Bitcoin’s 50% Slide: Quantum Scare or Capital Rotation?

Bitcoin Magazine

Bitcoin’s 50% Slide: Quantum Scare or Capital Rotation?

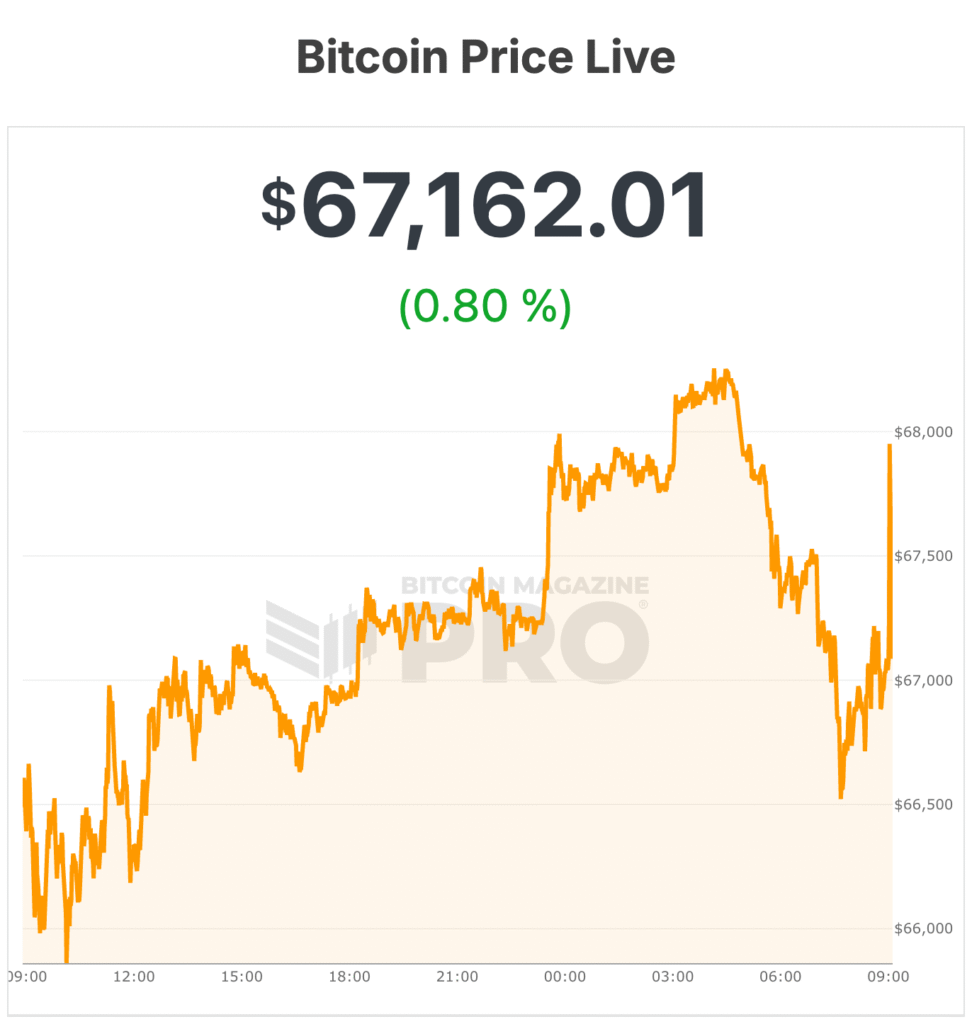

Bitcoin’s 46% decline from its October peak near $126,100 to roughly $67,000 has triggered debate over what is driving the pullback. Some market participants have pointed to quantum computing as a looming threat to the network’s cryptographic security. Others argue the explanation lies elsewhere, in shifting capital flows, tightening liquidity and changing miner economics.

On a recent episode of the Unchained podcast hosted by Laura Shin, Bitcoin developer Matt Corallo rejected the idea that quantum fears are behind the downturn. If investors were pricing in imminent quantum risk to Bitcoin’s cryptography, he said, Ether would likely be outperforming rather than falling in tandem.

Bitcoin is down roughly 46% from its all-time high, while Ether has fallen roughly 58% since an early-October market break. Corallo argued that this parallel weakness undercuts the claim that quantum computing is uniquely weighing on Bitcoin. He added that some holders may be looking for a scapegoat to explain weak price action.

The quantum debate has gained visibility as researchers explore post-quantum cryptography and as asset managers update disclosures. Last year, BlackRock amended the registration statement for its iShares Bitcoin ETF to flag quantum computing as a potential risk to the network’s integrity.

Corallo countered that market pricing does not signal urgency. He framed the current environment as one in which Bitcoin is competing for capital against other sectors, especially artificial intelligence.

Bitcoin mining and AI infrastructure

AI infrastructure requires large data centers, specialized chips and significant energy capacity. That capital intensity, he suggested, has drawn investor attention and funding that might otherwise have flowed into digital assets.

Mining data reflects these crosscurrents. Bitcoin mining difficulty recently climbed to 144.4 trillion, a 15% increase and the largest percentage jump since 2021, when China’s mining ban disrupted the network before operations stabilized.

Difficulty adjusts every 2,016 blocks, about every two weeks, to keep block production near a 10-minute average regardless of hashrate changes.

The latest increase follows a 12% decline in difficulty after a drop in total computational power. In October, when bitcoin traded near $126,500, hashrate peaked around 1.1 zettahash per second. As prices slid toward $60,000 in February, hashrate fell to 826 exahash per second. It has since recovered to about 1 zettahash per second as bitcoin rebounded to the high-$60,000 range.

Even with that recovery, miner economics remain tight. Hashprice, a measure of daily revenue per unit of hashrate, sits near multi-year lows around $23.9 per petahash per second. Lower revenues have pressured margins, particularly for operators with higher energy costs. Large-scale miners with access to inexpensive power have continued to expand. The United Arab Emirates, for example, is estimated to hold roughly $344 million in unrealized profit from mining operations.

At the same time, several publicly listed mining firms are reallocating energy and computing resources toward AI and high-performance computing data centers. Bitfarms recently rebranded to remove explicit bitcoin references as it increases its focus on AI infrastructure.

Activist investor Starboard Value has urged Riot Platforms to expand further into AI data center operations. The shift underscores Corallo’s point that bitcoin now competes directly with other capital-intensive technologies.

Bitcoin is consolidating in ‘extreme fear’

Onchain data suggests the market remains in a compression phase. Analytics firm Glassnode reports that BTC has broken below its “True Market Mean,” a model that tracks the aggregate cost basis of active supply and currently sits near $79,000.

The firm identifies the Realized Price, around $54,900, as a lower structural boundary. Bitcoin has traded between roughly $60,000 and $70,000 in recent sessions, within that corridor.

Sentiment remains fragile. The Crypto Fear and Greed Index has registered “extreme fear” for weeks. Yet some analysts see valuation support.

Bitwise’s head of European research, André Dragosch, said bitcoin appears undervalued relative to global money supply growth, gold and exchange-traded product flows. He expects consolidation rather than a rapid recovery, noting that sharp capitulations rarely produce immediate V-shaped rebounds outside crisis events.

Macro data may shape the next move. Traders are watching U.S. core PCE inflation figures for signals on Federal Reserve policy. Higher inflation could support scarce assets in theory, but a hawkish response could strengthen the dollar and pressure risk markets.

At the time of writing, Bitcoin is trading near $67,000.

This post Bitcoin’s 50% Slide: Quantum Scare or Capital Rotation? first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Spur Protocol Daily Quiz 21 February 2026: Claim Free Tokens and Boost Your Crypto Wallet

SEC Eases Stablecoin Capital Rules