Google Play Store Clears the Air: Non-Custodial Wallets Will Not Be Banned

What was likely an honest mistake in a seemingly innocuous Google Play Store policy update in July, caused an uproar in the crypto community.

No Ban for Non-Custodial Wallets in the Google Play Store

In an unusual move, Google owned up to accidentally banning all non-custodial crypto wallets from the Google Play Store and promised to revise its new policy to clarify that non-custodial wallets on the platform don’t need to be government-licensed banks or registered money services businesses (MSBs).

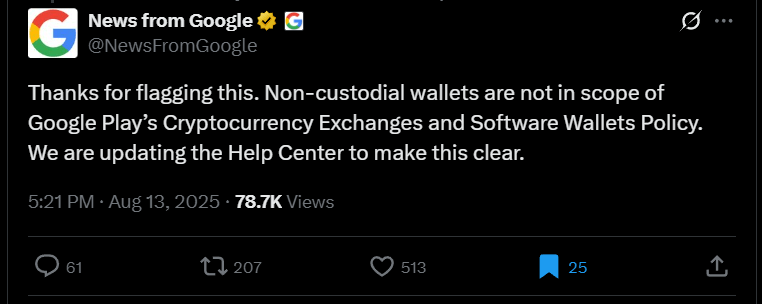

(Google clarified that non-custodial wallets are “not in scope” of their new policy which many thought was meant to ban such wallets from the platform.)

(Google clarified that non-custodial wallets are “not in scope” of their new policy which many thought was meant to ban such wallets from the platform.)

The Google Play Store had quietly updated its policy on July 10, 2025. But it wasn’t prepared for the backlash generated by an article from The Rage published on Wednesday, revealing a wrinkle in the new policy that would have required all crypto wallets in the Google Play Store across 15 jurisdictions to have government licensing and registration.

“Thanks for flagging this,” Google wrote in a response on X. “Non-custodial wallets are not in scope of Google Play’s Cryptocurrency Exchanges and Software Wallets Policy. We are updating the Help Center to make this clear.”

Custodial wallets store cryptocurrency on behalf of their customers. This is commonly done by exchanges and similar entities that must register with the U.S. Financial Crimes Enforcement Network (FinCen) as MSBs. But some customers prefer to have full ownership and control of their assets, so they instead use non-custodial wallets that allow users to store private cryptographic keys on their devices. Because of this fundamental distinction, FinCen does not consider non-custodial wallets to be MSBs, let alone banks.

Yet the new Google Play Store policy, until today, made no such distinction, requiring all “cryptocurrency exchanges and software wallets” in 15 listed jurisdictions including the U.S., the UK, the EU, and Canada, to be licensed or registered by government regulators, a move that would have eliminated many or all non-custodial crypto wallets from the platform.

“If your app is targeting any of the countries/regions listed below, you will be served location-specific forms to complete,” the policy reads. “If you don’t have the required registration or licensing information for certain locations, remove them from your app’s targeting countries/regions.”

The language infuriated crypto legal experts and privacy gurus, with some describing it as “regulation by monopoly,” “insane,” and “a quiet coup on crypto.” The uproar was enough to get Google’s attention, and fortunately, the tech powerhouse promised to revise the new policy, promptly putting the controversy to rest.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

China Blocks Nvidia’s RTX Pro 6000D as Local Chips Rise