Who Really Owns Kaspa? On-Chain Data Reveals the Truth About Wallet Concentration

A recent thread from an unknown analyst going by “R.E.C.O.N” has been making the rounds on X, and it became popular for a simple reason: it brought actual wallet distribution data into a conversation that is usually driven by assumptions. The post went viral quickly, and even though the author isn’t a major public figure, the numbers shared are worth looking at, especially for anyone trying to understand how decentralized Kaspa really is at this stage.

The thread focuses on one of the most common concerns in crypto: who controls the supply, and how much concentration is too much.

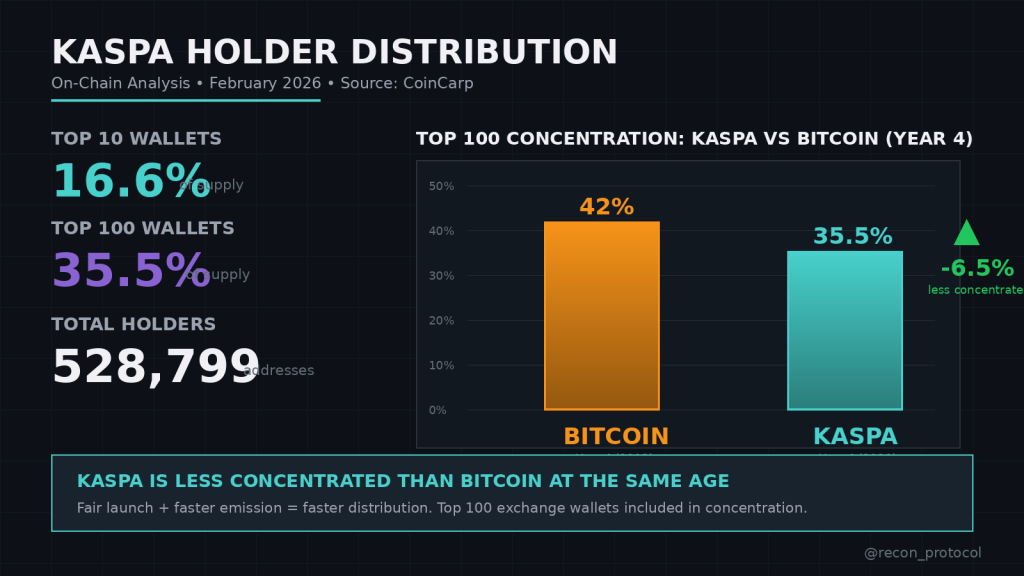

R.E.C.O.N started with the raw breakdown of Kaspa’s top holders as of February 2026. The top 10 wallets control about 16.6% of the supply, while the top 100 wallets hold roughly 35.5%. At first glance, those numbers can sound heavy, and the initial reaction from many people is predictable: “That’s too concentrated.”

But the thread argues that raw wallet rankings don’t tell the full story unless the wallets are labeled properly.

One of the most important distinctions is between whale wallets and exchange custody wallets. The top 10 includes several identified exchange addresses, such as MEXC, Uphold, Bybit, and Bitget. Together, these exchange wallets represent around 8% of the “top holder” concentration. That matters because exchange wallets don’t belong to one individual investor. They hold coins on behalf of thousands of users.

Source: X/@recon_protocol

Source: X/@recon_protocol

So the headline concentration looks more dramatic than the reality. Without separating exchange custody from private accumulation, the numbers can be misleading.

The next comparison in the thread is where things get more interesting. R.E.C.O.N compares Kaspa’s distribution to Bitcoin’s distribution at a similar age. Bitcoin’s top 100 wallets in 2013 reportedly held around 42% of the supply, while Kaspa’s top 100 today sits at 35.5%.

The point here isn’t that Kaspa is perfectly distributed, but that its concentration level is not abnormal for a four-year-old proof-of-work network. In fact, it may even be slightly more distributed than Bitcoin was during its early years.

The thread also shows Kaspa’s “fair launch” structure as a key reason distribution happens differently. With no team allocation, no VC unlock schedules, and no foundation treasury waiting to sell, supply enters the market mainly through mining emissions. That creates a slower, more organic distribution process over time.

Another important dataset mentioned is Kaspa’s holder behavior through HODL waves. According to the thread, around 61% of the supply hasn’t moved in over six months, and meaningful portions have remained dormant for one to three years.

That kind of inactivity can be interpreted in different ways. It could signal conviction from long-term holders, but it also means supply isn’t constantly being recycled through speculative selling. R.E.C.O.N argues that moderate concentration combined with dormant wallets is far less bearish than high concentration combined with aggressive distribution.

Still, the thread doesn’t ignore risks. It notes that a handful of large non-exchange wallets remain unidentified. These could be early miners or long-term holders, but if any of them decided to sell heavily, the market impact would be real. That’s not fearmongering, it’s simply the reality of any asset where large holders exist.

Finally, the thread points out that Kaspa has over 528,000 addresses, which is notable for a relatively young network that hasn’t relied on heavy VC marketing or coordinated adoption campaigns. The argument is that this is what organic growth looks like in a fair launch system.

Overall, the takeaway from R.E.C.O.N’s analysis is not that Kaspa is perfectly decentralized already, but that its wallet distribution is not unusually unhealthy when viewed in context. Exchange wallets inflate concentration stats, early-stage networks always look top-heavy, and fair launch mechanics tend to distribute supply gradually instead of through sudden unlock events.

The thread went viral because it challenged a common assumption with real numbers. And even without hype, it provides a useful reminder: decentralization is a process, not a snapshot.

Read also: Where is Kaspa (KAS) Price Headed This Week?

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Who Really Owns Kaspa? On-Chain Data Reveals the Truth About Wallet Concentration appeared first on CaptainAltcoin.

You May Also Like

Will Cardano Reach $10 by 2030? Analysts Break Down ADA’s Growth Cycles

Shiba Inu Price Forecast for Feb 9: Here’s Key Overhead Resistance for Any Move Upwards