Base's official coin launch staged a marketing reversal, and MEME coin plummeted before V hit a new high

Author: Nancy, PANews

Unlike the recent gradual recovery of MEME culture on Solana, the MEME ecosystem on Base is still in a state of silence. However, on April 17, the Base official suddenly made a high-profile exit, sharing its creation of MEME coins such as "Base is for everyone" on X, trying to ignite the cultural enthusiasm on the chain.

This carefully planned experiment of cultural revival on the chain quickly got out of control. The relevant MEME coins surged in a short period of time and then quickly collapsed. The official Base was also pushed to the forefront of public opinion. However, the plot did not end there. As the "Base is for everyone" rollover scene was re-created and evolved into a popular meme, the price of MEME coins unexpectedly reversed in a V-shape, and the sentiment on the chain also fluctuated.

Base coin issuance caused a stir, and the marketing failed but unexpectedly reversed

In the early morning of April 17, Base officially issued a token called "Base is for everyone" on the Zora platform and shared it in a high-profile manner through official promotion. Subsequently, the price of the MEME coin quickly soared to 17 million US dollars, and the long-dormant community atmosphere was instantly ignited. However, Base immediately launched a second token "Base @ FarCon 2025". This abrupt move was regarded as a "backstab" by the community, causing the price of the "Base is for everyone" token to plummet by 99% within a few hours, falling to a minimum of 717,000 US dollars.

Behind this plunge, in addition to the uncontrolled pace of coin issuance, high transaction taxes and insider trading suspicions have also become the fuse. It is reported that the MEME coin has set a 20% transaction tax, which leads to extremely high actual transaction costs and greatly weakens liquidity. Not only that, the distribution of tokens is extremely uneven, with the top three wallets holding 47% of the tokens, and one wallet holding 25.6%, raising concerns about market manipulation. According to Lookonchain monitoring, before the Base official token-related tweets, three wallets bought a large number of tokens in advance and then sold them, making a total profit of about US$666,000. The community's anger over insider trading has further damaged Base's credibility.

In the face of controversy, Base officials attributed the incident to an "experimental marketing". Base officials responded that Base posted on Zora because it believes that everyone should bring their own content to the chain and use tools that can make this happen. Memes, moments, culture. If Base wants the future to belong to the on-chain world, it must be willing to make bold attempts in the public eye. This is exactly what Base is doing. It should be clear that Base will never sell these tokens, and these are not the official network tokens of Base, Coinbase or any related products. The content shared by Base is a creative expression that will continue to bring culture to the chain.

NKECHI, the global builder of Base, also posted a clarification on Twitter that Base did not issue coins to pull the market. This is a "content coin", which is fundamentally different from the MEME coin. The core of the content coin is not speculation, but meaning. What you buy is not a project, but a moment, an atmosphere, and a culture. This is an expression on the chain, not an expectation on the chain. This field is still very new, and Base is still learning, but don't take "misunderstanding" as "failure". Base has been talking about bringing culture to the chain, open experiments, and supporting unlicensed creative expression. Because in this new economy, everyone - whether it is a brand, developer, artist or shitposter, can put content on the chain and turn it into a "coin". Posters, advertisements, videos, memes, art - can all be coins. This is not just content, this is a new way of marketing, a new way of creation, and a new way of expression.

Despite the official efforts to clarify, the storm did not subside immediately. Instead, it accidentally ignited a meme movement. Communities and crypto projects have used "** is for everyone" as a template to set off a viral creation boom, with full sarcasm and narrative power. With the help of market sentiment, Base's marketing unexpectedly gained a lot of attention, and the price of the "Base is for everyone" token staged a dramatic V-shaped reversal. According to GMGN data, the token rebounded to a maximum of US$22.55 million, and the trading volume in the past 24 hours exceeded US$33 million.

Daily revenue hits a two-year high, Zora is about to issue tokens

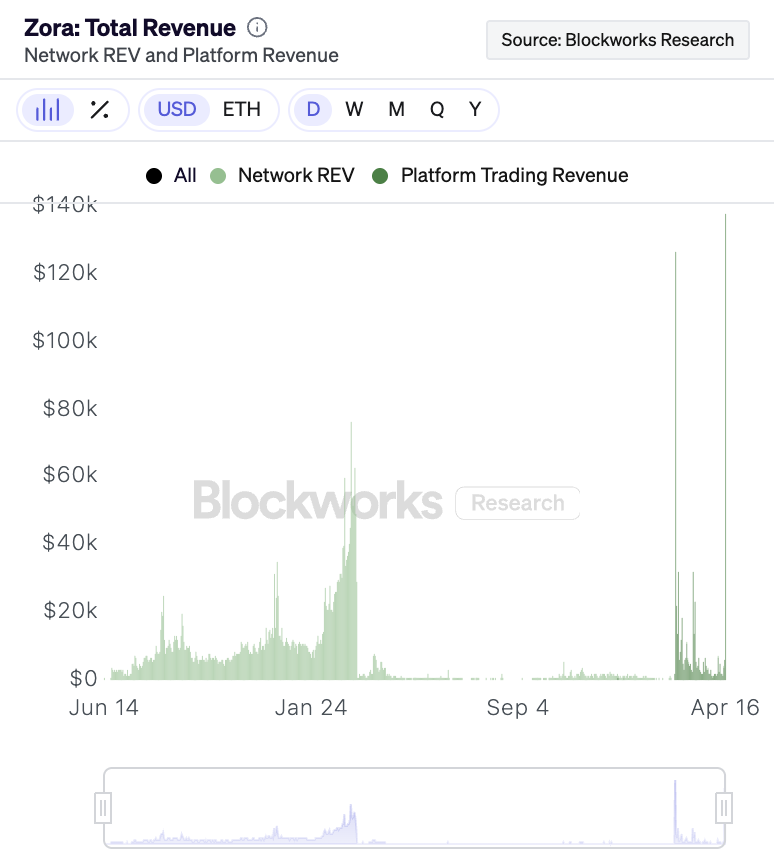

"Zora is a social network where every post is a MEME coin." In this Base coin issuance storm, Zora is the direct beneficiary of traffic and revenue.

According to Blockworks data, Zora's latest daily revenue exceeded $137,000, a rare high in the past two years. Prior to this, affected by the sluggish NFT market, Zora was once in a dilemma of a sharp decline in participation. However, compared with the revenue from the previous NFT craze, Zora has declined a lot at this stage.

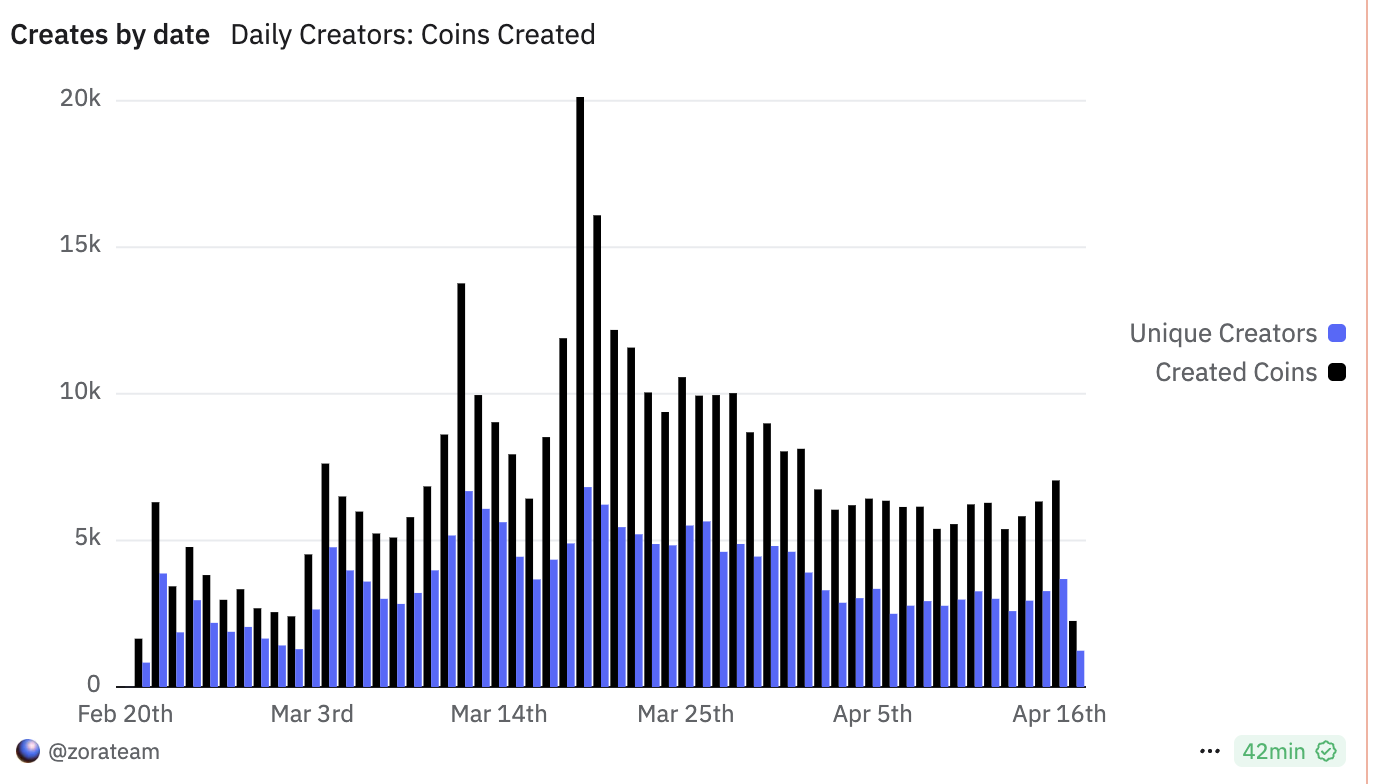

Not only that, Zora's market participation is still limited. Dune data shows that in the past two months, the number of Zora's daily independent creators has remained in the tens of millions, and the number of daily token creation has been between thousands and tens of thousands. Compared with other MEME coin issuance platforms such as Pump.fun, Zora's market share still lags behind: as of April 16, the market shares of Pump.fun and Zora were 74.3% and 25.7%, respectively. Within the Base ecosystem, Zora's issuance of coins only accounts for 4%, and its influence is very limited.

The Base token issuance was interpreted by the outside world as a promotion for Zora. In March this year, Zora announced plans to launch the native token ZORA on the Base network, with a total supply of 10 billion tokens. The first snapshot was taken at 9 am (Eastern Standard Time) on March 3, 2025, and the second snapshot will be taken three days before ZORA goes online.

Not only that, Zora's operating model is consistent with the vision of Base and Coinbase. Each post on the platform is converted into a tradable ERC-20 token. In fact, Coinbase has been actively promoting the development of the "on-chain creator economy", encouraging creators to start projects in an on-chain manner, and co-hosted Onchain Summer with Base. According to Zora's official disclosure, Zora has more than 2.4 million collectors and 618,000 creators, created more than $27.7 million in rewards, and driven more than $376 million in transactions in the secondary market.

In general, from ignition, failure to resurgence, this farce-like cultural experiment not only rekindled the attention of the MEME market for Base, but also once again demonstrated the absurdity and vitality of on-chain culture.

You May Also Like

Salvo Games Partners with WebKey to Power Scalable Web3 Gaming Using DePIN, Break Barriers of User Interaction with Web3

⁉️ Epstein, a convicted pedo, invested in Coinbase