Best Cryptocurrencies Under $0.10 for 2026–2027

The post Best Cryptocurrencies Under $0.10 for 2026–2027 appeared first on Coinpedia Fintech News

The top cryptocurrency market in early 2026 is becoming increasingly selective. Investors are moving away from hype-driven tokens like Dogecoin (DOGE) and PEPE (PEPE) and focusing instead on projects with working products and real utility. As meme momentum cools and capital rotates, attention is shifting toward low-priced protocols with live infrastructure and long-term growth potential. One emerging new crypto project under $0.10 is beginning to attract that early positioning ahead of the 2027 cycle.

Dogecoin (DOGE)

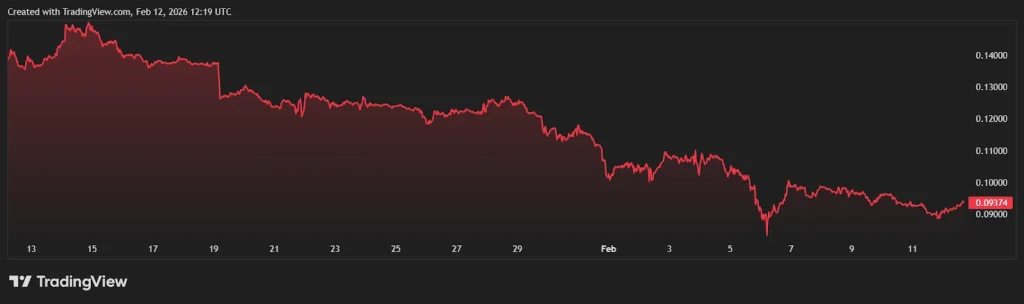

Dogecoin (DOGE) currently trades at approximately $0.09, with a market capitalization of roughly $14 billion. While it remains the most famous meme coin in the world, its path to a new all-time high has become very difficult. The coin is currently fighting significant downward pressure as the broader market enters a “risk-off” mood. Without a capped supply, millions of new DOGE enter the market every year, making it harder for the price to stay above key technical levels.

Technical analysts are keeping a close eye on major resistance zones between $0.11 and $0.13. DOGE has failed to break these levels multiple times in early 2026, leading to a “bearish” structure on the daily charts. If it cannot reclaim $0.10 soon, there is a risk it could slide back toward the $0.07 support area. The coin still has a loyal community, but the lack of a clear technical use case is starting to weigh on its long-term growth potential.

Pepecoin (PEPE)

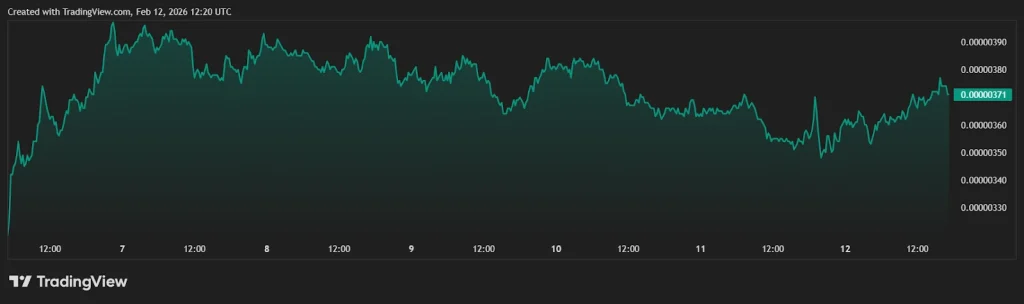

Pepecoin (PEPE) is currently trading at a fraction of a cent, with a market cap of about $1.5 billion. As a newer meme coin, it offers much higher volatility than Dogecoin, which attracts short-term traders looking for quick gains. However, PEPE is also facing a clear downtrend in February 2026. The token has been stabilizing near a critical support zone between $0.0000036 and $0.0000038. If this floor breaks, analysts warn that it could drop to much lower levels.

The resistance zones for PEPE are quite heavy, particularly around $0.0000050 and $0.0000068. To see a true reversal, the coin would need a massive surge in social media mentions or a new viral trend. Since PEPE is almost entirely driven by sentiment rather than utility, it remains highly vulnerable to changes in the market narrative. Many investors are starting to look for projects that offer more than just a funny mascot as they prepare for the 2027 cycle.

Mutuum Finance (MUTM)

While many meme coins struggle to establish long-term utility, Mutuum Finance (MUTM) is focused on building structured DeFi infrastructure. It is a decentralized lending and borrowing protocol aiming to let users supply tokens to earn yield or borrow against collateral without relying on traditional intermediaries.

The protocol’s whitepaper includes liquidity pools where supplier APY adjusts dynamically based on utilization. For example, stablecoin pools may target variable yields in the 8–12% range when borrowing demand is strong.

Borrowing is governed by predefined Loan-to-Value (LTV) ratios—such as 70%, meaning a user depositing $10,000 in collateral could access up to $7,000 in liquidity, with automated liquidation thresholds protecting system stability.

Mutuum Finance has already raised over $20.4 million during its structured distribution phase, signalling early capital commitment alongside infrastructure development. The project is currently in Phase 7 of its presale, with the token priced at $0.04. Since starting at $0.01 in early 2025, MUTM has already seen a 300% surge in value.

The project has a fixed supply of 4 billion tokens, with exactly 45.5% (1.82 billion tokens) allocated for the community. With over 19,000 holders already involved, the demand for this utility-driven token is outshining many of the purely speculative assets in the sub-ten-cent category.

Why Analysts Favor MUTM for Outperformance

Market experts believe MUTM is positioned to outperform DOGE and PEPE because of its core design. Dogecoin has an infinite supply, which creates constant sell pressure. Pepecoin has a massive supply and zero utility, making it a “hit or miss” investment.

Mutuum Finance’s roadmap, however, outlines a buy-and-distribute mechanism. A portion of the fees from the lending platform is used to buy back MUTM tokens and reward those who stake their assets. This links the token’s value directly to the growth of the platform.

Consider a $700 investment comparison. If you put $700 into DOGE at $0.09, you get about 7,777 tokens. For that to double, DOGE needs to hit $0.18, which requires billions in new market cap.

If you put $700 into the MUTM presale at $0.04, you secure 17,500 tokens. With a confirmed launch price of $0.06, that $700 is already worth $1,050 the moment it hits the market. Analysts believe that as the protocol scales, MUTM could reach $0.40 to $0.60, offering a much higher ceiling than legacy meme altcoins.

Technical Proof and Security

The strength of Mutuum Finance is rooted in its infrastructure rather than short-term pricing. The team has already deployed the V1 protocol on the Sepolia testnet, allowing users to interact directly with lending pools and observe how mtTokens accrue interest in real time.

Beyond supplier mechanics, the system also introduces debt tokens that represent outstanding borrow positions. These tokens track accrued interest and update dynamically as repayment obligations change.

Each borrowing account is governed by a health factor (or stability ratio), which measures collateral value relative to outstanding debt. If this ratio falls below a predefined threshold, automated liquidation logic activates to protect overall pool solvency.

To ensure the system is safe, Mutuum Finance (MUTM) has undergone a manual audit by Halborn Security. It also maintains a high 90/100 trust score from CertiK. For those looking for the best crypto under $0.10, the combination of a working product, professional audits, and a 300% growth track record makes MUTM a standout choice. As Phase 7 nears its end, the window to enter before the $0.06 launch is closing fast.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

You May Also Like

Solid growth outlook supports Ringgit – Standard Chartered

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!