‘Paper’ Bitcoin Isn’t Suppressing Price – Silver Shows Why, Jeff Park Says

Bitcoin’s unusually subdued options pricing and weak month-to-date activity are setting up what ProCap CIO and Bitwise adviser Jeff Park calls a dangerous asymmetry: upside momentum is unlikely without volatility, and the longer BTC stays “quiet,” the more violent the eventual move could be.

In a post via X on Jan.27, Park described the current tape as “still a trader’s market,” arguing that low implied volatility and thin participation are a poor foundation for a clean grind higher. “It is very unlikely for Bitcoin to find momentum to the upside without experiencing significantly higher volatility,” he wrote.

“The fact that we are at ~38 IV combined with horrible volume MTD gives me pause (lower than ANY month of 2025, and especially bad for January in general) when you can see what the metals complex is doing. You literally can’t imagine a worse set up for disappointment.”

What Happened In Silver And Why It Could Repeat For Bitcoin

Park’s reference point is a silver market that has gone from strong to disorderly. Silver prices have surged above $117 per ounce on Monday, with reports pointing to a speculative bid layered on top of tight physical conditions and heavy retail participation via bars, coins, and physically backed ETFs.

The move also featured a sharp single-day jump. On Jan. 26, the most-active silver futures contract rose 14%, the largest one-day gain since 1985. That price action coincided with a staggering surge in trading and options activity across silver vehicles.

Bloomberg ETF analyst Eric Balchunas highlighted the scale: “WHOA: The volume in the SLV is $32b.. that 15x its avg and by far the most volume of any security on the planet. For context, SPY is $24b, NVDA and TSLA $16b. Can’t remember the last time something so relatively small took over like this. Game Stop maybe.”

He later added that SLV “ended up trading $40b worth of shares [on Monday],” adding: “To put that into perspective, that’s more than it traded in all of Q1 last year. Jan + Feb +Mar = $35b. Options volume also in stratosphere. It’s already done $1.5b in pre-market, which is 3x more than any other ETF, 5x more than Tesla, Nvidia. Again, reminds me of Game Stop in its how is this even possible-ness.”

“Paper” Exposure As An Accelerant

A common crypto refrain is that “synthetic” or “paper” bitcoin suppresses spot price. Park argued the opposite dynamic is often underappreciated and he used silver to illustrate how leverage and market structure can turn into the catalyst.

“People often blame incorrectly that ‘synthetic/paper’ bitcoin is the cause of price suppression,” Park wrote. “I have long argued it is quite the opposite, which you can see how it manifests in silver below- Silver didn’t have a 6-sigma event because the spot market was so vibrant.”

In his telling, silver’s melt-up wasn’t driven by orderly spot demand; it was driven by the “shenanigans” inside financialized exposure. “Silver’s record-setting meltup comes from all the shenanigans behind ‘paper silver’ where margin rules, leveraged instruments and vehicles, and liquidity and maturity transformation mismatches create tremendous pressure on breaking points where no physical supply can be introduced fast enough to counter the velocity of paper supply,” he said.

“For Park, the takeaway is directional but not calendar-specific. “To root for Bitcoin is to root for its volatility,” he wrote. “Anyone who tells you otherwise does not understand the fundamentals of the commodities market … It may not be today or yet tomorrow, but eventually Bitcoin is going to rip many faces off. Volatility or bust.”

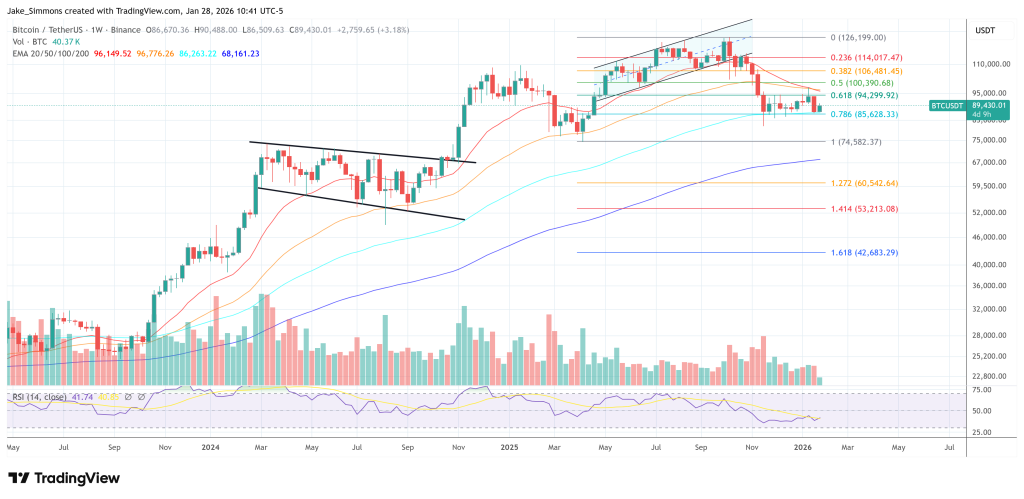

At press time, BTC traded at $89,430.

You May Also Like

UBS CEO Targets Direct Crypto Access With “Fast Follower” Tokenization Strategy

Ondo Finance launches USDY yieldcoin on Stellar network