XRP Price News: DeepSnitch AI’s Community Confident the Live AI Analytics Suite Is the Main Driver of 100x Predictions, XRP and DOGE Show Lack of Momentum

Kraken’s xStocks platform blew past $25B in total transaction volume in less than eight months post- launch. This confirms that tokenization is picking up pace among traditional investors.

Meanwhile, many expect the XRP price news to improve as Ripple’s Stuart Alderoty is set to attend the White House stablecoin meeting. Yet, many traders are impatient and scared, which has driven significant capital to DeepSnitch AI and other presales.

DeepSnitch AI secured over $1.66M during the bearish market in Q1. Yet, while conviction and hype are significant drivers of the success, the main reason for the 100x predictions is the project AI analytics suite driven by AI agent tech.

Kraken hits new milestones

xStocks, a tokenized equities platform owned by Krake, achieved over $25B in total transaction volume. What makes this result more impressive is that Kraken launched eight months ago.

The $25B figure includes trading on CEX and DEX platforms, minting and redemption activity, which represents a massive 150% compared to $10B from November 2025.

xStocks tokens are 1:1 backed by regulated issuer Backed Finance, with Kraken as the primary distribution/trading venue. At launch in 2025, it offered over 60 tokenized equities tied to major US tech names like Amazon, Meta, Nvidia, and Tesla.

On-chain volume has been a major driver, hitting $3.5B with over 80,000 unique on-chain holders, showing users are self-custodying and integrating into DeFi ecosystems beyond centralized trading.

Meanwhile, retail traders await XRP price news to improve as they await large pumps and increase their allocations in presale projects.

Affordable crypto coins (February 2026)

- DeepSnitch AI: Why is everyone aping DSNT? Interface preview is now released

It’s perfectly understandable that retail is diving deep into affordable opportunities. However, the latest XRP price news today isn’t looking so hot with XRP dipping by over 5%.

XRP remains wallet-friendly, but it’s likely to stay affordable for a few additional years, meaning it could take a while until you see any gains. In contrast, DeepSnitch AI has a clear high-conviction, high-upside narrative.

DeepSnitch AI, as a presale, not only provides a hedge against short-term volatility but also represents an asymmetric play that you can enter at just $0.04064 per token.

Yet, the project is much more than a high-gain opportunity. One of the main reasons behind DeepSnitch AI securing over $1.66M (amid the current bear market, mind you) is its AI utility.

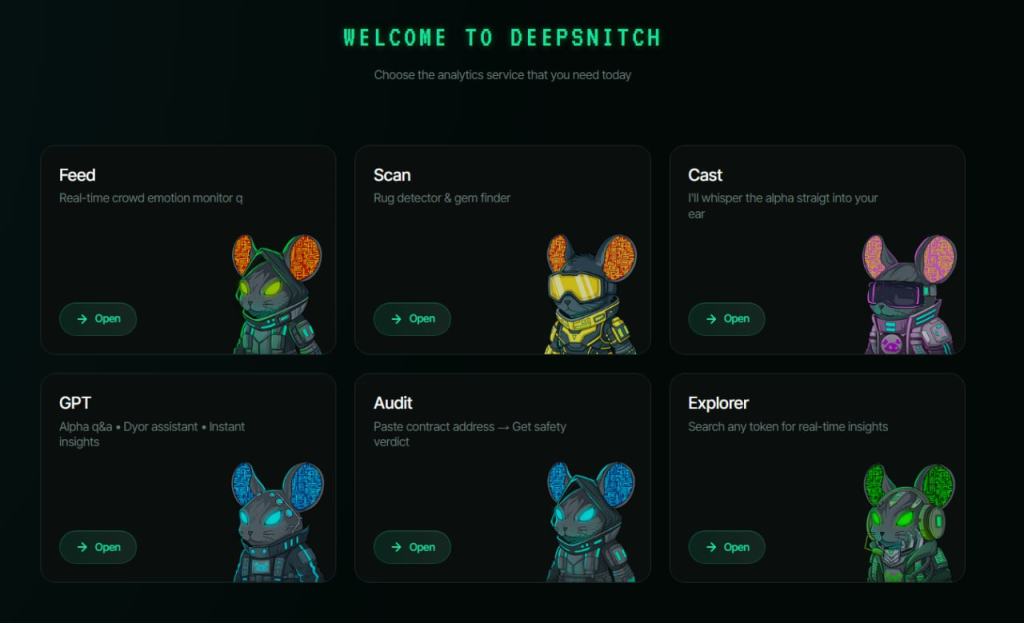

The platform is powered by five AI agents and is organized into a clean dashboard from where you can choose a variety of analytics services. One AI agent tracks social media noise to alert you of sentiment shifts or FUD, the other scans for rugs and hidden gems, with the GPT agent providing alpha Q&A and instant DYOR.

All of these features are designed to simplify and strengthen your daily trading activities, meaning that aping now not only allows you to apply bonus codes to unlock as much as 300% extra tokens on large allocations, but you can also use DeepSnitch AI to stack consistent wins in the trenches.

- XRP price news: What are the latest XRP market developments?

According to CoinMarketCap data from February 19, XRP traded at around $1.40.

XRP price news today revealed that the coin declined from $1.48 the day before, but the bulls may start exerting some hefty pressure soon. The 20-day EMA at $1.52 is within grasp, and conquering this area will open the possibility of a test of the breakdown level at $1.61.

If the price turns down from current levels and falls below the lower support will lead to a drop to the $1.15 area from early February.

The recent Ripple updates could potentially push the XRP price news into bullish territory. Ripple’s Stuart Alderoty will attend the White House stablecoin yield meeting along with Coinbase’s Paul Grewal and other notable reps.

- Dogecoin: Will DOGE finally recover?

DOGE zig-zagged its way to $0.097 on February 19, according to CoinMarketCap data.

Similar in short-term setup to the XRP price news, DOGE is also hovering below the 20-day EMA. In the next few days, Dogecoin could rally above the 20-day EMA at $0.10. Closing above this key level may lead to a surge to the 50-day SMA at $0.12, with the target set at $0.16.

Do note that sellers will try to put a stop to this rally by likely dumping at $0.12, and if they persevere, DOGE could drop to $0.08.

Final words: Buck the downturn trend

XRP isn’t doing well, and the latest XRP price news shows that the trading action is at a standstill. This means that presale projects are not only more affordable than XRP, but they could offer much higher ROI.

DeepSnitch AI, for instance, provides a $0.04064 entry, and the community sees the presale coin pumping by at least 100x post-launch, which is hard to achieve with established cryptos even when the market isn’t in the state of disarray.

You can also ensure the greatest yield by making use of the latest codes, such as DSNTVIP300, which you can enter at checkout to reserve a 300% bonus for allocations $30K+, which rounds out to $90K of extra value.

Buck the downturn by locking down your DSNT tokens in the DeepSnitch AI presale. Visit X or Telegram. If you’re interested in the latest updates.

FAQs

- What are the latest developments in XRP price news and Ripple’s involvement?

XRP traded around $1.40 after a 5% drop below the 20-day EMA at $1.52. Fortunately, Ripple’s Stuart Alderoty will attend the White House stablecoin meeting, which could boost sentiment if a positive outcome happens.

- What makes DeepSnitch AI’s AI-powered suite the key driver of its 100x predictions?

The suite is designed around simplicity, offering traders easy access to various types of analytics, including hidden gem detection, sentiment/FUD tracking, breakout signals, and instantaneous DYOR: These features provide it with mass appeal.

- Why are traders rotating into presales?

Many traders switch to investing in presales during bear markets because early-stage ICOs are shielded from daily price swings.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post XRP Price News: DeepSnitch AI’s Community Confident the Live AI Analytics Suite Is the Main Driver of 100x Predictions, XRP and DOGE Show Lack of Momentum appeared first on CaptainAltcoin.

You May Also Like

PCE Data Sparks Tensions: A Key Day for Bitcoin

Crucial Fed Rate Cut: October Probability Surges to 94%