JUST IN: Bitwise Files for First-Ever Chainlink Spot ETF

The post JUST IN: Bitwise Files for First-Ever Chainlink Spot ETF appeared first on Coinpedia Fintech News

Bitwise Asset Management has taken a bold step to widen the U.S. crypto ETF market.

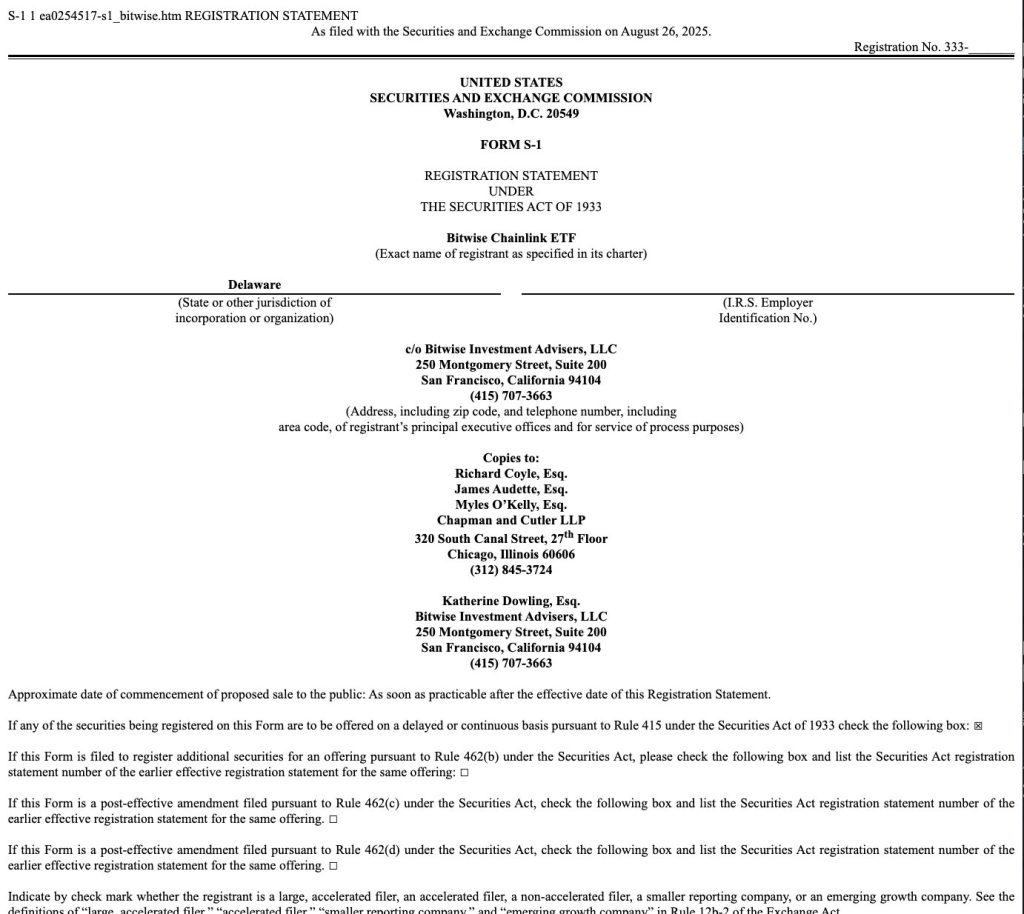

The firm filed an S-1 with the U.S. Securities and Exchange Commission (SEC) today, seeking approval to launch the Bitwise Chainlink ETF, a fund designed to track the spot price of LINK.

If approved, it would be one of the first U.S.-listed ETFs tied to an oracle network token, pushing the ETF market beyond Bitcoin and Ethereum.

What’s in the Filing

The preliminary filing shows that the ETF will hold LINK directly, with Coinbase Custody Trust Company as custodian and Coinbase Prime acting as the execution agent. The fund would track the CME CF Chainlink-Dollar Reference Rate, with both cash and in-kind creation and redemption options available for investors.

Interestingly, the filing makes no mention of staking.

This comes despite the SEC’s guidance earlier this year that staking on proof-of-stake networks does not count as a securities transaction. Bitwise has chosen to keep the product straightforward, focusing only on LINK’s spot market price.

Why Chainlink?

Chainlink is not an ordinary altcoin. Since its launch in 2019, the decentralized oracle network has become essential for DeFi, tokenization, gaming, NFTs, and cross-chain projects. Its technology supplies reliable off-chain data to smart contracts and is integrated with major institutions, including banks and even central banks.

The LINK token currently trades at $23.42, placing it as the 13th largest crypto asset by market cap, though still down more than 50% from its 2021 peak above $52.

SEC Review Ahead

While the structure mirrors the spot Bitcoin and Ethereum ETFs already approved, the SEC’s stance on altcoin ETFs remains uncertain. By sticking to a simple design – 100% LINK holdings, a single custodian, and no staking – Bitwise may be hoping to smooth the approval path.

Still, approval is far from guaranteed. The SEC’s decision here could set the tone for whether other altcoins will follow.

Global Demand Shows the Way

Europe already offers investors Chainlink products, with firms like 21Shares and VanEck running LINK ETPs. Demand is proven, but the U.S. market is far larger.

Globally, crypto ETFs have attracted nearly $30 billion in inflows this year, with assets under management above $150 billion. A U.S.-listed Chainlink ETF could bring a new wave of institutional capital into the token.

The Bigger Picture

The filing comes as crypto ETFs continue to diversify. Just yesterday, Grayscale moved to convert its Avalanche Trust into a spot AVAX ETF, while Bitwise itself has pending applications for XRP, Solana, Dogecoin, and Aptos.

The ETF race is moving beyond Bitcoin and Ethereum, and it’s getting exciting!

You May Also Like

Federal Reserve’s Rate Cuts May Affect Cryptocurrency Market

‘High Risk’ Projects Dominate Crypto Press Releases, Report Finds