Altcoin Season Breakout: SUI, ARB, GALA Jump 65-85% to Lead Q4 2025 Rally

Bitcoin and Ethereum may dominate crypto discourse, but the second half of 2025 is shaping up to reward a different class of assets that build quietly with utility as Altcoin season intensifies.

As capital begins to rotate into tokens that combine infrastructure, governance, and usability, three underappreciated names are emerging: SUI, ARB, and GALA. These tokens are often ignored in mainstream narratives, yet their ecosystems, user metrics, and upcoming milestones position them for a potential breakout in Q3 and Q4.

SUI: The Underestimated L1 Gaining Users

Sui has developed a distinct approach among Layer 1 blockchains. Its object-based structure and parallel execution support faster, more scalable applications. Despite offering features such as zkLogin and sponsored gas to improve user experience, SUI remains less discussed compared to networks like Ethereum or Solana.

That may be changing. By mid-2025, total value locked (TVL) on Sui exceeded $580 million, based on DeFiLlama data. Activity in native DeFi platforms and early traction in GameFi are helping to build momentum.

Applications like DeepBook and Navi Protocol are active on the network, while its Move-based development environment is attracting focused interest. With a market cap of over $13 billion and growing engagement levels, including 2.4 million interactions tracked by LunarCrush, Sui is seeing increased traction despite limited media focus.

Sui is currently trading at $3.96, 66% up from 30 days ago.

ARB: A Governance Token Gaining Strategic Control

Arbitrum remains the leading Ethereum Layer 2 network by TVL, yet the ARB token has not reflected that strength in its valuation. As of July 2025, ARB has a $2.5 billion market cap, even though Arbitrum secures over $14 billion in assets and handles large volumes across its applications.

The difference now is the role of governance. Token holders are actively directing ecosystem decisions through the Arbitrum DAO, including a recent $200 million allocation to support gaming development.

The rollout of Stylus, an upgrade allowing the use of programming languages like Rust and C++, may encourage broader participation from developers. As protocol use continues to expand and the DAO’s treasury oversight grows more visible, ARB may start reflecting its broader network influence.

Arbitrum (ARB) has seen an 85% increase in the past month, driven by Altcoin season, and is trading at $0.48 now.

GALA: From Speculative Token to Platform Asset

GALA, once widely traded during the 2021 cycle, has shifted focus to building a structured Web3 ecosystem.

The token now supports multiple functions across Gala Games, including in-game payments, NFT activity, and node infrastructure. While media attention has faded since its early surge, development within the platform continues.

In 2025, games such as Mirandus and Legends Reborn are nearing release, while Gala Film and Gala Music are gaining support from creators. GalaChain is being steadily decentralized, and node activity is expanding. GALA now has a market cap of around $900 million.

Still, community interaction is climbing. July saw 265,000 engagements and nearly 4,000 social mentions. If the broader GameFi sector sees renewed interest, Gala’s multi-application approach may gain new relevance.

The price of GALA has surged by 65% over the past 30 days and is currently trading at $0.02.

The Case for Asymmetric Upside

SUI, ARB, and GALA offer practical utility with limited exposure. While the market continues to focus on major tokens, these projects are seeing measurable progress in development and user participation.

If capital continues shifting toward use-case-driven assets during Altcoin season, these under-recognized names could benefit from renewed interest in the months ahead.

You May Also Like

Yango taps Flutterwave for cashless taxi, food delivery payments in Zambia

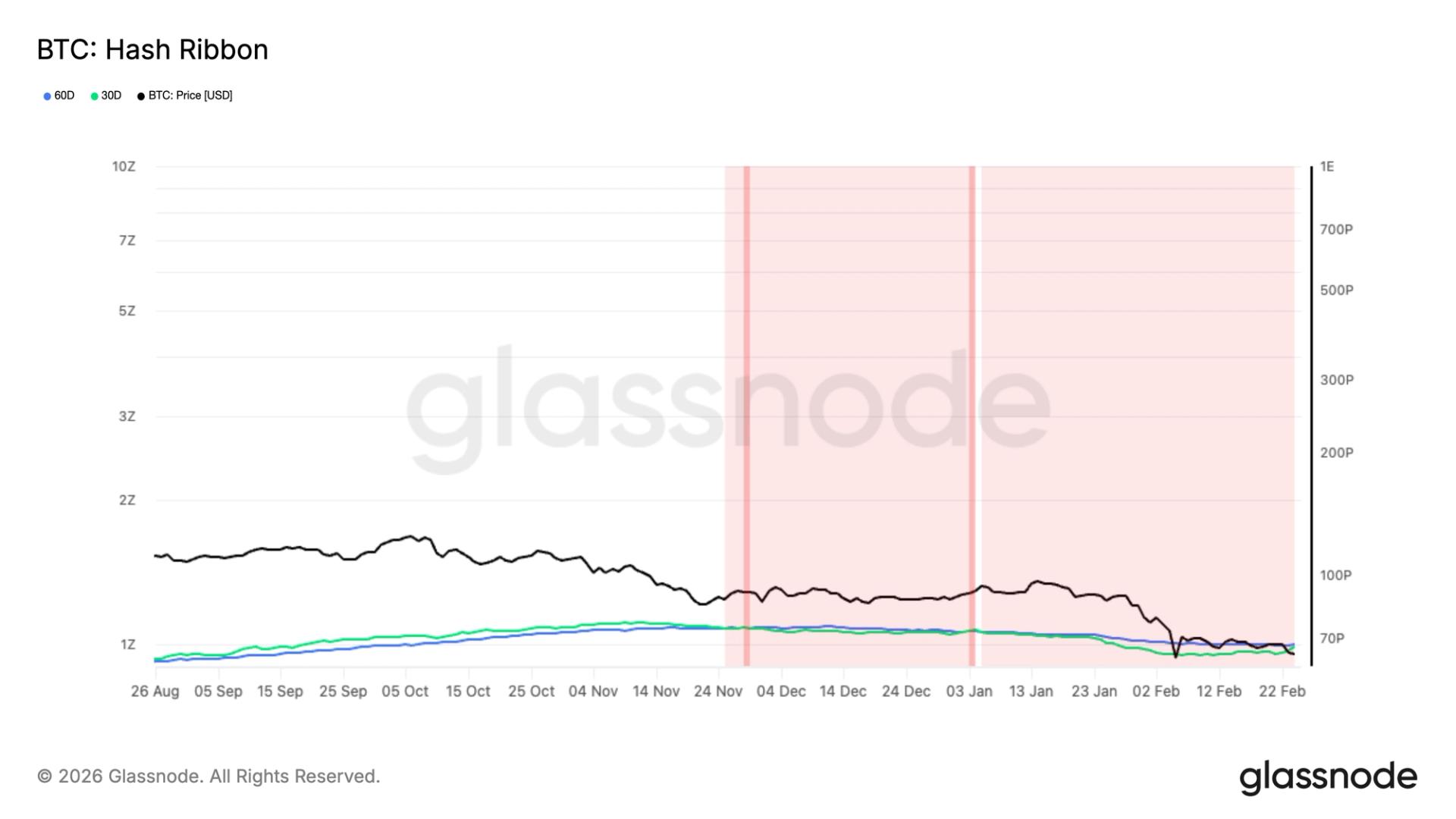

One of longest mining capitulations nears end, signaling potential BTC price bottom

Copy linkX (Twitter)LinkedInFacebookEmail