XRP Ledger Activates Permissioned Domains, Opening Doors for Regulated Institutions

The post XRP Ledger Activates Permissioned Domains, Opening Doors for Regulated Institutions appeared first on Coinpedia Fintech News

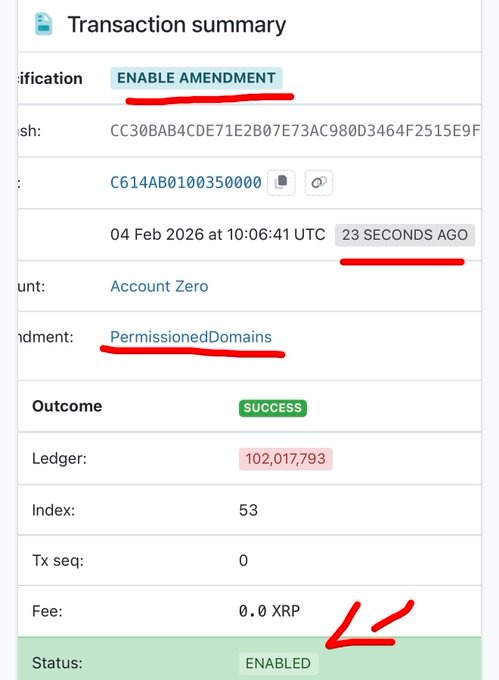

The XRP Ledger has taken a major step toward regulated blockchain adoption with the activation of a new feature called Permissioned Domains. The update went live on February 4, after receiving strong support from network validators, and is designed to help institutions use blockchain technology while staying compliant with regulations.

What Are Permissioned Domains on XRP Ledger?

Permissioned Domains allow users to create a restricted area on the public XRP Ledger where only approved accounts can take part. This allows developers, banks, and regulated companies to build apps where only verified users can access certain services.

This feature works with the Credentials system, which helps confirm things like KYC and AML checks directly on the blockchain. Together, they make it possible to run secure financial activities on a public network while keeping access limited and controlled.

The amendment was activated at ledger index 102,017,953, and the first Permissioned Domain appeared on the network immediately after launch.

Strong Validator Support Drove the Upgrade

The amendment, known as XLS-80, needed at least 80% validator approval for two consecutive weeks to go live. That threshold was reached in late January, and by the time activation occurred, more than 90% of validators had voted in favor.

This level of support shows broad agreement within the XRP Ledger community that controlled access features are important for the network’s future growth.

Another related upgrade, called Permissioned DEX, is also approaching activation and is expected to go live around February 18 if voting continues at current levels.

- Also Read :

- XRP News Today: Bank of America Adds XRP ETF Amid Institutional Demand

- ,

Why This Matters for Banks and Enterprises

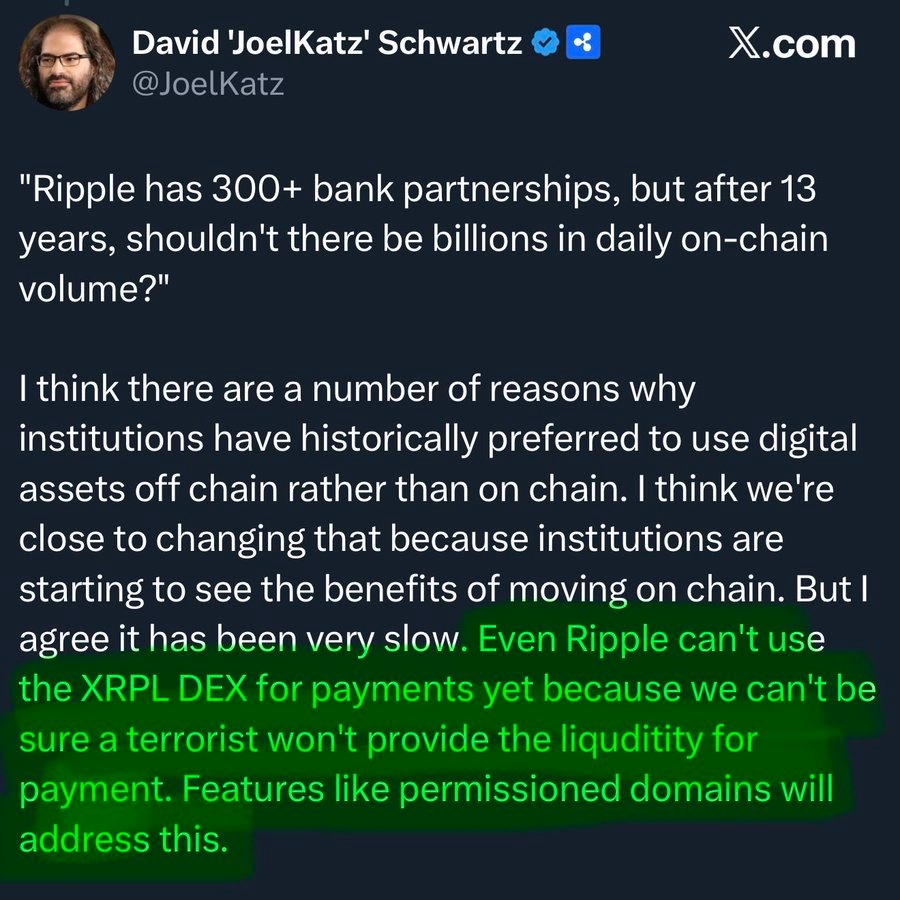

Ripple’s CTO explained that compliance has long been a barrier for institutions wanting to use public blockchains. Permissioned Domains help solve that problem by allowing liquidity pools, trading features, and payment flows to operate only among verified participants.

This makes it easier for institutions to safely use blockchain technology for stablecoins, foreign exchange trades, tokenized assets, and cross-border payments, without violating regulatory rules.

With Permissioned Domains now live, the XRP Ledger is positioning itself as a network that can support both open innovation and regulated financial use cases.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Permissioned Domains let institutions restrict access on XRP Ledger, allowing only verified accounts to use certain apps and services securely.

They work with blockchain credentials to enforce KYC and AML checks, letting banks and businesses operate safely on a public ledger.

Banks, developers, and regulated companies can use Permissioned Domains to run apps and services for verified participants only.

They enable secure trading, stablecoin flows, and tokenized assets while ensuring regulatory compliance on a public blockchain.

You May Also Like

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

Ethereum Fusaka Upgrade Set for December 3 Mainnet Launch, Blob Capacity to Double