Solana (SOL) Price: Record Staking and Institutional Inflows Signal Recovery

TLDR

- WisdomTree, managing $152 billion in assets, is expanding its tokenized funds to the Solana blockchain

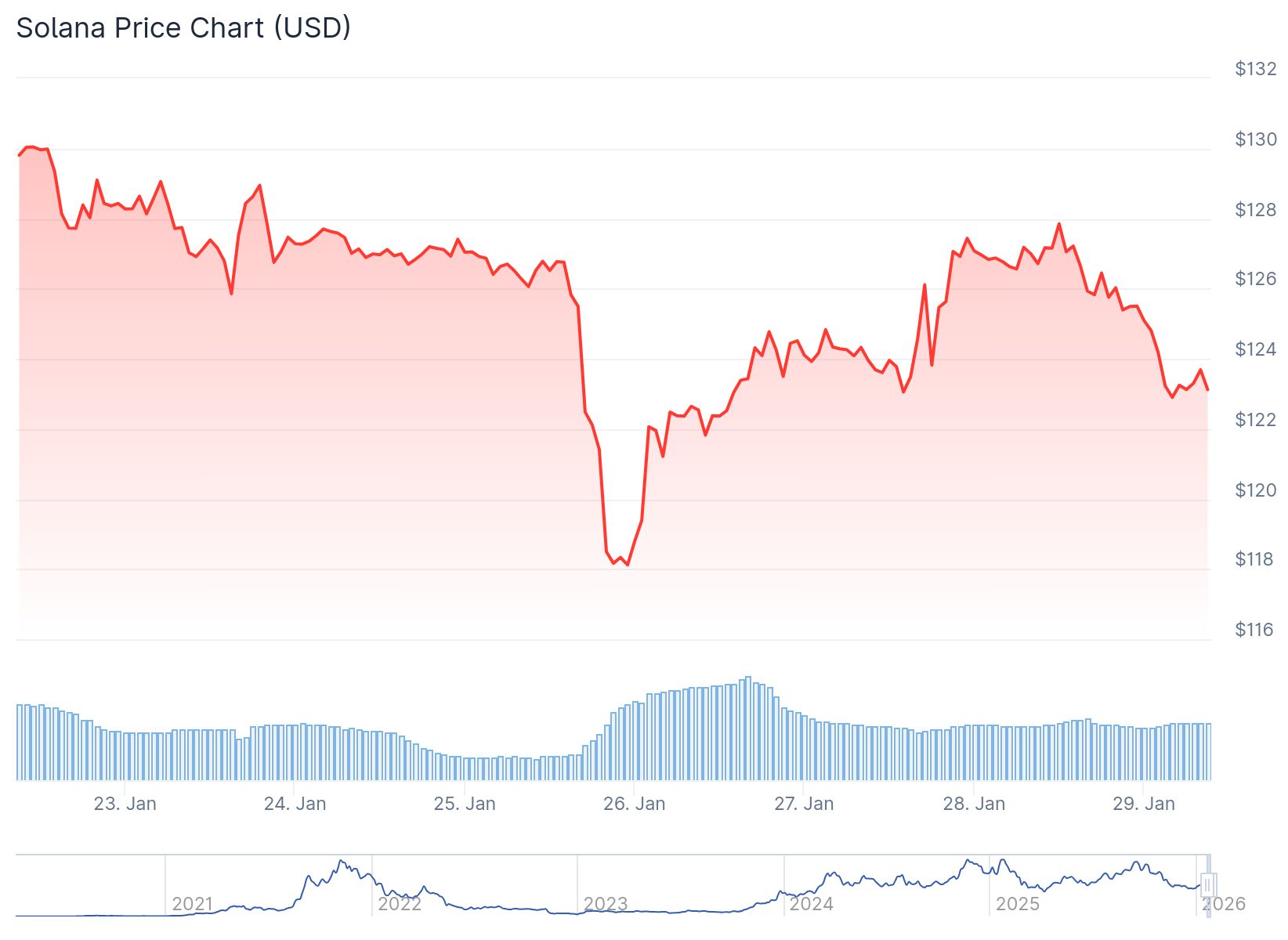

- Solana price has formed a double-bottom pattern at $117, which is often a bullish reversal signal

- SOL staking hit a record high of 425.7 million tokens, representing 68.9% of circulating supply

- Solana ETFs attracted $111 million in inflows this month, with institutional investments reaching $92.9 million in January

- Network activity surged with transactions up 22% to 2.1 billion and active addresses up 52% to 90 million in 30 days

Solana price is currently trading around $125 after falling 50% from its September high of $255. The token reached a low of $117 before showing signs of recovery.

Solana (SOL) Price

Solana (SOL) Price

WisdomTree announced it will bring its tokenized funds to the Solana blockchain. The company manages over $152 billion in assets.

Institutional and retail customers will access these funds through WisdomTree Connect and WisdomTree Prime platforms. Users can mint, trade, and hold tokenized assets on Solana.

Solana now holds over $2.5 billion in real-world assets. The network leads in tokenized stocks with $1.6 billion in assets.

Other major firms like BlackRock, Ondo, and VanEck have already expanded to Solana. WisdomTree joins this growing list of institutional players.

Network Activity Reaches New Heights

Solana transactions increased 22% over 30 days to reach 2.1 billion. Active addresses jumped 52% to over 90 million during the same period.

These numbers place Solana ahead of Ethereum in network activity. Ethereum recorded 14.5 million active addresses and 66 million transactions.

The network plans to launch the Alpenglow upgrade. This update will enable Solana to process over 100,000 transactions per second.

Spot Solana ETFs continue attracting capital. The funds received $111 million in inflows this month.

The Bitwise SOL ETF now holds over $711 million in assets. Institutional demand brought $92.9 million into Solana in January alone.

Staking and Technical Signals Point Higher

SOL staking reached a record 425.7 million tokens. This represents 68.9% of the total circulating supply.

Around 15.64% of staked tokens sit in liquid staking platforms. This allows users to stake while remaining active in DeFi protocols.

Long-term holders are accumulating more SOL. The 3-6 month holding category grew from 21% to 24% of total supply.

The price chart shows a double-bottom pattern at $117. The pattern has a neckline at $150.

SOL sits near the 78.6% Fibonacci Retracement level. Technical indicators like RSI and MACD suggest weakening selling pressure.

The RSI stands at 56 and is trending upward. The MACD has crossed into positive territory.

Analysts see a potential move to $147 in the near term. The ultimate target sits at $200, which is 60% above current levels.

A break below $117 would cancel the bullish outlook. The memecoin sector on Solana has also seen increased activity with tokens like DOGE and PENGU gaining traction.

The post Solana (SOL) Price: Record Staking and Institutional Inflows Signal Recovery appeared first on CoinCentral.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

BetFury is at SBC Summit Lisbon 2025: Affiliate Growth in Focus