Analysis: Bitcoin is expected to continue to consolidate until August and it will be difficult to break through the key resistance level of $122,000 in the short term

PANews July 25 news, Matrixport pointed out in the latest report that Bitcoin may maintain a consolidation trend in the summer. Although it has previously broken through the key trend line and reached a higher trading range, a technical correction has occurred after the market sentiment was high, and Bitcoin fell 0.6% in the past week. Technical indicators show that both Bitcoin and Ethereum are in an overbought state, and the risk of further corrections has increased.

The report pointed out that as the market enters a quiet period in the summer, traders may begin to close their positions, especially Ethereum's open contracts have increased significantly. Rising funding costs may weaken market confidence and promote further adjustments. In addition, profit-taking by early investors has exacerbated selling pressure. Matrixport believes that it will be difficult for Bitcoin to break through the key resistance level of $122,000 in the short term, and the market is expected to continue to consolidate until August. In addition, the White House postponed the release of the cryptocurrency report originally scheduled for July 22 to July 30, which may focus on stablecoin-related policies rather than Bitcoin reserve strategies.

You May Also Like

Exploring Market Buzz: Unique Opportunities in Cryptocurrencies

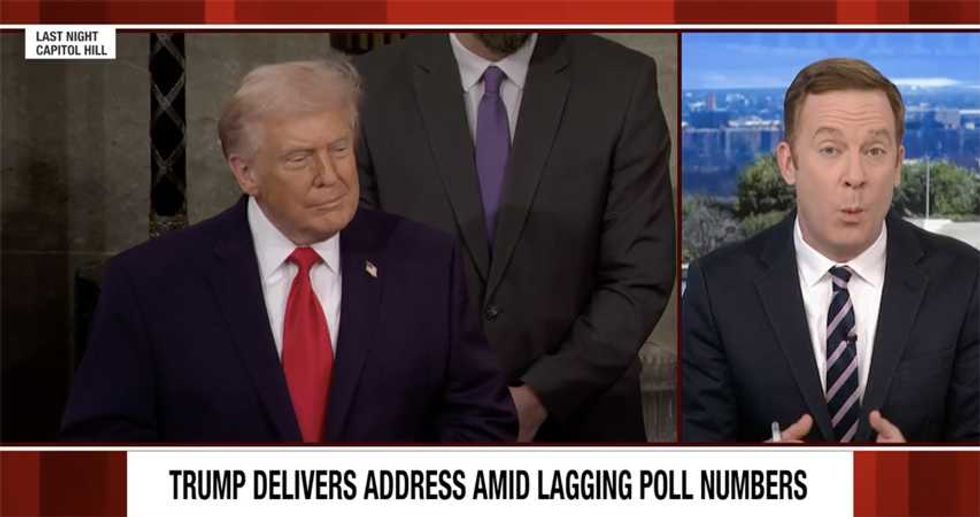

Trump's 'pretty boring' State of the Union was a flop: MS NOW's Lemire