Crypto Volatility: A Risk or Normal Asset Behavior?

Cryptocurrency adoption and wild market moves are the two facets of the same phenomenon.

There are always huge swings in the market, from periods of extreme optimism to complete anarchy, whenever news breaks regarding the widespread use of cryptocurrencies.

Why is this happening? The plot continues because of adoption, and the story itself keeps things moving. Major corporations are embracing Bitcoin, and numerous nations are exploring the potential of blockchain technology and central bank digital currencies (CBDCs).

These indicators enhance the ecosystem by incorporating institutional capital into cryptocurrency investments, and as a result, bring about a cycle of euphoria and the resultant extreme moves in between.

When news of adoption leads to rapid price increases, attention frequently moves away from sustainable value and toward immediate speculation. This can lead to fluctuations that deter the very institutions and individual investors that adoption seeks to engage.

Embracing new strategies is essential for long-term development, particularly in the realm of cryptocurrencies and emerging technologies. Pumps can generate enthusiasm, but in the absence of genuine utility and confidence, they quickly lose momentum. The true advantage lies in consistent, knowledgeable engagement rather than merely pursuing fluctuations.

On the other side of the argument is that most assets take time to realize their true potential, and the initial wild moves start to turn and bring down the spikes eventually.

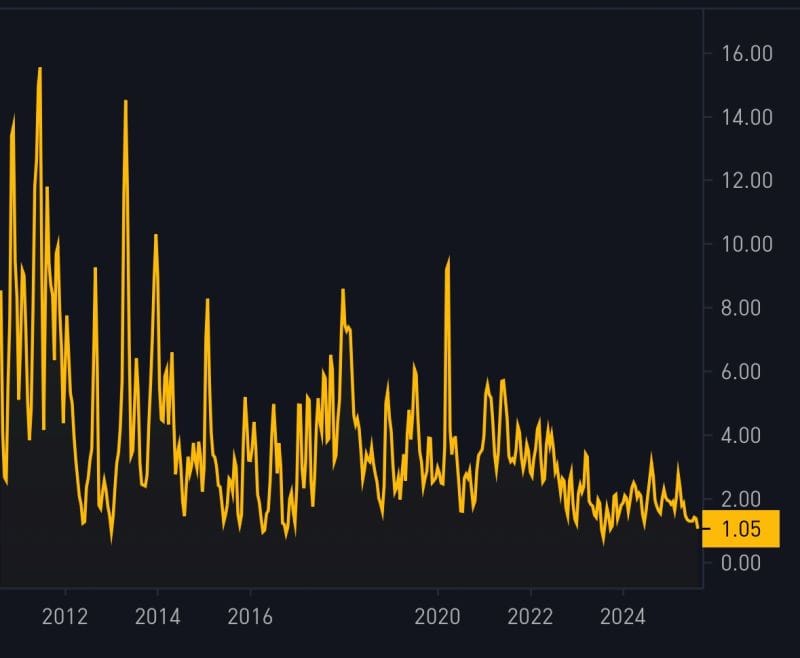

For cryptos, the initial volatility, ranging from 10% to 15%, has now significantly reduced to under 1% in recent times.

That exhibits lower volatility compared to Nvidia, Amazon, and Tesla, among other assets. And here’s the twist that often goes unmentioned: Fluctuations in the market aren’t necessarily negative. Fluctuations are the breeding ground for potential gains.

The Genuine Risk?

The strategy involves acquiring at elevated prices, divesting at reduced values, and maintaining a position of neutrality.

Investing in international real estate or digital currencies like Bitcoin requires embracing strategic volatility in today's markets rather than trying to avoid it.

Source: Bitbo.io

Source: Bitbo.io

Whether compared to other asset classes or on its own, Bitcoin's volatility is plain to see. However, the fluctuations in the token's price should not be considered a measure of its reliability as a store of value.

Although Bitcoin exhibits greater volatility compared to other major asset classes, it is noteworthy that it has become less volatile than certain well-known securities held by long-term investors.

The introduction of new money is often expected to cause a commodity or asset class that is still in its early stages of development and has a small market cap to display more volatility.

During its early years, Bitcoin's volatility was above 200% on an annual basis, and it frequently reached triple-digit fluctuations.

With the continued development of this asset class and its increasing market capitalization, the influx of capital is expected to have less of an impact because it will go toward a more solid capital foundation.

The market and the behavior of the average buyer or seller are very resistant to large infusions of new capital. Gold, for example, exhibited similar traits before gaining the safe haven status that it enjoys now. More importantly, traders' expectations of Bitcoin volatility, as shown by the prices of derivatives, have historically outpaced the actual volatility.

That is a telling narrative when it comes to discussing the volatility of an asset class, especially the ones on the rise.

In conventional finance, fluctuations are often equated with “risk.” Consequently, increased volatility is associated with greater actual or perceived risk. Nonetheless, volatility typically pertains to a statistical metric that indicates the spread of returns, like standard deviation.

Over the years, Bitcoin's value has fluctuated wildly, revealing its extreme volatility. Looking at the results, though, it's clear that a lot of them lean heavily toward the positive.

Elsewhere

Blockcast

Institutional Stake-hodlers: stETH vs stVaults vs Sales Cycle

Lido Ecosystem Foundation's head of institutional relations Kean Gilbert hops on Blockcast to confirm that institutions are here, after a long journey of discovery and education. Discover what happens during the shift from traditional finance to the forefront of blockchain innovation, and explore the strategic moves shaping the future of Ethereum and liquid staking.

Access the episode from your preferred podcast platform here.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama. Previous episodes of Blockcast can be found here, with guests like Kapil Duman (Quranium), Eric van Miltenburg (Ripple), Jeremy Tan (Singapore parliament candidate), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Samar Sen (Talos), Jason Choi (Tangent), , Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets.

You May Also Like

UNI Price Prediction: Targets $4.50-$5.00 by March as Technical Momentum Builds

Logitech G Drops a Wide Array Of New Products And Innovations At Logitech G PLAY 2025