Jack Dorsey’s Square begins onboarding merchants for Bitcoin payments

Square, the point-of-sale unit of Jack Dorsey’s Block, Inc., has started onboarding merchants to accept Bitcoin payments.

The rollout, confirmed by Dorsey in a July 23 post on X, marks the first phase of a wider program to enable Bitcoin (BTC) transactions at Square terminals. Initial sellers will use the system in a limited release, with a broader expansion expected by 2026.

The system uses the Bitcoin Lightning Network to enable faster and cheaper transactions. To protect themselves from price volatility, merchants have the option to either keep the Bitcoin they receive or instantly convert it to fiat money. Early users can now access the option, which was first previewed at the Bitcoin 2025 conference in Las Vegas.

The integration was designed to support both small and large retailers. According to the company, the setup is meant to lower payment processing costs, which typically range between 1.5% and 3.5% for credit card transactions. Bitcoin payments settle in minutes and are processed with lower fees.

The rollout comes alongside Block’s wider Bitcoin strategy, which includes its 8,584 BTC treasury, a self-custody wallet called Bitkey, and development of Bitcoin mining infrastructure. The company continues to reinvest 10% of Bitcoin-related gross profits into monthly BTC purchases.

To encourage wider adoption, Block is also pushing for updated regulations. The company has supported a federal licensing framework for digital assets as well as tax breaks for small Bitcoin payments. Following the July 17 passage of the Digital Asset Market Clarity Act by the U.S. House, these proposals have gained significant momentum.

Given that Bitcoin payments are already accepted by companies like PayPal, Coinbase, and BitPay, Square is entering a competitive market. Square’s non-custodial model gives users full control of their Bitcoin, aligning with the principles of decentralized finance.

However, there are still barriers to adoption. Some customers prefer more traditional methods, and many merchants are still unfamiliar with Bitcoin payments. In order to make the transition as smooth as possible, Block is addressing this by providing automatic conversion and a simplified setup.

Block is expected to make its debut on the S&P 500 on the same day as the rollout, highlighting its growing position in both the fintech and crypto sectors.

You May Also Like

Yango taps Flutterwave for cashless taxi, food delivery payments in Zambia

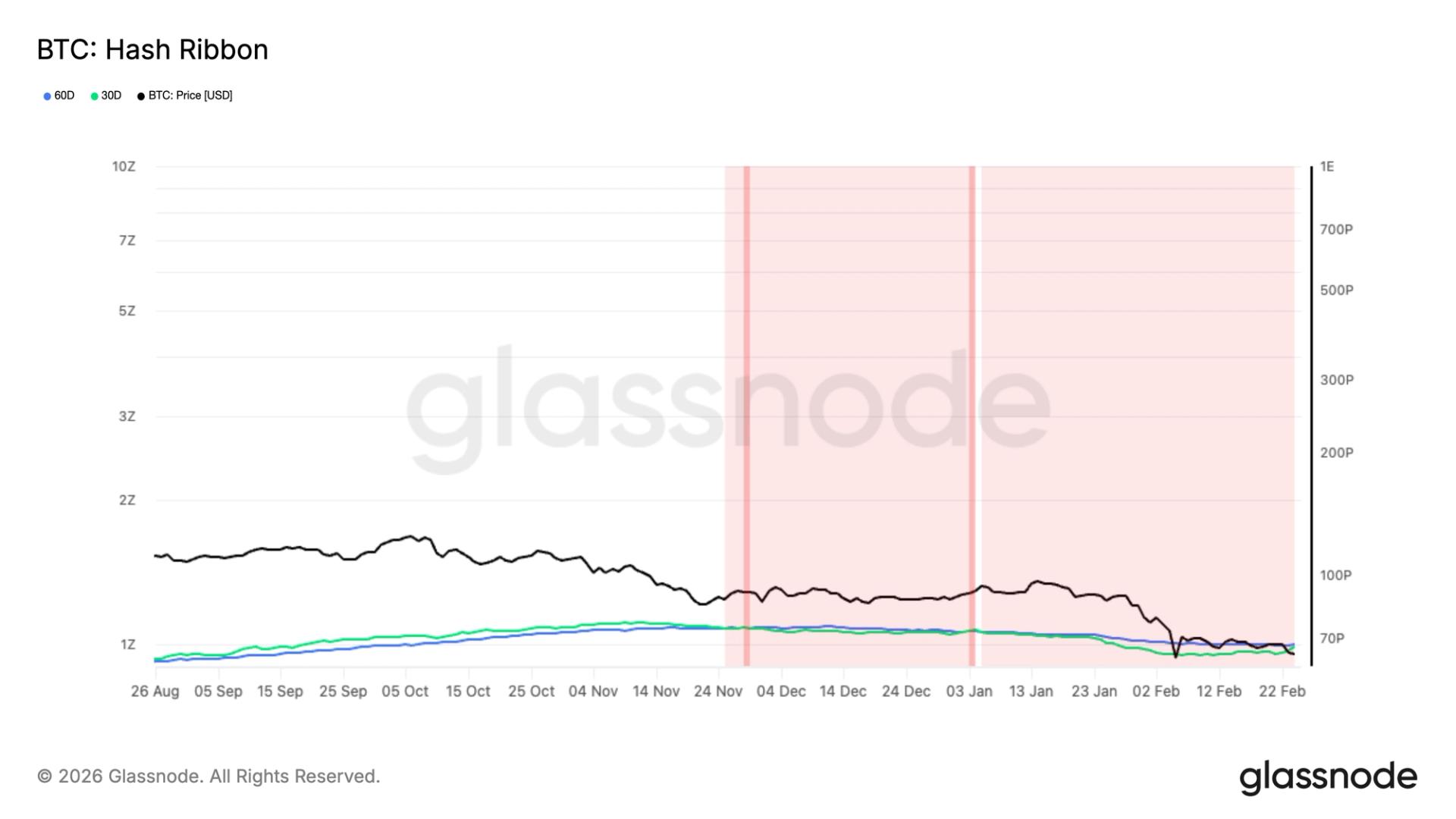

One of longest mining capitulations nears end, signaling potential BTC price bottom

Copy linkX (Twitter)LinkedInFacebookEmail