Bitcoin, Ethereum, XRP Price Prediction Ahead of FED Meeting Today

The post Bitcoin, Ethereum, XRP Price Prediction Ahead of FED Meeting Today appeared first on Coinpedia Fintech News

With the Federal Open Market Committee (FOMC) meeting scheduled for today, cryptocurrency markets have entered a cautious phase of price volatility. Bitcoin (BTC), Ethereum (ETH) and XRP are trading in narrow ranges as traders pause for fresh direction from the U.S. central bank, widely expected to hold interest rates unchanged.

The lack of near-term rate move has shifted focus squarely onto the tone and guidance from Fed Chair Jerome Powell. His remarks on inflation, labor markets, and future rate expectations will likely have more impact on sentiment than an unchanged policy rate itself. Markets are reflecting this caution as BTC is consolidating below $90k, ETH is holding near $3k, and XRP remains range bound around $2, unable to sustain decisive upside beyond key resistances.

Bitcoin Price Holds Ground as Traders Await Macro Clarity

Bitcoin’s price action has been devoid of strong directional conviction ahead of the FOMC meeting. Currently, BTC price is hovering around $89,230, replicating a tight range movement. The sideways move reflects broader macro uncertainty. The market is not currently pricing steep rate cuts or hikes, instead it is bracing for Powell’s commentary on the economic outlook and inflation trends.

Bitcoin price is on the edge of a sharp bounce and a break above $90k hurdle with strong volume could reignite broader bullish participation. A break below $85k support could usher in deeper decline ahead.

Ethereum Eyes Key Support as Macro Risk Persists

Ethereum price has shown relative resilience compared to Bitcoin, managing to hold above the $3k support zone. ETH’s consolidation mirrors Bitcoin’s range behavior, with traders opting for defensive positioning rather than aggressive directional bets ahead of the FOMC meeting.

In the last three months, Ethereum has tested multiple times the support zone of $2700 and the resistance zone of $3300. As ETH is at the lower zone of the support, it may showcase a bear trap and could break the upper edge of the zone amidst the volatility ahead. In that case, ETH price breaks $3300 and could push toward $3500, while a break below $2700 may lead to retesting $2500.

XRP Accumulates Near Key Levels as Sentiment Balances

XRP has showcased accumulation near the key demand zone of $1.70-$1.90, but taking a pause amidst indecision among traders ahead of the Fed meeting. Despite recent institutional interest, the token has not broken decisively past the hurdle of $2.40 and retested lower levels, suggesting that broader market risk sentiment remains muted.

However, if XRP price succeeds to break past $2.40, a major upswing toward $3 followed by $3.50 could be seen in the near term. Until XRP maintains its demand zone of $1.70, the bullish structure remains intact.

- Also Read :

- Fed Interest Rate Forecast: What to Expect From FOMC Meeting Today

- ,

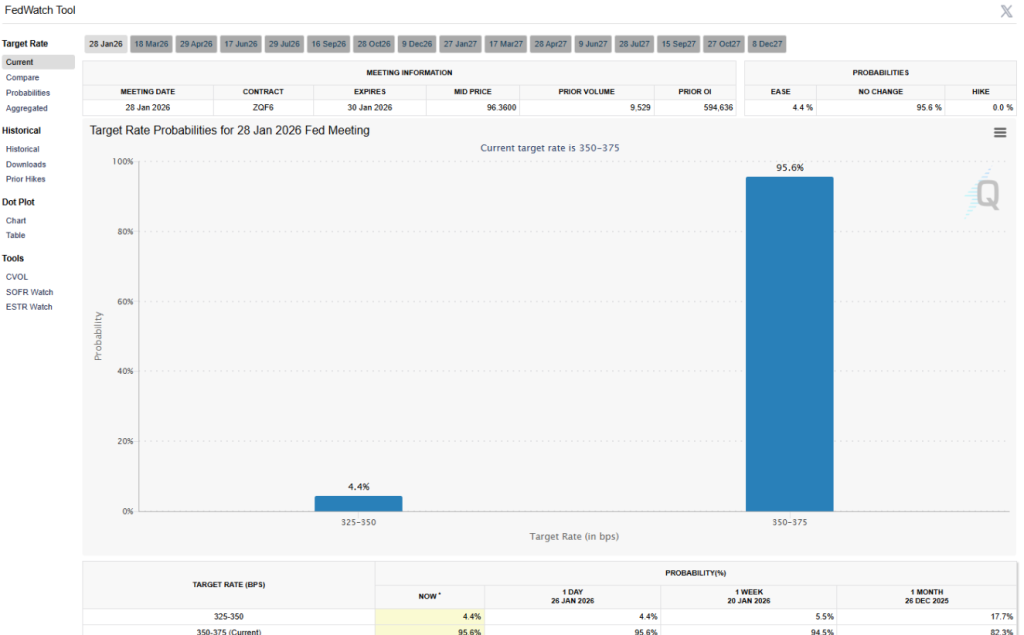

FedWatch Data Confirms Focus on Guidance

According to the CME FedWatch Tool, markets are overwhelmingly pricing in a rate pause at the current range. With the headline decision largely anticipated, attention has shifted away from rates themselves.

Instead, traders are focused on Jerome Powell’s forward guidance. Historically, crypto markets have reacted more sharply to changes in tone than to unchanged policy decisions. This backdrop explains the current compression in volatility across Bitcoin, Ethereum and XRP and remains stable and structurally prepared for volatility once clarity arrives.

FAQs

FOMC meetings impact crypto through Fed guidance; even steady rates can move Bitcoin and altcoins if Powell signals future cuts or risks.

Volatility often rises during Powell’s press conference, not the statement itself. Any surprise tone on inflation risks, labor strength, or timing of cuts can act as a catalyst.

Markets often react again hours later as analysts digest guidance. Treasury yields, the dollar index, and U.S. equity futures can signal whether crypto momentum may follow.

You May Also Like

Trend Research has liquidated its ETH holdings and currently has only 0.165 coins remaining.

Changan Launches 2026 Global Testing Season with SDA Intelligence Update and Sodium-Ion Battery Strategy