Weekly ETF Recap: Bitcoin and Ether ETFs Draw Strong Institutional Demand With Combined $1.9 Billion Inflow

Bitcoin exchange-traded funds (ETFs) notched an impressive $1.39 billion in net inflows, while ether ETFs booked $528.12 million, marking their fifth consecutive green week and third-highest weekly inflow since launch.

Bitcoin ETFs Post $1.39 Billion Weekly Inflow As Ether ETFs Record Third-Highest Ever Weekly Gain

Investor appetite for crypto exposure via ETFs surged last week, as bitcoin ETFs locked in a robust $1.39 billion in net inflows, capping a perfect 5-day inflow streak. This underlined growing institutional confidence in the digital asset market.

The single largest daily inflow came on Tuesday, June 10, when bitcoin ETFs attracted $431.12 million. Leading the charge was Blackrock’s IBIT, which netted a staggering $1.21 billion for the week, outpacing all competitors.

Bitwise’s BITB added a strong $82.83 million, Fidelity’s FBTC brought in $79.79 million, while Vaneck’s HODL ($29.02 million), Grayscale’s GBTC ($15 million), Grayscale’s Bitcoin Mini Trust ($12.75 million), Invesco’s BTCO ($7.65 million), and Franklin’s EZBC ($6.30 million) also posted net gains. This caused total net assets for bitcoin ETFs to soar past $130 billion.

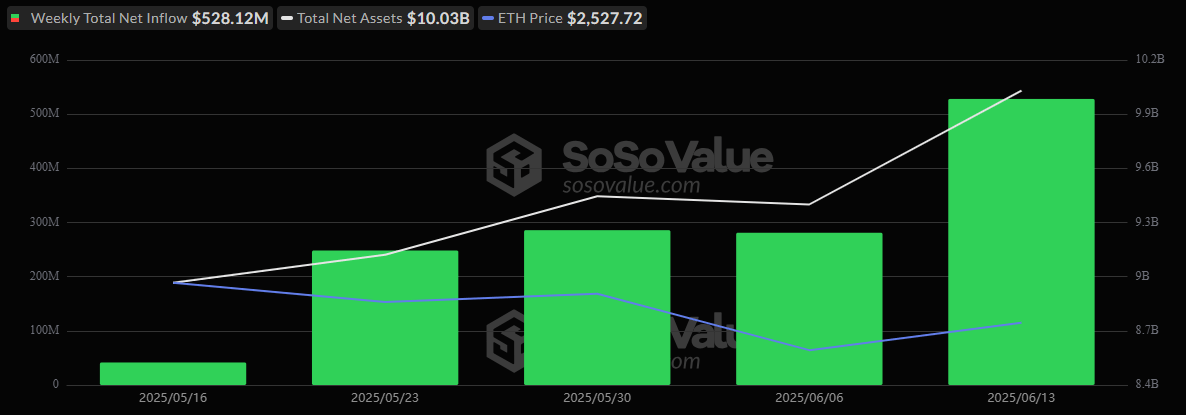

Ether ETFs 5 Weeks of Consecutive Gains. Source: Sosovalue

Ether ETFs 5 Weeks of Consecutive Gains. Source: Sosovalue

Ether ETFs continued their historic run, marking their fifth consecutive week of inflows with a sizable $528.12 million net addition, the third-highest since launch. The largest daily surge came on Wednesday, June 11, with $240.29 million flowing in.

Blackrock’s ETHA led all ether funds with $380.95 million, followed by Fidelity’s FETH ($78.49 million), Grayscale’s Ether Mini Trust ($40.57 million), Bitwise’s ETHW ($14.81 million), and Grayscale’s ETHE ($13.30 million).

The past week’s action reflects continued institutional optimism toward both bitcoin and ether ETFs, as broader market sentiment leans positive amidst regulatory clarity and strong macroeconomic signals.

You May Also Like

Galaxy Digital’s 2025 Loss: SOL Bear Market

Why This New Trending Meme Coin Is Being Dubbed The New PEPE After Record Presale