401k crypto Trump: Here’s what Trump executive orders has in store for crypto

The order dubbed ‘401k crypto Trump’ have raised the crypto market by 2.7%, as the bill would allow retirement accounts to invest in digital assets alongside other types such as real estate and private equity.

- 401k crypto Trump’ has allowed for cryptocurrency and other digital assets to be added to American retirement accounts.

- President Trump’s executive order could unlock part of the nearly $9 trillion invested by U.S. citizens, injecting long-term capital into the market

- Although the order is still fresh, the executive order managed to boost the overall crypto market cap by 2.7%

On August 7, President Donald Trump signed an executive order that would make it possible for alternative assets such as private equity, cryptocurrency and real estate to be included in the standard 401(k) retirement account.

A 401(k) retirement account is a tax-advantaged retirement savings plan offered by employers in the United States. Usually, employees can choose to have a portion of their paycheck automatically deposited into the account. This money is then invested into things like mutual funds, stocks, or bonds.

With the new Trump executive orders, employees are now allowed to choose to invest their retirement funds into cryptocurrency and other alternative assets like private equity and real estate. The executive order is designed to make it easier for American citizens to put their pension funds into crypto instead of just stocks and bonds.

“My Administration will relieve the regulatory burdens and litigation risk that impede American workers’ retirement accounts from achieving the competitive returns and asset diversification necessary to secure a dignified, comfortable retirement,” said Trump in the order now dubbed “401k crypto Trump” in search terms online.

The order directed the Securities and Exchange Commission, Labor Department and Treasury to update their rules to give investors access to add alternative assets into their pension fund portfolios.

The regulatory move opens the door to a large pool of capital that could be injected into the crypto market. According to data from the Investment Company Institute, in the third quarter of 2024, U.S. citizens had a total of nearly $9 trillion invested into their 401(k)s.

Large-scale inflows from retirement accounts would bring substantial long-term capital, improving liquidity across major cryptocurrencies. This could lead to a more stable crypto market and more capital gains coming in from people investing their pension funds into crypto.

Not only that, inclusion of crypto in retirement portfolios would legitimize digital assets in the eyes of the public and traditional finance. This institutional recognition could accelerate mainstream adoption, encouraging more financial advisors and pension funds to allocate portions of their fund into crypto.

401k crypto Trump’s impact on the crypto market

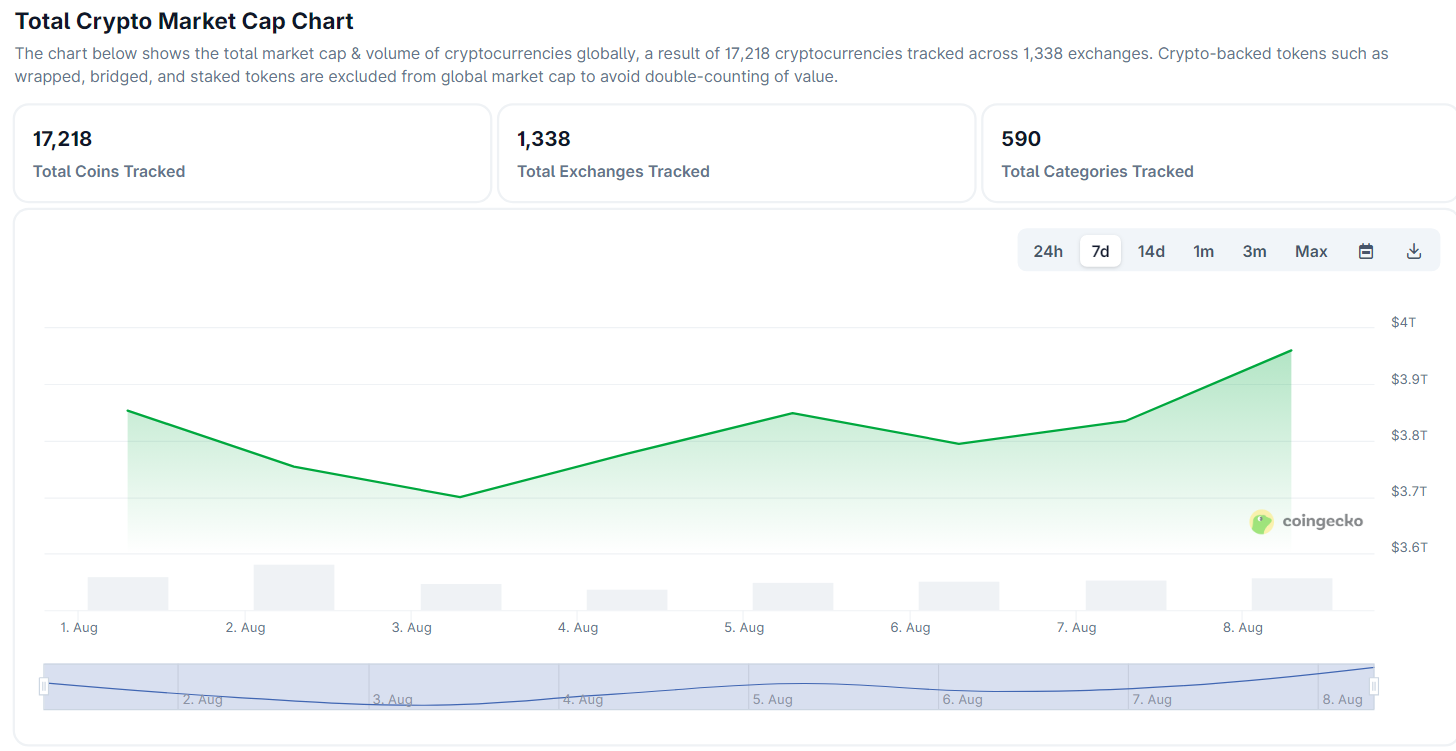

Although news of Trump’s executive order is still very fresh, it has already imbued a newfound confidence from traders in the crypto market. Shortly after the news began trending, with people frantically searching ‘401k crypto Trump,’ the overall crypto market cap rose by 2.7%.

The market cap, boosted by recent gains from major tokens like Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP), has reached nearly $4 trillion in just the span of a few hours.

At press time, Bitcoin alone has seen a 1.7% leap. The largest cryptocurrency by market cap reached a daily peak of $117,596, bringing it closer to its $120,000 milestone. It is currently trading hands at $116,549, just 4.3% from its all-time high of $122,838.

On the other hand, Ethereum has seen major gains as well. The “401k crypto Trump” has given a boost to the token, as it has been rising by 4.7% in the past 24 hours of trading and 3.1% in the past hour alone. Its market cap has also enjoyed a surge of 4.62%, increasing to $38.4 billion.

At the moment, ETH is trading at $3,896, having reached a daily peak of $3,952 as it nears the $4,000 ceiling.

Meanwhile, XRP has received an 11.41% boost from the Trump executive orders. The token is currently trading at $3.34, just 3 cents shy of its daily high. In the past week, the token has seen an increase of 12%.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

The Channel Factories We’ve Been Waiting For

Onyxcoin Price Breakout Coming — Is a 38% Move Next?