BlackRock Ethereum ETF's assets exceeded $10 billion in one year

PANews reported on July 24 that according to The Block, BlackRock's Ethereum exchange-traded fund (ETF) ETHA has exceeded $10 billion in assets under management in less than a year, becoming the third ETF in history to reach this milestone within a year. Eric Balchunas, senior analyst at Bloomberg ETF, said on the X platform that ETHA's assets jumped from $5 billion to $10 billion in just 10 days, showing the strong appeal of Ethereum among institutional investors. Data shows that on July 23, the cumulative inflows of nine tradable Ethereum funds in the United States reached $8.65 billion, while ETHA had a net inflow of $325 million on the same day. Analysts predict that ETFs and Ethereum-related companies may purchase $20 billion worth of Ethereum in the next year, further boosting market demand.

You May Also Like

Exploring Market Buzz: Unique Opportunities in Cryptocurrencies

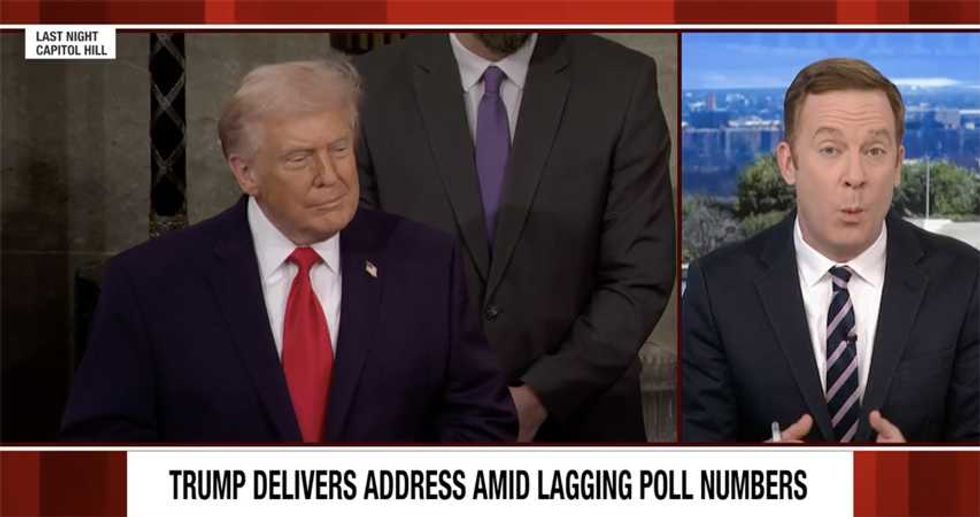

Trump's 'pretty boring' State of the Union was a flop: MS NOW's Lemire