Stablecoins Threaten to Disrupt U.S. Bank Deposits and Payments, Morningstar DBRS Warns

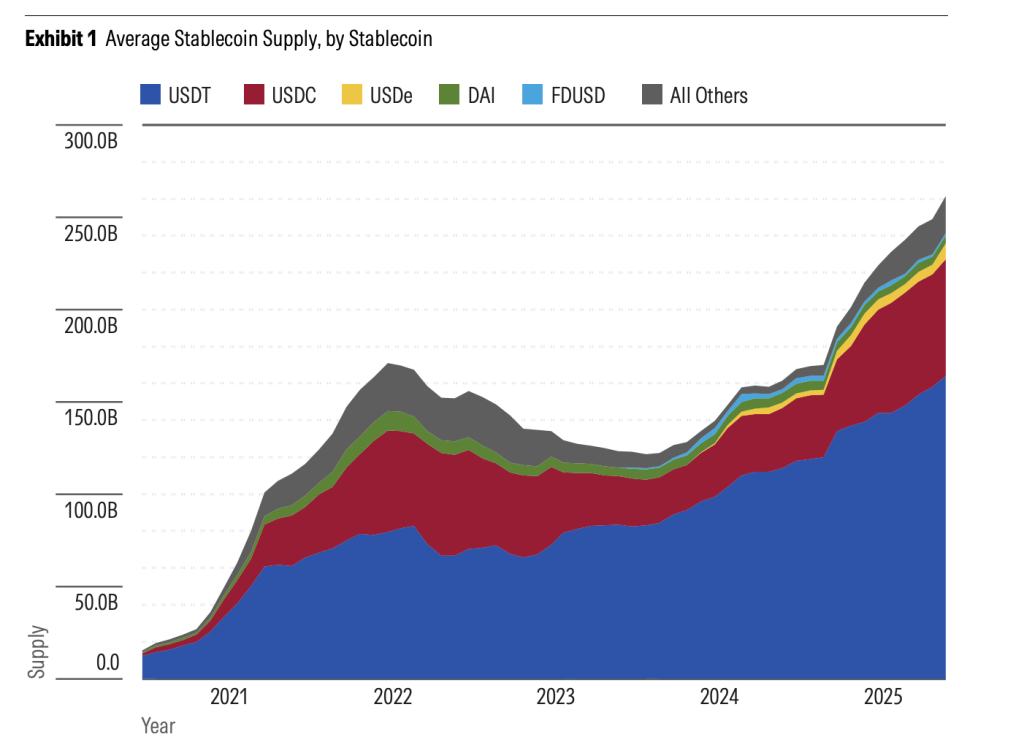

Stablecoins have rapidly become a central pillar of the digital asset economy, now exceeding a combined market capitalization of $230 billion as of mid-2025, according to Morningstar DBRS.

The market is led by Tether (USDT) and Circle (USDC), with other players including USDe, DAI, and FDUSD (see Exhibit 1). This growth has been fuelled by their stability — pegged to the U.S. dollar — and their ability to function as digital cash within the blockchain ecosystem.

The passage of the first federal stablecoin legislation on July 17 has also accelerated adoption. With regulation in place, U.S. banks are beginning to explore launching their own stablecoins, notes the agency.

“Stablecoins offer efficiency and innovation in the financial system, but they also pose both opportunities and risks for banks,” Morningstar DBRS analysts wrote in a report published Tuesday.

How Stablecoins Work: Cheaper, Faster, Smarter Money

Morningstar explains stablecoins are designed to combine the reliability of fiat currencies with the efficiency of blockchain. Unlike traditional payment rails — credit cards, ACH, or wire transfers — stablecoin transactions settle in seconds.

“Stablecoins are programmable money,” Morningstar notes, highlighting their use in smart contracts that automatically execute financial operations.

This has made them attractive for cross-border payments, e-commerce, and remittances. Major issuers like Tether, Circle, and PayPal back their coins with reserves of short-term U.S. Treasuries and cash equivalents, ensuring stability and redeemability.

The efficiency advantage is stark: where wire transfers can cost up to $50 and take days to settle, stablecoins move instantly with negligible fees. This dynamic is drawing users away from banks’ legacy systems.

Risks to U.S. Banks: Deposits and Payments at Stake

Morningstar warns that the rise of stablecoins poses real risks to U.S. banks’ core business models. The most immediate concern is deposit flight.

If consumers increasingly hold funds in stablecoins for rewards, convenience, or integration with decentralized finance, banks could lose the deposits that underpin their lending operations.

According to the Bank for International Settlements, stablecoins still account for just 1.5% of total U.S. deposits, but growth is accelerating. “

A large-scale shift of funds from bank accounts into stablecoins could constrain banks’ ability to fund new loans or extend credit,” Morningstar analysts said.

Banks also risk losing lucrative payment fees. Stablecoins bypass networks like ACH and SWIFT, enabling cheaper and faster transfers. As Exhibit 2 shows, the cost advantage is significant, threatening revenue from transaction services.

Not All Bad News: A Path Forward for Banks

Despite the risks, Morningstar highlights potential opportunities. Banks could leverage their regulatory credibility to serve as custodians of stablecoin reserves, manage U.S. Treasury holdings, and provide settlement and compliance infrastructure. These services could open new fee income streams.

The newly passed GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act) sets capital and reserve requirements for issuers, creating a more level playing field. Some banks are considering launching their own fully backed stablecoins, integrated into existing compliance systems, to retain deposits and stay competitive.

“Whether stablecoins ultimately represent an opportunity or a threat to U.S. banks will depend on regulatory design and market adoption,” Morningstar concludes.

You May Also Like

Aave CEO Breaks Silence on Game-changing Upgrade in Q4: Details

NZD/USD holds losses below 0.5750 ahead of China trade data

![Will dogwifhat [WIF] break $1.29 or stay stuck in consolidation?](https://ambcrypto.com/wp-content/uploads/2025/09/Erastus-2025-09-17T121713.938-min.png)