Bitcoin Bear Control Solidifies: $84K Support Broken, Price Eyes $68K–$60K Zone

Bitcoin Magazine

Bitcoin Bear Control Solidifies: $84K Support Broken, Price Eyes $68K–$60K Zone

Bitcoin Price Weekly Outlook

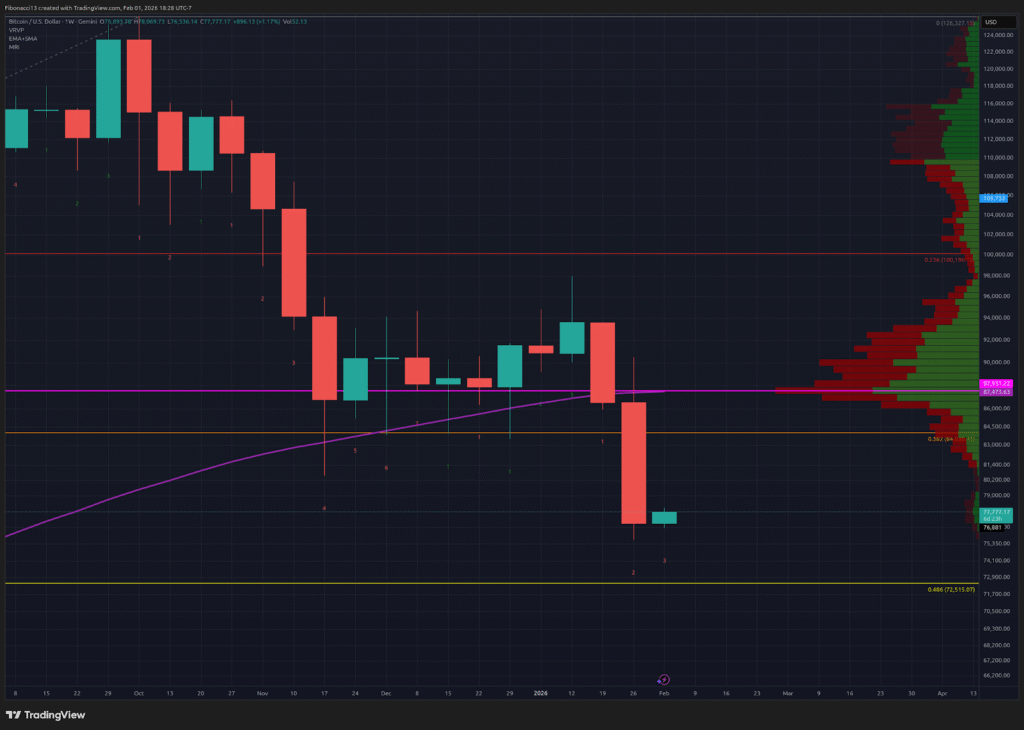

Last week, we were expecting the critical $84,000 support level to break, and to the bulls’ dismay, it did. Bitcoin had a small bounce after the prior week’s close, then proceeded to dump down through the $84,000 support level all the way down to $75,600 on Saturday, before moving up a little to close the week out at $76,919. Bitcoin dropped 13% last week, so we may see a bounce early this week back to $80,000 or so, but continuation downwards should be expected before too long.

Key Support and Resistance Levels Now

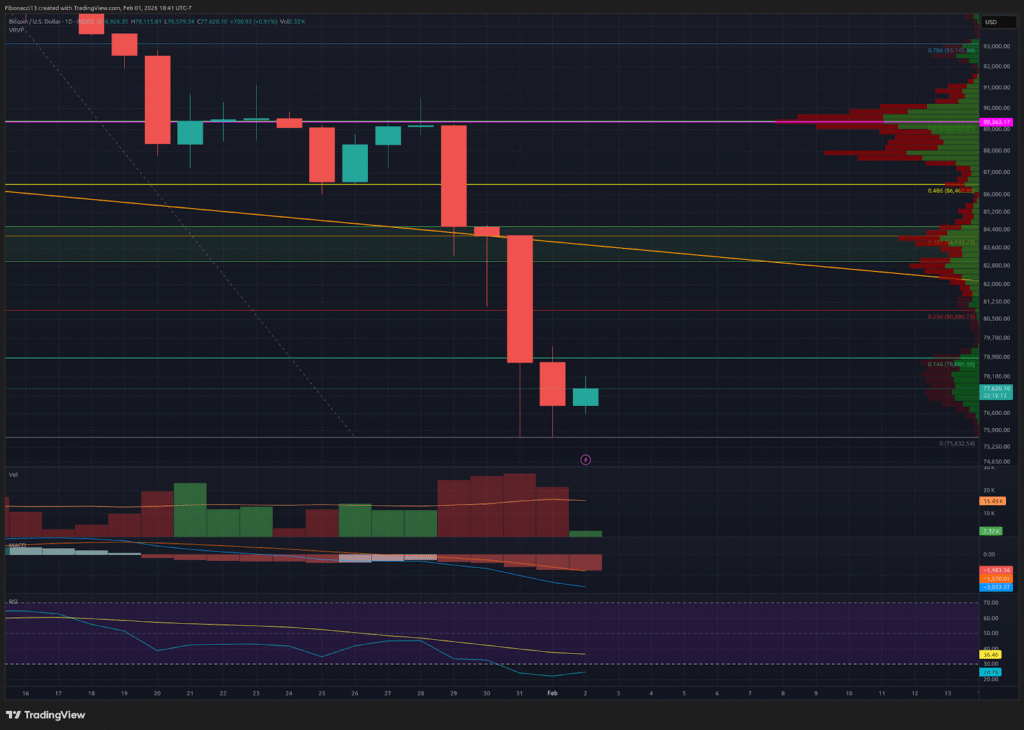

The bulls are reeling this week after losing that key $84,000 support level. We are seeing a little bit of a bounce early on here, but the bulls will be hard-pressed to regain much ground. $79,000 should serve as resistance early on here, with $81,000 sitting as the next resistance above. Now that $84,000 has broken as support, it should be strong resistance on the way back up. $87,600 at the POC on the volume profile should be a brick wall of resistance if the bitcoin price can manage to wick above $84,000.

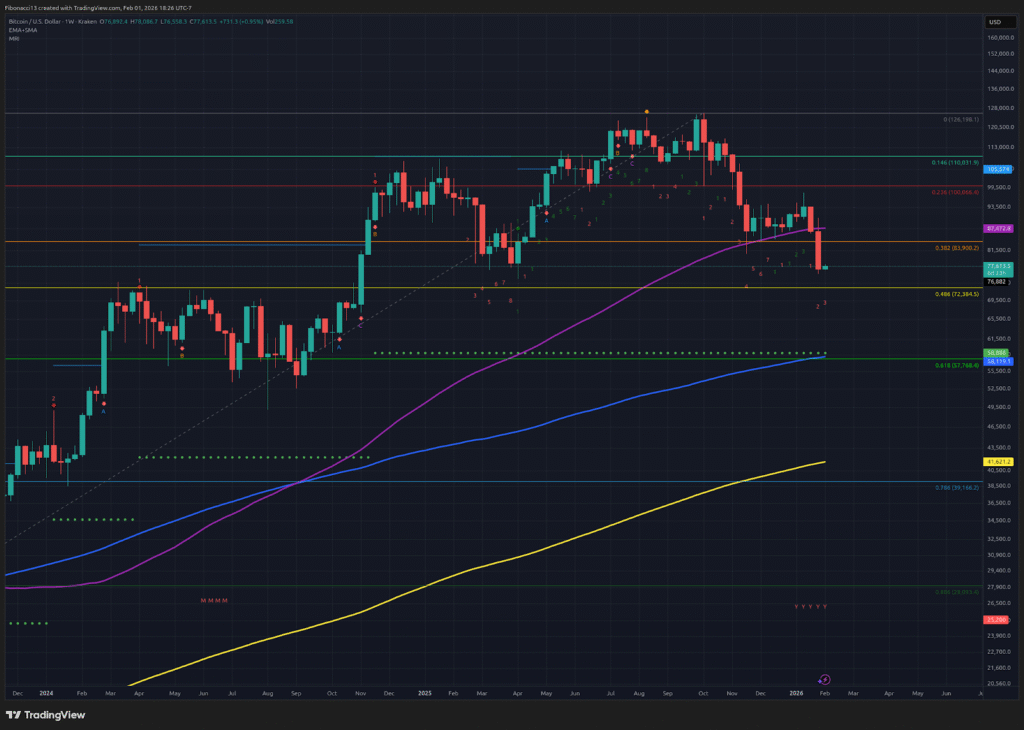

The bears are now sitting comfortably in control. The price bounced from $75,600, so we will look to this level initially as support, but don’t expect it to hold up if under pressure. Below $75,000, we will look at $72,000 all the way down to $68,000 as a support zone. A solid bounce from this level is warranted with all the volume that built up there in the 2024 consolidation period. Losing $67,000 below this support opens up the door to $58,000 at the 0.618 Fibonacci retracement. $42,000 sits as support below here, but don’t expect to see it anytime soon.

Outlook For This Week

Zooming into the daily chart, we see that the RSI has hit oversold levels over the last few days. The bulls should try to muster a small push back up soon. Bitcoin price will likely look to continue the push down to at least $72,000 here before mustering a bounce. When and if the bounce comes, it should try to tag the $79,000 resistance at least, and possibly even $81,000, but don’t expect more than that.

Market mood: Extremely Bearish – The bears finally busted down the door at the $84,000 support level. They will look to carry this momentum forward as the bewildered bulls seek out where to make their stand.

The next few weeks

At this point, even the most stubborn of bulls must concede that we are indeed in a long-term bear market. Losing the 100-week SMA, which had been support for several weeks, was a big sign of strength for the bears. Expect the bitcoin price to remain below $87,600 until a long term bottom is in place here. There is a high volume node from $68,000 down to $60,000, so expect the price to take its time moving around this area if $68,000 is lost as support.

Terminology Guide: Bitcoin Price Weekly Outlook

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

SMA: Simple Moving Average. Average price based on closing prices over the specified period. In the case of RSI, it is the average strength index value over the specified period.

Oscillators: Technical indicators that vary over time, but typically remain within a band between set levels. Thus, they oscillate between a low level (typically representing oversold conditions) and a high level (typically representing overbought conditions). E.G., Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD).

RSI Oscillator: The Relative Strength Index is a momentum oscillator that moves between 0 and 100. It measures the speed of the price and changes in the speed of the price movements. When RSI is over 70, it is considered to be overbought. When RSI is below 30, it is considered to be oversold.

Volume Profile: An indicator that displays the total volume of buys and sells at specific price levels. The point of control (or POC) is a horizontal line on this indicator that shows us the price level at which the highest volume of transactions occurred.

High Volume Node: An area in the price where a large amount of buying and selling occurred. These are price areas that have had a high volume of transactions and we would expect them to act as support when price is above and resistance when price is below.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

This post Bitcoin Bear Control Solidifies: $84K Support Broken, Price Eyes $68K–$60K Zone first appeared on Bitcoin Magazine and is written by Ethan Greene - Feral Analysis and Juan Galt.

You May Also Like

Galaxy Digital Authorizes $200M Share Buyback as Stock Rebounds

Kalshi debuts ecosystem hub with Solana and Base