Federal Reserve Shutters Group That Policed Banks’ Crypto Activities

The US Federal Reserve Board said it will close its “novel activities supervision program,” a group set up in 2023 to monitor banks’ involvement with companies in the crypto space.

“Since the Board started its program to supervise certain crypto and fintech activities in banks, the Board has strengthened its understanding of those activities, related risks, and bank risk management practices,” the Fed said in an Aug. 15 notice.

Instead of a standalone initiative, the program will now integrate its “knowledge and the supervision of those activities into the standard supervisory process,” the Fed Board said. It will also rescind the 2023 supervisory letter that created the program.

Fed Program Was Created In The Aftermath Of 2023 Crypto Collapse

The initiative was set up five months after the collapse of three major US lenders that were closely situated with the crypto industry and tech startups, namely Silvergate Bank, Silicon Valley Bank, and Signature Bank.

The collapse started when crypto prices began dropping amid concerns over Silvergate’s health following the November 2022 collapse of the now-defunct crypto exchange, FTX.

At the time, Silvergate was deeply entrenched in the crypto industry, with roughly 90% of its deposits then related to digital assets.

The collapse of FTX triggered mass withdrawals, with Silvergate reporting it had lost $8 billion in deposits. The bank also had to realize a loss of around $718 million on its investments just to cover the withdrawals.

The panic from the Silvergate bank then spread to Silicon Valley Bank (SVB), which was not heavily involved in the crypto space but felt the ramifications of the Silvergate collapse due to its exposure to many tech startups and VC-backed firms that overlapped with companies in the digital asset industry.

That panic finally trickled down to Signature bank, who ended up buckling under the pressure from a wave of withdrawals.

At one point, Signature bank’s withdrawals reached $10 billion in a single day, forcing the bank to shut down its Signet offering, an interbank payment network that exchanges such as Coinbase relied on. This reduced liquidity in the crypto space.

Regulators Opt For Softer Approach To Crypto Oversight Under Trump

The closing of the novel activities supervision program does not necessarily indicate a scale back in oversight of banks engaging with crypto companies, but does come amid a trend of US government agencies easing their oversight of the crypto industry under Donald Trump’s administration.

Since the start of the year, the US Securities and Exchange Commission (SEC) has dropped several investigations and enforcement actions into crypto companies. SEC Chair Paul Atkins has also announced the agency’s “Project Crypto” initiative, with the goal to ease licensing requirements on crypto firms.

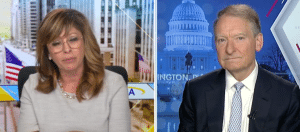

During a Fox Business appearance yesterday, Atkins said that the agency is “mobilizing” all of its “different divisions and offices” to implement the recommendations from Trump’s crypto working group to make the US more crypto-friendly.

Atkins talks to Fox Business (Source: Fox Business)

That includes adjusting rules that “have been around for 90 years or so,” he said.

“We don’t want the crypto assets to be on some flash drive in somebody’s drawer,” he added. “They need to be in a secure place … the reason for doing all this and addressing these various regulations is to provide some certainty for people.”

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

US Senate Releases Draft Crypto Bill Establishing Clear Regulatory Framework for Digital Assets