Pantera Research Report: 300 million bets on DAT, the second phase of the crypto bull market has begun

Source: Pantera Capital

Original title: DAT Value Creation

Compiled and compiled by: BitpushNews

Preface:

Crypto venture capital firm Pantera Capital revealed for the first time in its latest blockchain letter that it has invested over $300 million to date in Digital Asset Finance (DAT) companies, a growing class of publicly traded companies that hold cryptocurrency reserves on their balance sheets.

Pantera said its investment thesis for DAT companies is simple: "DATs can generate income, which increases the net asset value per share, and over time you will have more ownership of the underlying tokens than simply holding spot. Therefore, holding DATs can provide higher return potential compared to holding tokens directly or through ETFs."

The following is the original text:

DAT VALUE CREATION

Our investment philosophy for Digital Asset Treasury companies (DATs) is based on a simple premise:

DATs can increase the net asset value (NAV) per share by generating income, thereby owning more of the underlying token over time than simply holding spot.

Therefore, holding DATs may offer higher return potential than holding tokens directly or through an ETF.

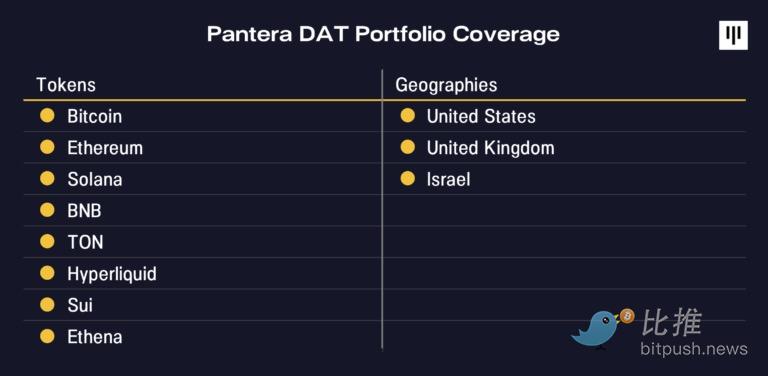

Pantera has deployed over $300 million in DATs across various token and capital markets. These DATs are leveraging their unique advantages and employing strategies to grow their digital asset holdings in a manner that increases per-share value. Below is an overview of our DAT portfolio.

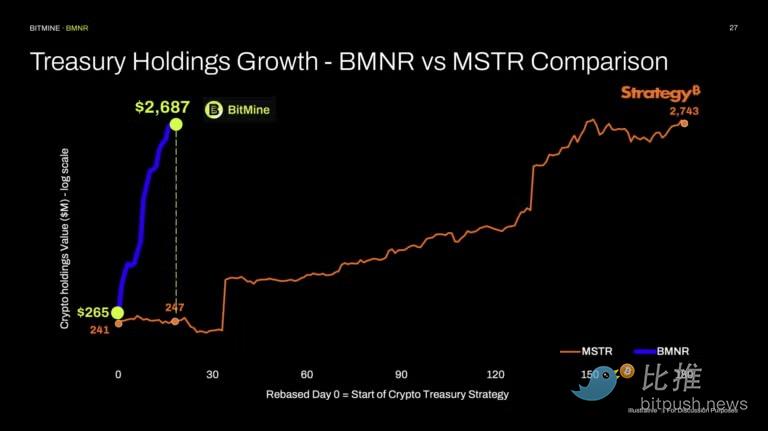

BitMine Immersion (BMNR), the first investment from Pantera's DAT Fund, embodies a company with a clear strategic vision and strong execution. As Chairman, Fundstrat's Tom Lee has outlined BitMine's long-term vision: to acquire 5% of the total Ethereum supply—what they call "5% Alchemy." We believe BMNR is valuable as a case study of a DAT that has executed effectively.

BitMine (BMNR) Case Study

Since BitMine launched its treasury strategy, it has become the world's largest Ethereum treasury and the third-largest DAT globally (after Strategy and XXI), holding 1,150,263 ETH, valued at $4.9 billion (as of August 10, 2025). BNMR is also the 25th most liquid stock in the US, with a daily trading volume of $2.2 billion (five-day moving average as of August 8, 2025).

The Case for Ethereum

The key factor for the success of DATs is the long-term investment value of their underlying tokens.

BitMine's DATs concept is based on a core thesis: Ethereum will be one of the most significant macro trends of the next decade as Wall Street migrates on-chain. As we wrote in last month's letter, the "Great Migration On-Chain" is underway, driven by tokenized innovation and the growing importance of stablecoins. Currently, $25 billion in real-world assets exist on public blockchains—not counting the $260 billion in stablecoins, which collectively constitute the 17th-largest holder of U.S. Treasury bonds.

“Stablecoins have become the ChatGPT story of the crypto world.”

— Tom Lee, Chairman of BitMine, Pantera DAT Conference Call, July 2, 2025

The majority of this activity occurs on Ethereum, allowing ETH to benefit from the growing demand for block space. As financial institutions increasingly rely on Ethereum’s security to support their operations, they will be incentivized to participate in its proof-of-stake network—thus driving further accumulation of ETH.

Growing ETH Per Share (“EPS”)

After determining the investment value of the underlying token, the business model of DATs is to maximize token ownership on a per-share basis. There are several primary ways to increase ETH per share ("EPS"):

- Issue shares at a premium to the net asset value (NAV) of each token.

- Issue convertible bonds and other equity-linked securities to capitalize on the volatility inherent in stocks and underlying tokens.

- Obtain more tokens through staking rewards, DeFi income, and other operating income. It is worth noting that this is an additional method unique to ETH and other smart contract token DATs, which the original Bitcoin DATs (including Strategy) do not have.

- Acquire another DAT that is trading near or below NAV.

To that point, BitMine grew its ETH per share (coincidentally, abbreviated as “EPS”) at an astonishing rate in the first month of its ETH treasury strategy, far outpacing other DATs. BitMine accumulated more ETH in its first month than Strategy (formerly MicroStrategy) did in the first six months of its ETH treasury strategy.

While BitMine primarily grows EPS by issuing shares and generating staking rewards, we believe BitMine is likely to soon expand its strategy to begin issuing convertible bonds and other financial instruments.

Value creation examples

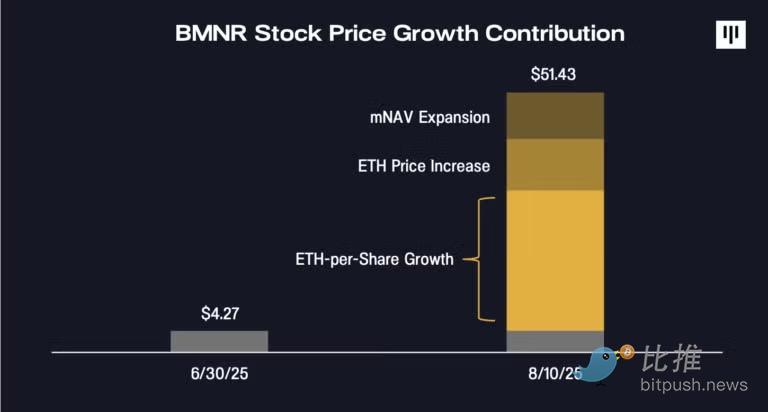

The price of DATs can be broken down into the product of three factors:

(a) the number of tokens per share,

(b) the price of the underlying token,

and (c) multiples of NAV (“mNAV”).

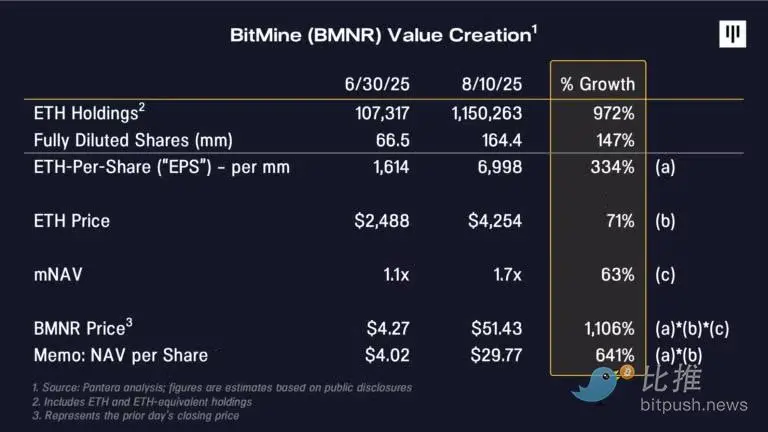

At the end of June, BMNR's stock price was $4.27 per share, approximately 1.1x its NAV of $4 per share from its initial DATs funding round. Just over a month later, the stock price closed at $51, approximately 1.7x its estimated NAV of $30 per share. This represents an 1,100% price increase in just over a month, with:

(a) EPS growth of approximately 330% contributed approximately 60% of the increase;

(b) The increase in ETH price from $2.5k to $4.3k contributed approximately 20% of the increase;

(c) The expansion of the mNAV multiple to 1.7x contributed approximately 20% of the increase.

This means that the vast majority of BMNR's share price increase is driven by the growth in the underlying amount of ETH per share, which is the core engine that management can control and is what distinguishes DATs from simply holding spot.

The third factor we haven’t explored yet is mNAV. Naturally, one might ask: why would anyone be willing to buy DATs at a premium to NAV?

Here, I find it useful to draw an analogy with balance sheet-based financial businesses like banks.

Banks try to generate income on their assets, and investors assign a valuation premium to companies they believe can consistently generate income above their cost of capital. The highest-quality banks, such as JPMorgan Chase, trade at more than two times NAV, or book value.

Similarly, if investors believe a DAT can consistently grow its NAV per share, they will also choose to value it at a premium to its NAV. We believe that BMNR's approximately 640% growth in NAV per share in just one month more than justifies its mNAV premium.

Whether BitMine can continue to effectively execute its strategy will become apparent over time, and it will inevitably face challenges along the way.

However, BitMine’s management team and track record to date have attracted support from heavyweights in traditional financial institutions, including Stan Druckenmiller, Bill Miller, and ARK Invest. We expect that the growth stories of the highest-quality DATs will be recognized by more institutional investors, as Strategy has experienced.

Ethereum's 10th Anniversary

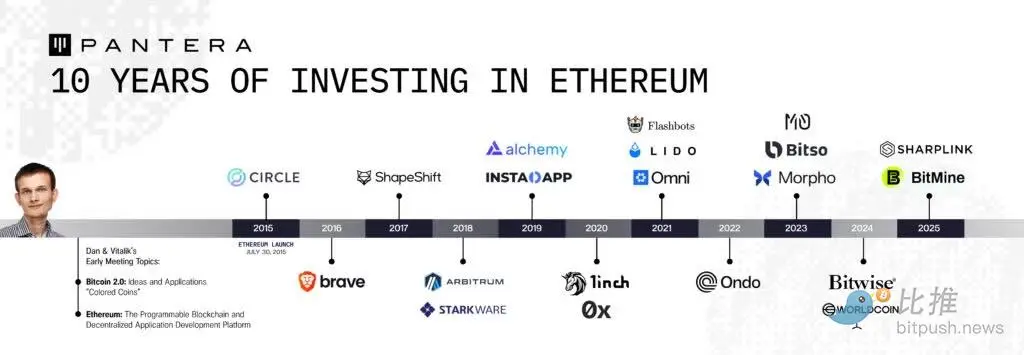

July 30th marks Ethereum’s tenth anniversary.

The first time I met Vitalik Buterin, he was a 17-year-old reporter for Bitcoin Magazine!

In 2014, we met again on the Colored Coins project – a fascinating precursor to today’s RWAs, NFTs, and various asset-backed tokens. He proposed the concept of Ethereum in January 2015.

Its growth is truly astonishing. Ten years of consistent, stable operations and uninterrupted trading. Ten years of innovation and reshaping the future of global markets.

We support numerous visionary teams and developers building applications and infrastructure that advance Ethereum’s mission. Our commitment to this ecosystem remains as strong as ever. The work is not done.

The Renaissance of Prediction Markets: Everything Can Be a Market

The prediction market renaissance is underway. While new prediction markets continue to emerge, there are now numerous prediction trading platforms across a wide range of market event types, formats (e.g., mobile platforms, Tinder-like swipe interfaces, trading terminals), and geographies.

This resurgence was catalyzed by several events:

- The success of Polymarket and Kalshi: Prediction markets consistently garner billions of dollars in monthly trading volume. Their success—particularly in the election market following the 2024 US presidential election—demonstrates the demand for event-based markets.

- Regulatory Clarity for Prediction Market Event Contracts: On October 2, 2024, the Court of Appeals for the District of Columbia Circuit denied a request for a stay of execution, allowing Kalshi to launch its election contract. Robinhood also launched its election market that same month. The impact that regulatory clarity can have on innovative companies in the financial markets is astounding.

- The growth of the speculative generation: The median age of first-time homebuyers is 38, having risen significantly over the past few years. Retail zero-day options trading is poised to account for two-thirds of all daily options trading volume, demonstrating retail investors' thirst for quick wins in volatile markets. The "TikTokization" of financial markets continues, along with the desire to bet on more markets until there's nowhere left to bet.

While the speculative allure of prediction markets drives participation, these markets are far from useless. By aligning incentives with information, they can help uncover accurate information and insights.

Markets help predict outcomes, and new markets are emerging—including political events, corporate earnings forecasts, weather forecasts, and FDA drug approvals.

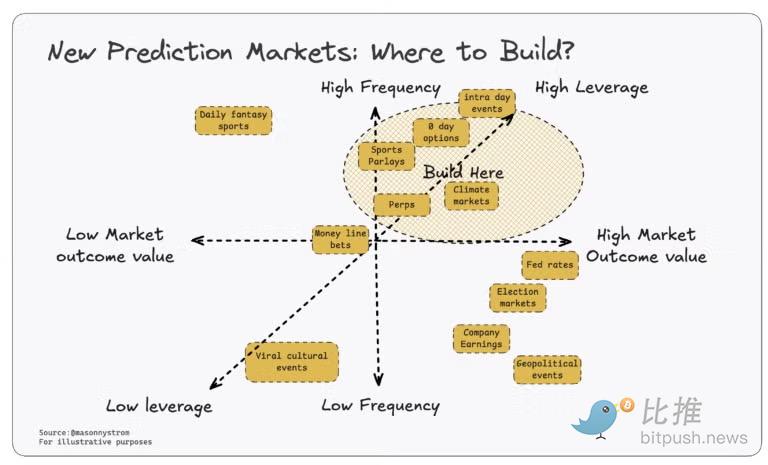

As the prediction market grows, many teams have adopted different product directions and market entry strategies. From an investment perspective, I believe that the new prediction markets that will achieve long-term success will focus on building excellent products that serve markets with the following common characteristics:

- Markets with very frequent events

- Markets with high leverage or the ability to earn large profits with small amounts of capital

- Markets with high outcome value—that is, where the predictive value itself has signaling significance

Let’s discuss this in more detail:

High leverage

Users seek high leverage or stacked odds to increase returns. Parlays, perpetual swaps (perps), and intraday event markets—all of these prediction market products have the potential to increase demand for prediction market events. Imagine the midterm elections, if someone could correctly place parlays on all outcomes. Given the rise of zero-day options, intraday markets (half-day, hourly, minutely) are also worth considering.

High-frequency prediction markets

Prediction markets are habit-forming — users come to bet on the markets they are interested in. More markets helps keep users engaged, but what really matters is the presence of high-frequency markets, which drives user retention.

Users who want to bet on a one-time, high-profile event (a presidential election, a pop culture event, etc.) can do so on any platform, and they'll likely end up using the platform they visit most frequently. Having more recurring markets will also create better economics for platforms, allowing them to list more markets, cover customer acquisition costs, or otherwise become more competitive. This is already happening in sports betting, where platforms like DraftKings use DFS (Daily Fantasy Sports) as a valuable acquisition and retention tool to cultivate habitual user behavior.

High market outcome value

Elections are not frequent events, but they have high signaling value, which attracts a lot of capital into these markets.

Polymarket recently released FDA approvals, decisions that can make or break multi-billion dollar businesses. Kalshi's climate market has predictive signal value, and in theory, other types of derivative contracts could be constructed based on a large number of daily predictive signals. Markets with high outcome value will drive higher trading volume and deeper liquidity.

In contrast, many pop culture markets—reality shows, Grammy winners, Nobel Prize winners—while fun to bet on, have low-value outcomes. Sometimes, the low value is partly because the outcomes can be manipulated. A prediction market based on a TV show like "Survivor" can be fun, but if the stakes are high enough, people will find ways to manipulate the market.

The explosion of prediction markets will leverage efficient markets to generate valuable predictive insights and provide a leveraged form of entertainment for the same customers who trade individual stocks or bet on sports. We are about to see an explosion in the types of markets and the things people can bet on. The era of markets for everything is upon us.

Entering the second stage of the bull market

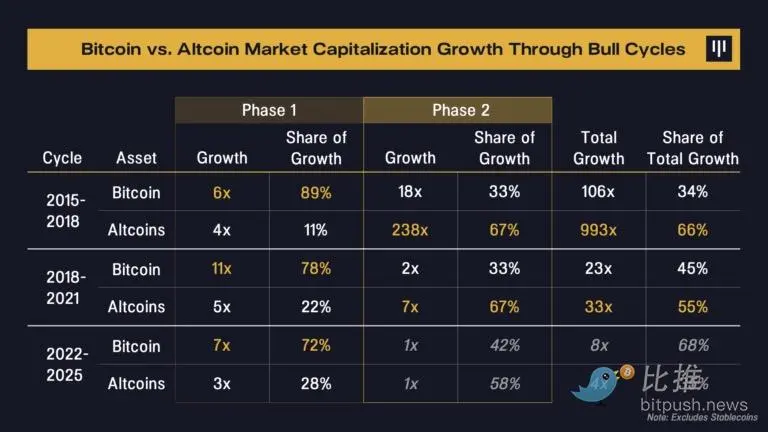

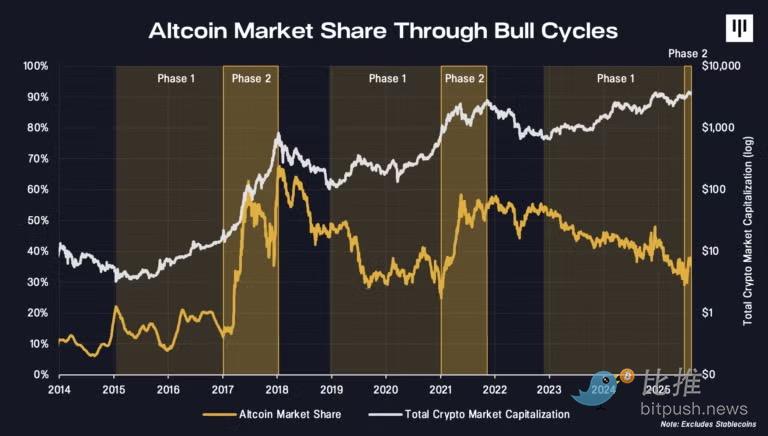

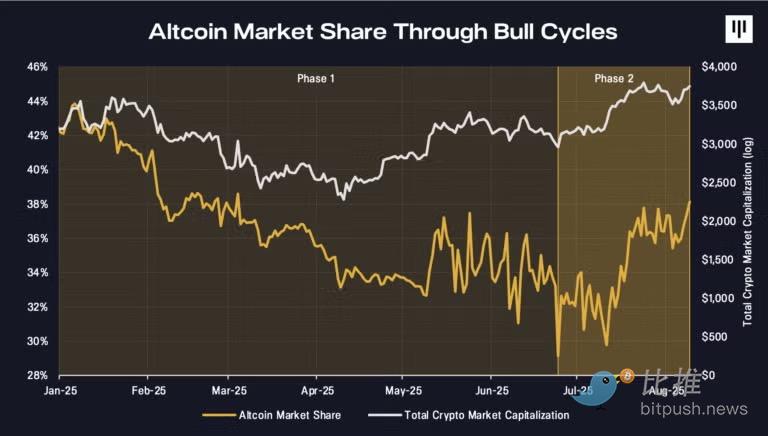

Bitcoin tends to lead bull cycles, while altcoins tend to lag early on. As the cycle progresses, altcoins typically gain momentum and outperform Bitcoin by the end of the cycle. We refer to these as the "first phase" and "second phase" of a bull market.

Importantly, altcoins have contributed the majority of value creation in the past two cycles. In the 2015-2018 cycle, altcoins accounted for 66% of the growth in total crypto market capitalization. In the 2018-2021 cycle, they contributed 55%.

So far in this cycle, altcoins have accounted for only 35% of the total market growth.

Bitcoin has long benefited from regulatory clarity—not only because it's classified as a commodity, but also because its role as "digital gold" is well understood. This was a key driver of its outperformance against altcoins early in the cycle, as altcoins have historically faced greater regulatory uncertainty—until recently. With the arrival of a new administration, this dynamic is shifting, driving meaningful progress in digital asset innovation.

The regulatory clarity and benefits that have historically favored Bitcoin are now beginning to extend to altcoins. The market is beginning to reflect this.

Momentum is building as regulatory victories continue to accumulate. Last month, President Trump signed the GENIUS Act into law, setting the stage for a flourishing of regulated stablecoins in the United States, which could become an engine for global financial transactions. The CLARITY Act, which has already passed the House of Representatives, aims to establish a clearer distinction between digital commodities and digital securities—helping to resolve the long-standing jurisdictional uncertainty between the SEC and the CFTC. A shift is underway, and there's reason to believe that non-bitcoin tokens will be among the biggest beneficiaries.

Innovation and development are accelerating, particularly in the tokenization space. Robinhood recently launched equity tokens powered by Arbitrum, aiming to democratize stock investing and create more efficient markets. Major US banks such as Bank of America, Morgan Stanley, and JPMorgan Chase are exploring issuing their own stablecoins. BlackRock's BUIDL Fund has accumulated $2.3 billion in tokenized Treasury bonds. Figure has processed over $50 billion in blockchain-native RWA transactions. In addition to its tokenized Treasury bond fund, Ondo plans to offer over 1,000 tokenized stocks on the NYSE and Nasdaq through Ondo Global Markets. The on-chain migration is underway.

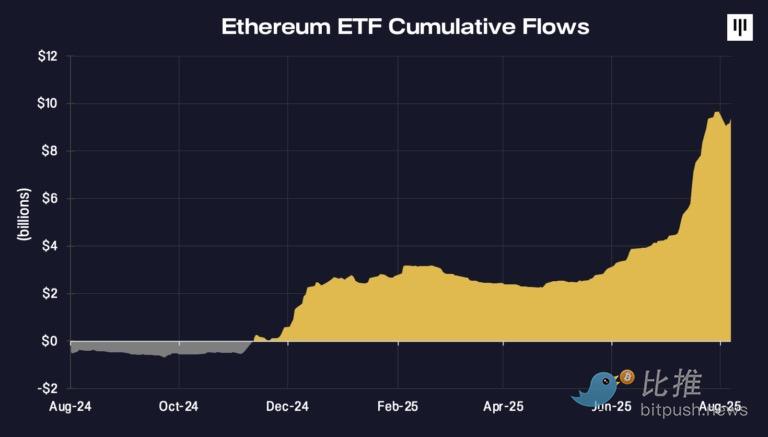

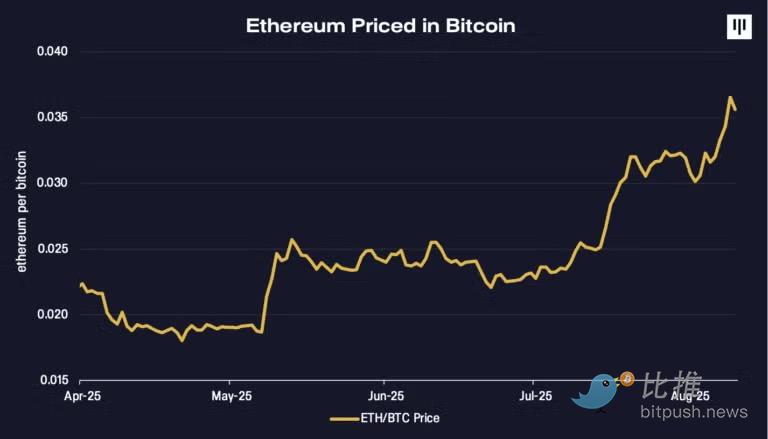

Ethereum drives growth in alt-bitcoin market share

Most real-world assets are flowing into Ethereum.

Of the $260 billion stablecoin market, 54% are issued on Ethereum. 73% of on-chain treasury assets are on Ethereum. DATs are accumulating at unprecedented levels. Wall Street is waking up to this, and demand for ETH is surging.

Ethereum, priced in Bitcoin terms, has risen 103% since hitting a bottom in April 2025.

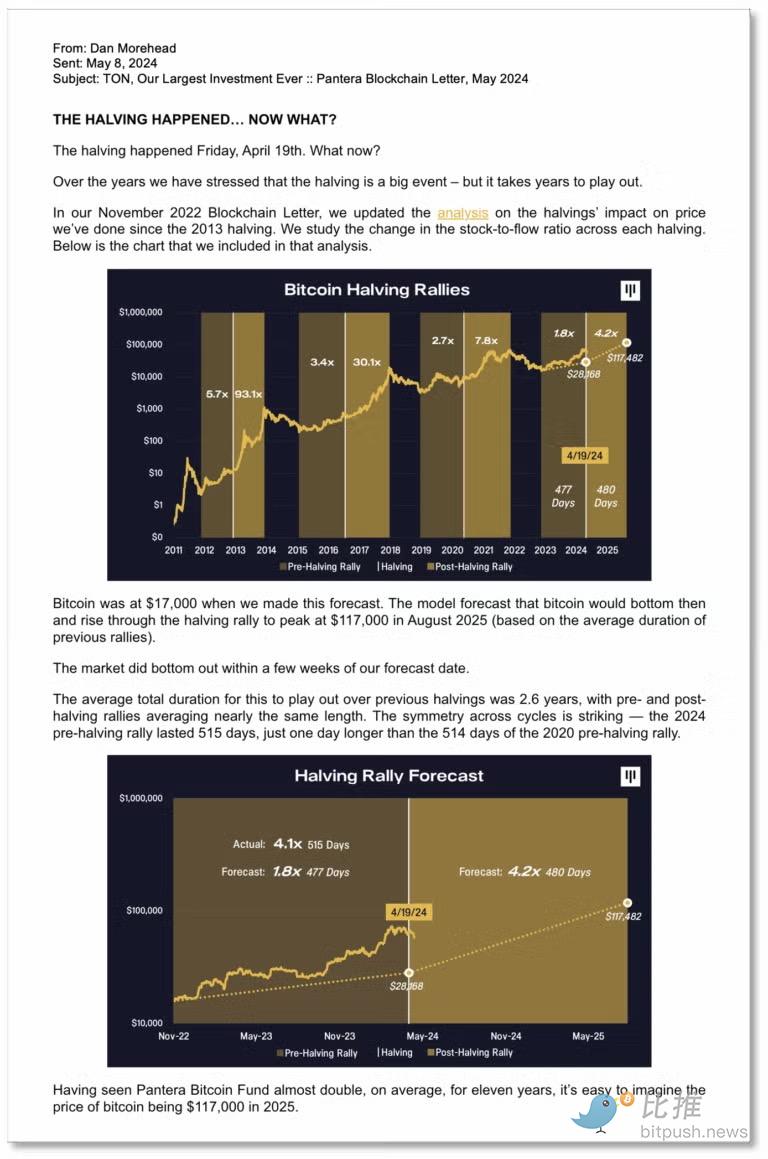

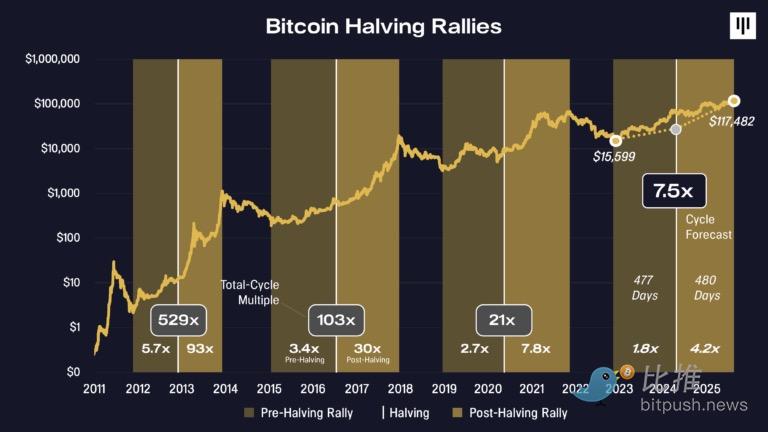

Bitcoin Halving Cycle – Accurate Prediction

This is crazy!

During the crypto winter, we used research from the three previous Bitcoin halvings to predict that Bitcoin would reach $117,482 on August 11, 2025.

It really achieved that!!!

The Halving Happened… Updated

In our November 2022 Blockchain Letter, we updated our analysis of the price impact of halvings since the 2013 halving. We examined how the stock-to-flow ratio has changed after each halving. The chart below is an updated version of our analysis from that time.

Have a great August,

“Putting the ‘alternative’ back in ‘Alts’” – Dan Pantera

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Rand Capital Announces $0.29 per Share Cash Dividend for First Quarter 2026