Crypto In Your Golden Years? 27% Of British Adults Say Yes

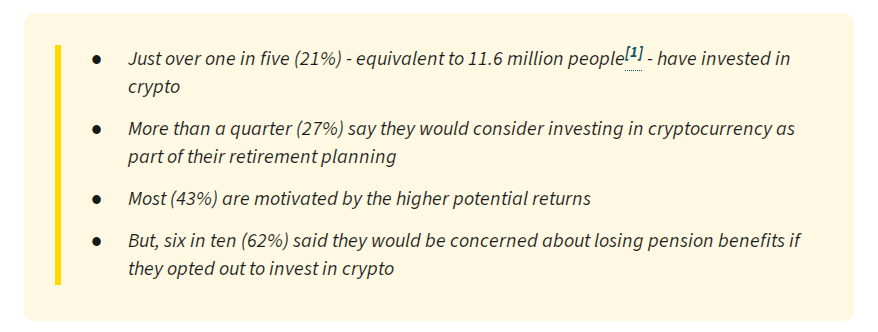

Brits are showing a growing interest in putting crypto inside retirement plans, but many still don’t fully grasp the risks. According to a new survey by Aviva, 27% of UK adults said they would be open to including digital currency in their retirement portfolios, while 23% said they might withdraw part or all of their existing pensions to buy crypto directly.

Growing Appetite Despite Worries

Based on reports from Censuswide, which polled 2,000 UK adults between June 4 and June 6, more than four in five people hold pensions that add up to about £3.8 trillion ($5.10 trillion).

If even a small slice of that moved into crypto, it could be meaningful for markets. Of the respondents who said they were open to digital currency in pensions, just over 40% pointed to the chance of higher returns as the main draw.

Younger Savers Lead The Shift

Younger adults appear to be the most active. Reports show nearly 20% of people aged 25 to 34 admitted to withdrawing pension money to buy crypto at some point.

Aviva’s research also found that about one in five UK adults — roughly 11.5 million people — have held crypto at some time, and two-thirds of that group still hold some form of digital asset.

That mix of ownership and age-skewed behavior helps explain why digital currency is now part of conversations about retirement planning.

Survey participants flagged clear concerns. Hacking and phishing topped the list at 40%, while 37% cited a lack of regulation and consumer protection, and 30% named volatility.

Almost one-third admitted they didn’t completely grasp the trade-offs involved in replacing pensions with bitcoin, and 27% said they were unaware of any risks at all. Those numbers suggest interest outpaces understanding for a notable share of the public.

Regulation will likely play a large role in how fast any shift happens. Reports note that HM Revenue and Customs will require crypto platforms to collect full names, home addresses, and tax identification numbers for every trade and transfer starting January 1, 2026. That move is aimed at strengthening tax compliance and oversight and could change how some consumers view bitcoin’s privacy and convenience.

US Policy Also Moves The NeedleThe debate over retirement funds and crypto is not confined to the UK. US President Donald Trump signed an executive order allowing 401(k) plans to include Bitcoin and other cryptocurrencies, opening potential access to more than $9 trillion in retirement assets.

Featured image from Getty Images, chart from TradingView

You May Also Like

XRP Crowned South Korea’s Most-Traded Crypto of 2025

DeFi Development Corp. expands Solana treasury accelerator