190,000,000 ADA in 1 Week: Is Cardano on the Verge of a Further Dump?

Cardano’s ADA has been struggling lately, with its price nosediving to a five-year low at the start of February.

While bulls might be eager to see a decisive revival in the short term, the recent actions of the large investors suggest another move south could be on the way.

The Whales Know Something We Don’t?

The renowned analyst Ali Martinez revealed that Cardano whales have dumped approximately 190 million ADA in the past week. The USD equivalent of that stash is roughly $50 million (calculated at ongoing rates of $0.26 per coin).

Seven days ago, the total possessions of this cohort of investors were 13.57 billion ADA, whereas they currently hold around 13.38 billion tokens. The figure represents approximately 36.3% of the asset’s circulating supply.

There is a general assumption in the crypto space that whales are experienced investors who may have inside information about important upcoming events that could influence their buying or selling decisions. That said, their recent actions could spread panic across the community and prompt smaller players to cash out as well.

The purely economic impact is also worth noting. Large sell-offs increase the amount of ADA on the open market, which, combined with non-increasing demand, should lead to a price pullback.

ADA’s Relative Strength Index (RSI) is another bearish factor investors should be wary of. The indicator shows whether the asset is overbought or oversold based on recent price momentum. It ranges from 0 to 100 and helps traders identify when a trend may be about to end.

Readings above 70 signal that ADA has entered overbought territory and could be on the verge of a correction, while ratios below 30 favor a bullish scenario. As of this writing, the RSI stands at around 74.

ADA RSI, Source: RSI Hunter

ADA RSI, Source: RSI Hunter

History to Repeat Itself?

ADA is among the cryptocurrencies with vast communities, which consist of proponents and bullish analysts. Just a few days ago, X user Aman noted that the asset’s price has dropped to the demand zone of around $0.26, reminding that in the past this area has sparked major reversals.

Mentor shared a similar viewpoint, arguing that the last time ADA reached current levels, it later rose to nearly $1.40 in less than a month. “History is going to repeat itself soon,” they projected.

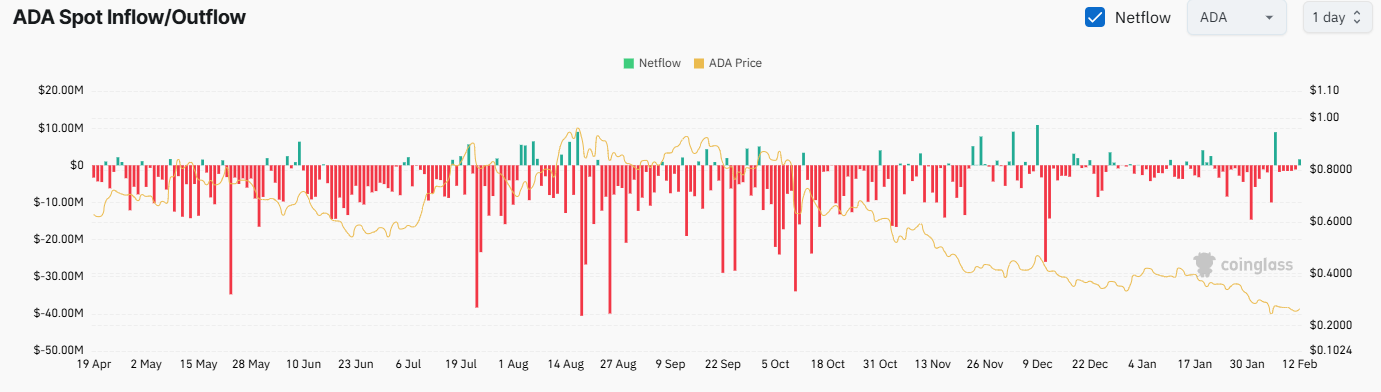

Over the last few months, ADA’s exchange netflows have been predominantly negative, which reinforces the optimistic predictions. The trend reflects investors moving coins from centralized platforms to self-custody, reducing the likelihood of short-term selling.

ADA Exchange Netflow, Source: CoinGlass

ADA Exchange Netflow, Source: CoinGlass

The post 190,000,000 ADA in 1 Week: Is Cardano on the Verge of a Further Dump? appeared first on CryptoPotato.

You May Also Like

Next Big Crypto? 11B Tokens Sold as APEMARS Stage 7 Closes in 24 Hours – Top 100x Meme Coin 2026 Poised to Outshine Cyber and Floki

BlackRock Increases U.S. Stock Exposure Amid AI Surge