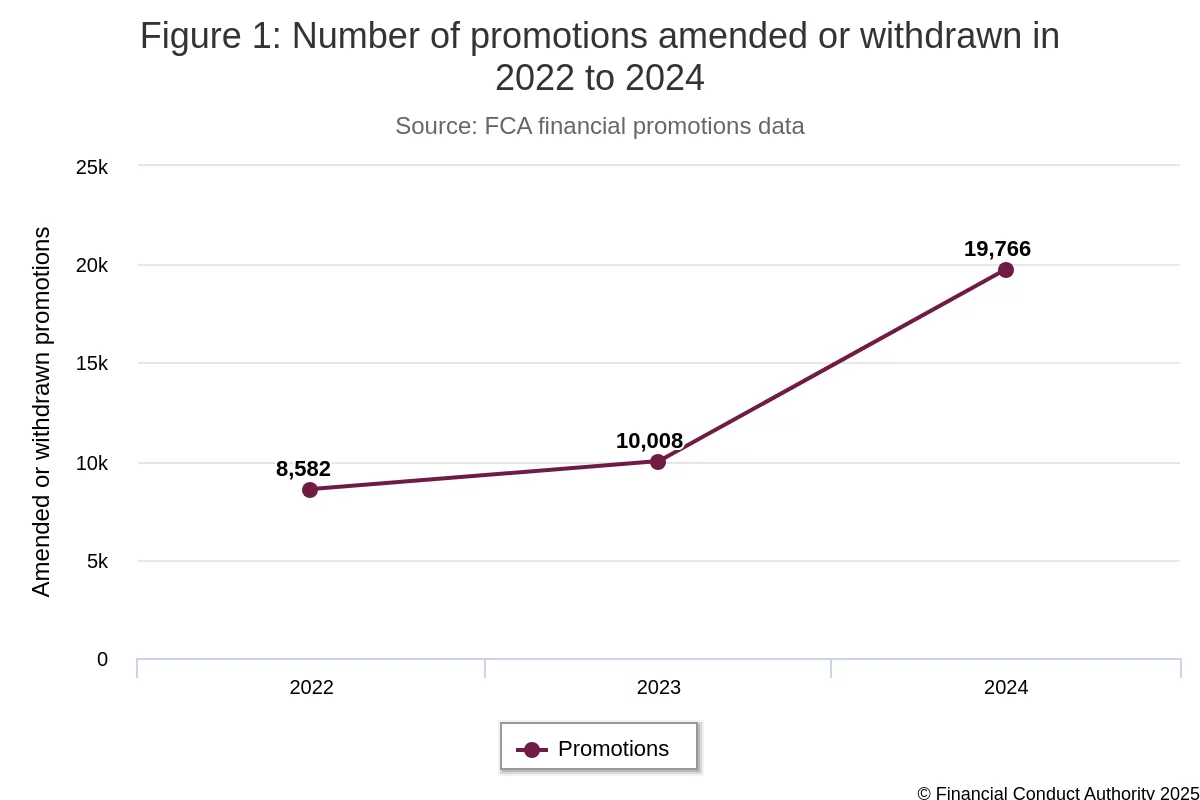

Source: FCA 46% of 19,766 promotions amended or withdrawn

Source: FCA 46% of 19,766 promotions amended or withdrawn

The alternative is already in the headlines: stricter advertising, a crackdown on ‘fin-fluencers,’ and enforcement that punishes sloppy claims. Firms that keep making the same mistakes and cutting costs when they should be allocating more funds will learn the hard way — fines, lost distribution, and, in worst-case scenarios: fines.

Marketing’s regulated arena

The audience of spot Bitcoin (BTC) exchange-traded funds has changed. The goal of marketing is no longer limited to just expanding distribution — it’s far bigger now as regulatory considerations impact every step of the PR strategy. Now, buyers are compliance-sensitive platforms and advisors who expect aligned, accurate messaging. Treating those channels like memecoin Telegram groups is a category error, and it’ll show up as higher customer acquisition costs and reputational drag.

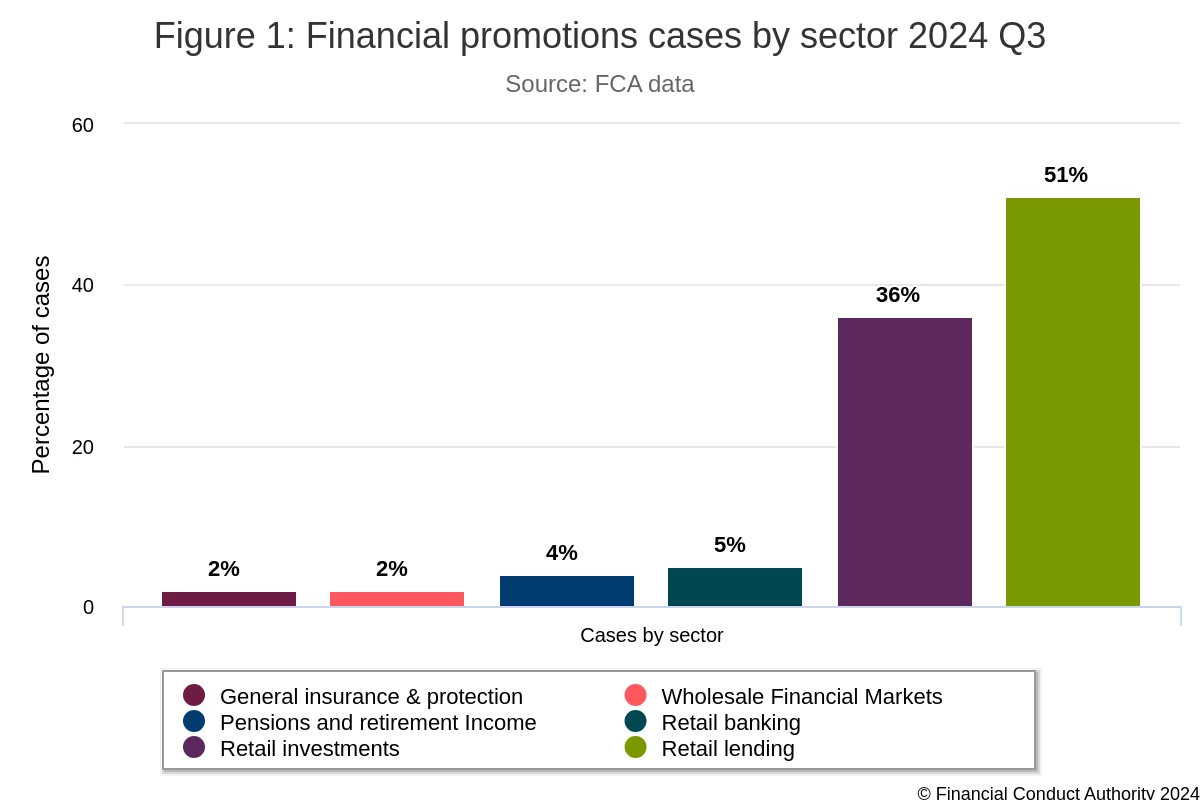

Regulators have established crypto promotions as a formal discipline, as seen in the United Kingdom’s FCA rules, which include cooling-off periods and the banning of refer-a-friend bonuses. That is sitting alongside a 2025 roadmap of consultations on custody, market abuse, and prudential rules, plus a proposal to open retail access to crypto exchange-traded notes (cETNs)

Source: FCA Financial Promotions cases in 2024 Q3

Source: FCA Financial Promotions cases in 2024 Q3

Marketers must operate within a ruleset that must be respected, understood, and adhered to in all endeavors.

Celebrity tokens aren’t a marketing strategy

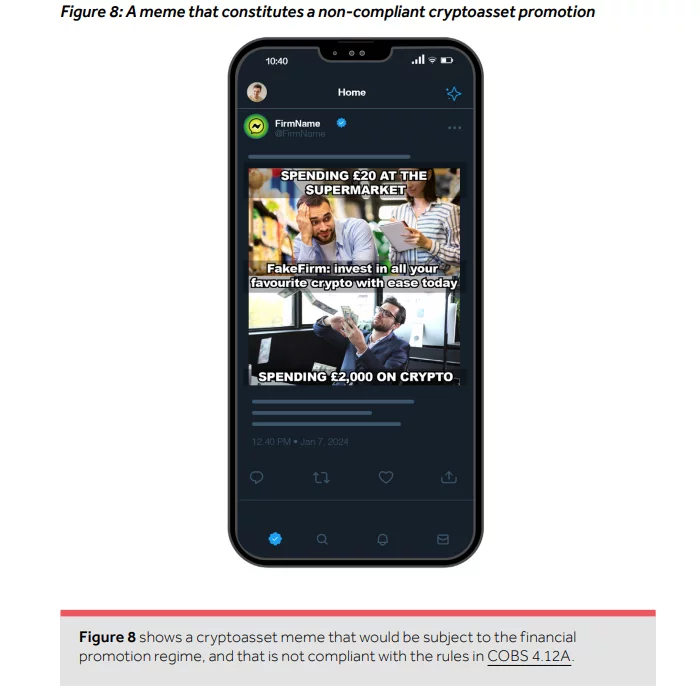

The appeal of borrowing fame is obvious, but it is detrimental in any modern marketing strategy. The risks heavily outweigh the benefits, and 2025’s wave of memecoin mania continues to spawn alleged scam factories with short-lived tokens that leave retail investors underwater.

Source: FCA’s Finalized guidance on financial promotions on social media

Source: FCA’s Finalized guidance on financial promotions on social media

A rumored Shenzhen ‘memecoin factory’ was tracked by crypto media, revealing the churning out of celeb-adjacent projects. This should be a stark reminder that attention can be bought, but liability indeed remains with the issuer. Don’t open the door to this kind of attention.

Some readers might object that celebrity tie-ins and edgy content can draw the industry ever-closer to mass adoption, and that the FCA’s enforcement posture reflects regulatory overreach (not industry malpractice). Others might debate that heavy guardrails in place, such as cETN access to consultations on lending, will chill innovation to a halt and entrench incumbents.

Reasonable people disagree all the time, and opinions change with the times. However, one thing that remains constant when it comes to marketing is this: professional standards are a prerequisite for the durable distribution of information. Without adhering to professional standards, marketing strategies crumble long before they hit the press.

Hire experience, teach domain

The first 10 marketing seats at any serious crypto-involved company should skew toward senior operators from regulated backgrounds, such as ETFs, brokerages, and payments. Pair this with crypto-native storytellers who resonate with and within crypto communities, and that combined experience set creates a native cohort that breeds long-term success.

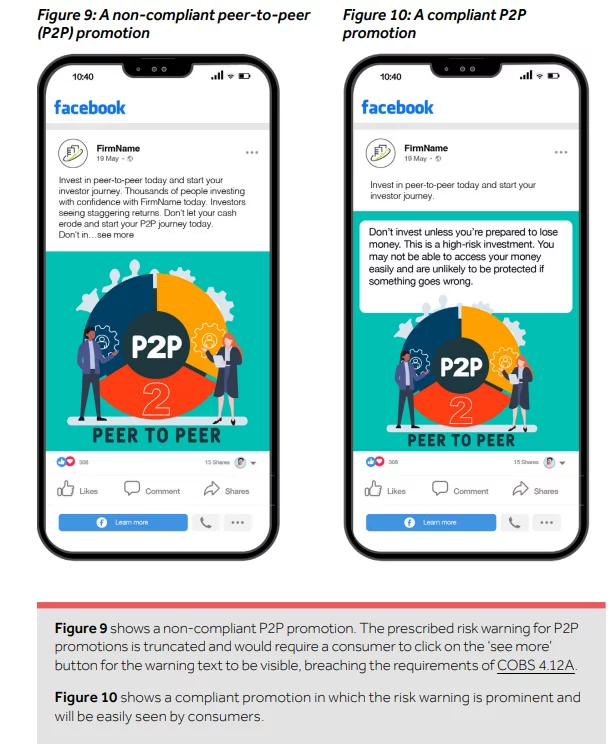

Source: FCA’s Finalized guidance on financial promotions on social media

Source: FCA’s Finalized guidance on financial promotions on social media

Hiring the right minds and skill sets in marketing in today’s age is vital to laying the right foundations for any company, let alone a web3 firm. The model provides a strong foundation to build upon, but what the building truly requires is further investment in education.

Every marketer, from a coordinator to a chief marketing officer, requires a comprehensive knowledge base encompassing on-chain mechanics, custody expertise, market structure understanding, token disclosure details, and an understanding of ad rules in target jurisdictions. It’s astonishing how many brands spend in excess of seven figures on agencies but balk at a week of structured onboarding that prevents the next compliance fire drill. By setting the hiring bar as high as possible, crypto firms fund an internal academy that turns competent generalists into crypto-competent professionals in under 90 days.

The sector that proves it can market as professionally as it builds internally will earn the trust that drives not just crypto adoption, but also leads to financial and reputational gains for the future. Amateurs don’t exist in companies that nurture their employees. Do it right the first time and witness success first-hand.

You May Also Like

Marathon Digital BTC Transfers Highlight Miner Stress

This U.S. politician’s suspicious stock trade just returned over 200% in weeks