BTC Price Enters a Reset Phase After $74,500 Crash Shakes Market Structure

The post BTC Price Enters a Reset Phase After $74,500 Crash Shakes Market Structure appeared first on Coinpedia Fintech News

BTC price fell sharply to $74,500 over the weekend following a sudden escalation in geopolitical tensions and a sharp rally in the US dollar. The violent move was cruelly responsible for erasing billions in market value, triggering forced liquidations and exposing fragile leverage across crypto markets as risk appetite abruptly vanished.

BTC Price Breakdown Fueled by a Liquidity Shock

The weekend sell-off marked one of the most aggressive downside moves in recent months and as experts hoped for a positive Q1 2026 it didn’t went as planned. As thin liquidity conditions amplified volatility as Bitcoin became a source of immediate liquidity rather than a defensive asset. Contrary to safe-haven expectations, BTC price USD moved in tandem with risk assets like ETH, XRP, and others as traders rushed to reduce exposure.

At the same time, President Donald Trump’s anger over the current Fed chair, Jerome Powell, led to the nomination of Kevin Warsh to the Federal Reserve, which further strengthened the dollar. This surge cruelly pressured traditional hedges as well, with gold and silver experiencing sharp declines post news. In light of this news, automated sell orders cascaded across crypto assets, accelerating the downside.

From a BTC price chart perspective, the speed of the drop suggested forced selling rather than discretionary exits, with leveraged long positions bearing the brunt of the move.

Retail Distribution vs Whale Accumulation

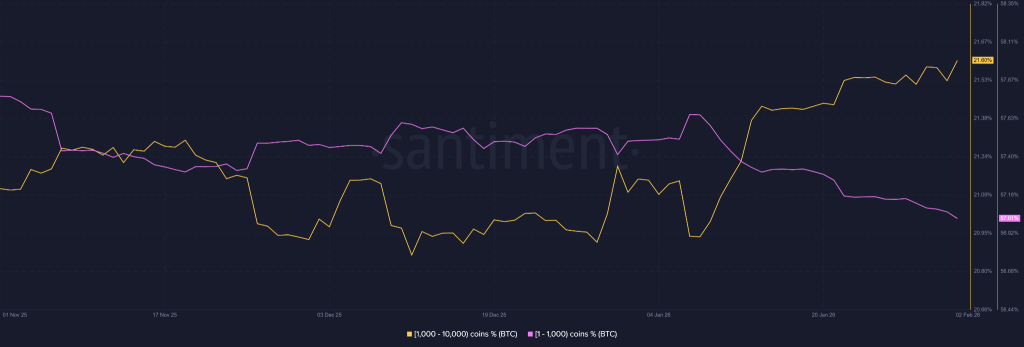

Beyond price action, on-chain data presents a more complex picture. Santiment metrics indicate that retail wallets holding fewer than 1,000 BTC were responsible for the crash as they have been steadily reducing exposure for over a month. This persistent selling aligns with fear-driven behavior often observed during sharp drawdowns.

Meanwhile, larger holders tell a different story. Wallets holding between 1,000 and 10,000 BTC have continued accumulating during the decline. This divergence suggests that while sentiment among smaller participants has deteriorated, but larger investors may be treating the drawdown as a rebalancing phase rather than an exit signal.

That said, this accumulation has not yet translated into visible price support, highlighting the scale of selling pressure still present from retailers.

Derivatives Market Shows a Forced Reset

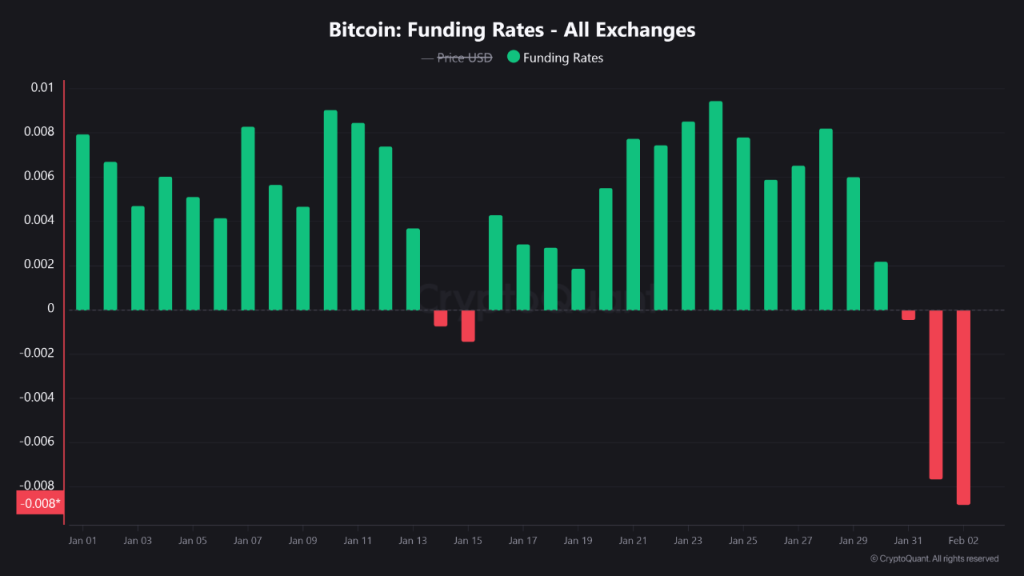

From a derivatives standpoint, the BTC crypto market has undergone a rapid reset. CryptoQuant data shows open interest collapsing from nearly $47.5 billion in late 2025 to roughly $24.6 billion, a drawdown of almost 50%. This signals the near-total removal of speculative leverage that previously supported higher prices.

Funding rates further confirm the shift. Rates plunged deep into negative territory, reaching levels not seen since September 2024. A reading near -0.008 reflects aggressive short positioning and the complete loss of short-term bullish control.

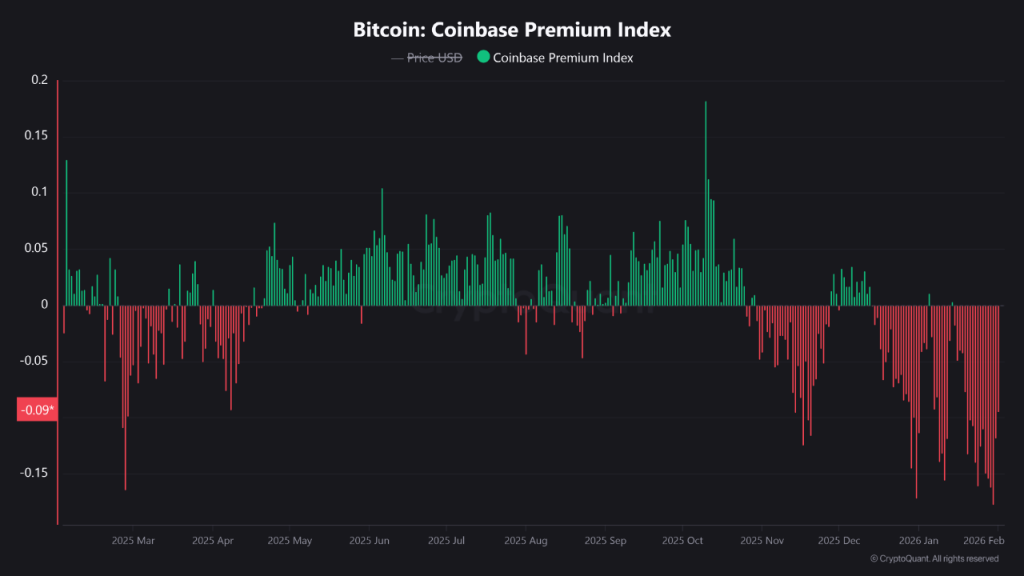

Meanwhile, the Coinbase Premium Index has remained deeply negative. This suggests that US-based institutional and professional traders continue to lead the selling pressure, reinforcing the lack of domestic demand.

Miner Capitulation Adds Structural Pressure

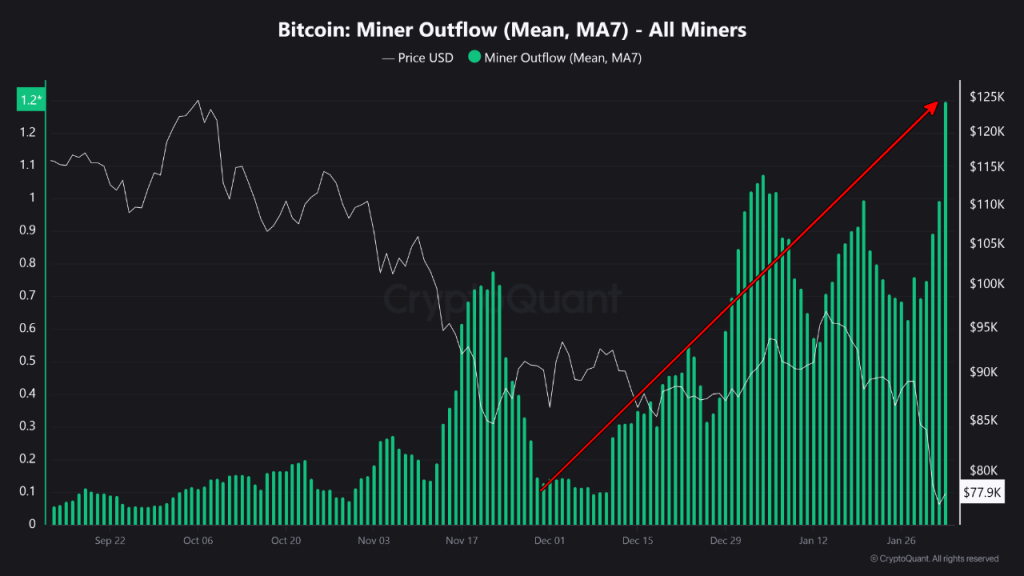

Still, pressure has not been confined to traders alone. The Bitcoin network has seen an estimated 30% drop in hashrate, pointing to meaningful miner capitulation. Rising miner outflows indicate a transition from holding mined BTC to active liquidation.

From a structural angle, miner selling typically accompanies periods of margin stress and declining profitability. While painful, these phases often coincide with broader market resets rather than trend continuation.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

The Next Bitcoin Story Of 2025