Solana (SOL) Nosedives by 25% in a Week: Further 50% Collapse on the Way?

The cryptocurrency market seems to can’t catch a break lately, and numerous digital assets continue to chart painful losses.

Solana (SOL) is among the poorest performers, with its price plunging by 25% in the past week alone. According to some market observers, the bears might be just stepping in.

Major Collapse on the Horizon?

Just hours ago, SOL tumbled to approximately $95, its lowest level since February 2024. As of this writing, it trades at around $96, which is a staggering decline from the all-time high of almost $300 registered nearly a year ago.

Many industry participants are now concerned that the asset may experience a further decrease in the short term. Ali Martinez, for instance, predicted that SOL could nosedive to $74.11 and even $50.18.

The analyst, going on X as curb.sol, outlined $100 as an “extremely important level” for the token. In their view, holding that zone could result in a new bull run to a fresh all-time high, whereas the opposite scenario might lead to a crash to roughly $50 sometime this year.

For their part, Alex RT₿ assumed the price may retreat to $70-$80 if SOL breaks below the $90 support level.

Any Chance for the Bulls’ Return?

It is important to note that some analysts believe the current rates could present great buying opportunities. The one using the X handle, Lucky, told their almost two million followers that “if the market behaves well, this could be a smart entry.”

Mookie also recently chipped in, vowing to go all-in should SOL drop below $100.

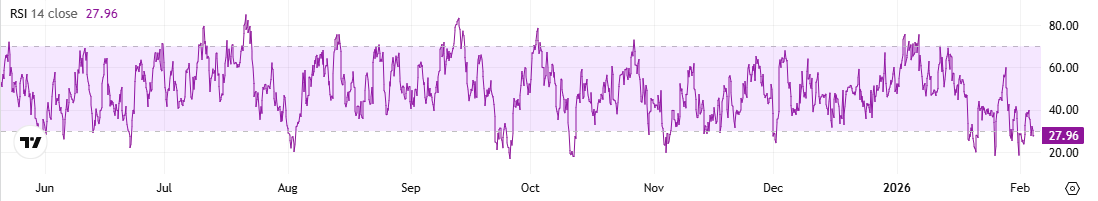

Meanwhile, some key indicators suggest it might be time for a rebound. SOL’s Relative Strength Index (RSI) fell well below 30, meaning the price has declined too much in a short period of time. Ratios under that level signal that SOL is oversold and due for a potential rally, whereas anything above 70 is seen as bearish territory.

SOL RSI, Source: CryptoWaves

SOL RSI, Source: CryptoWaves

Furthermore, exchange outflows have significantly surpassed inflows in the past several weeks. This suggests that investors have shifted from centralized platforms to self-custody, thereby reducing immediate selling pressure.

SOL Exchange Netflow, Source: CoinGlass

SOL Exchange Netflow, Source: CoinGlass

The post Solana (SOL) Nosedives by 25% in a Week: Further 50% Collapse on the Way? appeared first on CryptoPotato.

You May Also Like

WLFI Expands Into Forex With World Swap Launch

BUZZ HPC Closes Acquisition of 7.2 MW Toronto Site to Build Data Centre for Sovereign AI Infrastructure

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more