US crypto strategic reserve fever spreads to Asia and Latin America—here are the latest countries eyeing crypto reserves

The establishment of a US crypto strategic reserve has started a global trend of nations interested in holding crypto assets like Bitcoin. Here are the countries expressing interest in holding crypto.

- The US crypto strategic reserve started a global trend, with many countries considering adding BTC to their national reserves.

- Several Asian and Latin American countries have expressed interest in Bitcoin as a national reserve asset.

National crypto reserves seem to be all the rage this year after the U.S. established their own national crypto reserve in March 2025. President Donald Trump issued an executive order to establish a Strategic Bitcoin Reserve, using approximately 200,000 BTC (BTC) of seized crypto by authorities over the years.

According to data from Chainalysis, strategic crypto reserves serve as a hedge fund against inflation, signifying an alternative for countries that are more accustomed to holding traditional reserve assets like gold and the U.S. dollar.

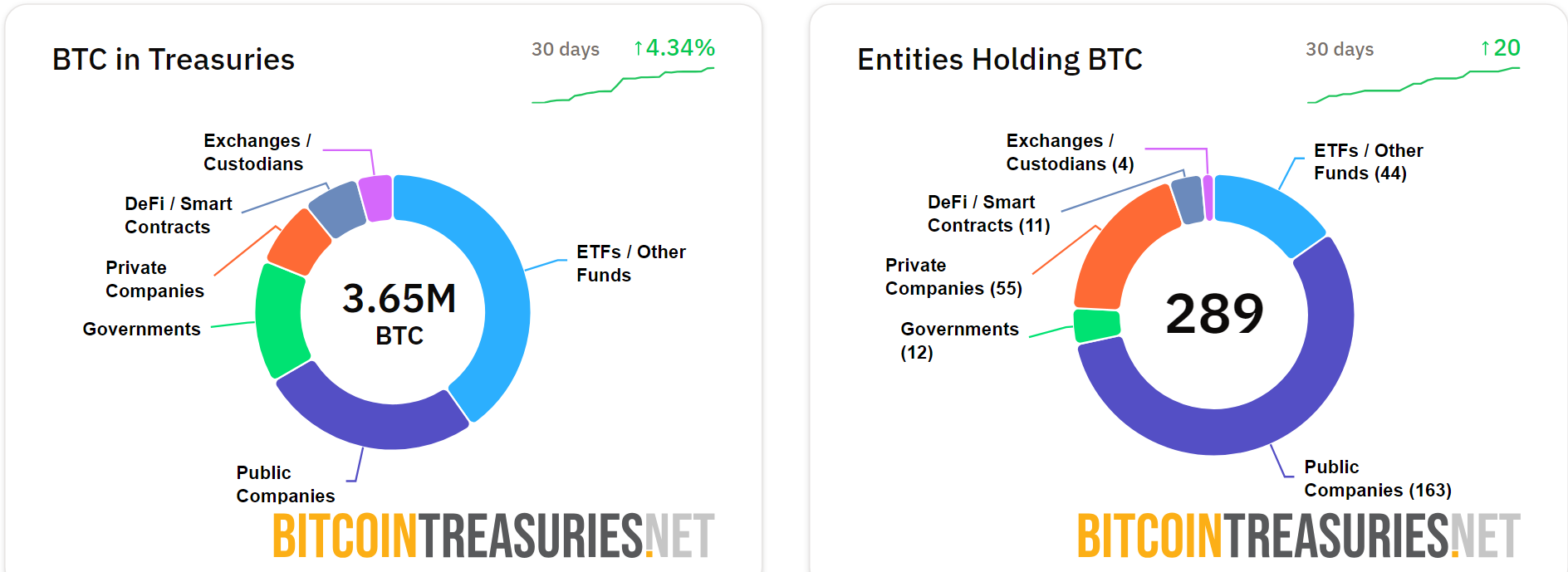

Bitcoin Treasuries have recorded 12 governments that hold Bitcoin, which include early adapters like Bhutan and El Salvador who are ahead of the curve. The United States holds the top spot by BTC holdings, followed closely by China.

However, most recently, several countries have been exploring the possibility of holding crypto in their reserves after the US crypto strategic reserve have opened up to assets like Bitcoin, Ethereum (ETH), Solana (SOL), XRP (XRP), and others.

Here are five countries that have recently expressed interest in following in the U.S’ footsteps by establishing a crypto reserve.

Countries that may follow in the US crypto strategic reserve trend

Indonesia

Local crypto advocacy group, Bitcoin Indonesia, was recently summoned to the office of Indonesia’s Vice President, Gibran Rakabuming Raka, to present a national Bitcoin strategy. In a recent post shared on August 5, the group claimed that the Indonesian government is currently considering whether Bitcoin could be integrated into its national reserve framework.

While Indonesia currently permits cryptocurrency trading, it bans its use as a form of payment, a regulation in place since 2017. Most recently, the Ministry of Finance raised crypto taxes for transactions on local and overseas crypto exchanges.

Brazil

Unlike Indonesia, which are still in the early stages, Brazil is already inching towards a more formal route when it comes to a national Bitcoin reserve. A public hearing for a bill that would allow up to 5% of the nation’s treasury reserves to be allocated to Bitcoin is scheduled for August 20 with the nation’s House of Representatives.

If the bill passes, the proposal could authorize an investment of approximately $15 billion. The nation may be the next to follow in the US crypto strategic reserve train.

India

Earlier in July, members from India’s ruling party, Bharatiya Janata, called for the nation to establish a strategic Bitcoin reserve according to a report by the SCMP. Party spokesman Pradeep Bhandari urged government officials that the country’s rapidly growing economy placed it in a “unique opportunity to lead.”

Although India is yet to establish a formal crypto reserve like the US crypto strategic reserve, it does have a number of BTC acquired from criminal seizures over the years.

Kazakhstan

In late June, Kazakhstan’s central bank announced that it was currently working on a detailed plan to establish a state crypto reserve alongside a legal framework.

Similar to the concept of the US crypto strategic reserve, which aims to fund it without spending a dime of tax payer money, National Bank Chairman Timur Suleimenov said that the Kazakhstan’s reserve will be funded using seized crypto assets and mined crypto from state-backed operations.

Pakistan

In late May, India’s rival state Pakistan have also declared plans to create a sovereign Bitcoin reserve. Michael Saylor, Chairman of Strategy the largest institutional holder of BTC, has expressed willingness to advise the nation in establishing its crypto reserve.

According to a previous report, the sovereign reserve will be powered by unused electricity. The initiative includes securing BTC in a national wallet and allocating 2,000 megawatts of electricity for state-run Bitcoin mining infrastructure.

The move echoes US crypto strategic reserve. In fact, Pakistan has already formed a Bitcoin-centered partnership with early BTC reserve adapter El Salvador to share knowledge and experience on how to build a Bitcoin reserve.

You May Also Like

WIF price reclaims 200-day moving average

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise