Bitcoin Critic Schiff Warns of Further Decline After BTC Falls Below $109K

Economist and longtime Bitcoin critic Peter Schiff has warned that BTC’s recent 13% drop to under $109,000 signals deeper weakness.

Market Context and Recent Price Action

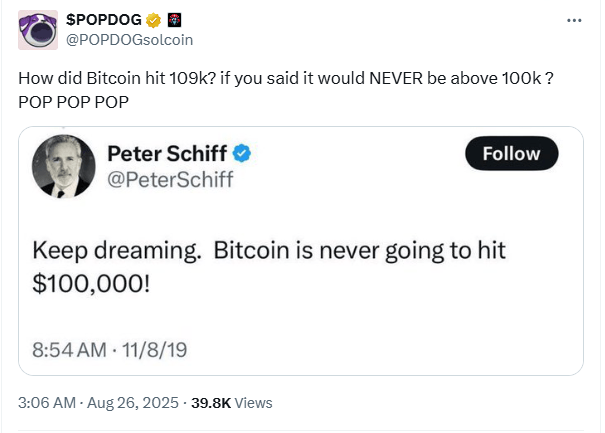

Economist and bitcoin critic Peter Schiff has said the top cryptocurrency’s decline by 13% to under $109,000 since peaking at $124,517 is a sign of weakness that should be a cause for concern. Schiff, who once vowed that bitcoin ( BTC) would never reach $100,000, said he now projects it will decline to $75,000, which is below Strategy’s (MSTR) average cost.

In an Aug. 26 post on X, Schiff advised BTC holders to sell the cryptocurrency now and repurchase it later at a lower price. The critic’s remarks were made just minutes after BTC plunged to $108,717, a new low since July 9.

Following the release of key Producer Price Index (PPI) data, the cryptocurrency’s price action has largely been on a downward trend. While the dovish remarks from U.S. Federal Reserve Chairman Jerome Powell at Jackson Hole did spark a rally, it proved to be short-lived, with BTC peaking just below $118,000 before resuming its decline.

BTC’s downward trend is energizing critics like Schiff who expect further losses in the near future. However, as expected, Schiff’s latest comments sparked a furious response from bitcoiners who were quick to remind the economist of his past vow that BTC would never reach $100,000.

Another user noted with incredulity that Schiff, who has a long and well-documented history of predicting BTC’s imminent collapse, is now confident it will fall to $75,000.

“Peter Schiff, the man who has called 100 of the last 2 Bitcoin crashes, now warns that $ BTC could plunge to $75,000. In 2018, he warned that it could collapse to $3,800. Incredible,” the X user said.

However, despite the prevailing bearish sentiment, a vocal group of pro- BTC experts remains confident in the cryptocurrency’s upside potential. One notable expert, known as Cryptobirb, remains adamant that the current BTC bull run has more than 55 days left before it concludes. According to Cryptobirb’s analysis, the peak of this cycle is expected to occur in a defined window between Oct. 19 and Nov. 20.

You May Also Like

Over $145M Evaporates In Brutal Long Squeeze

DOGE ETF Hype Fades as Whales Sell and Traders Await Decline