Iran’s Crypto Sector Suffers 11% Decline Following $90-M Exchange Hack

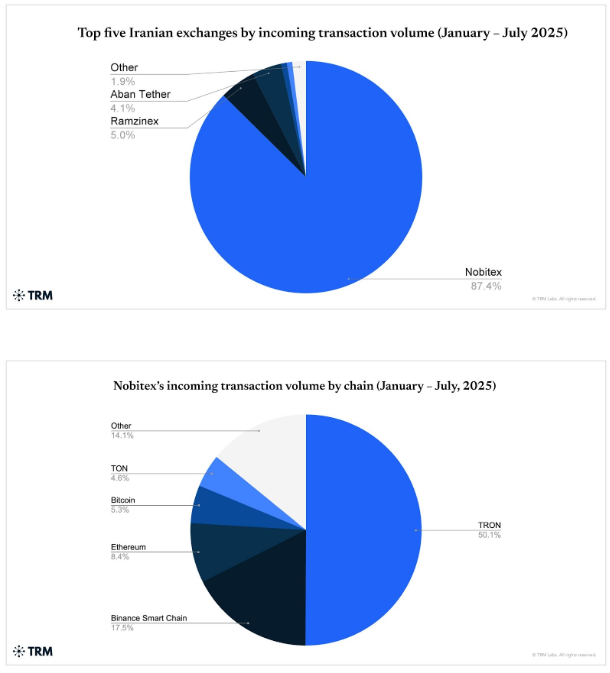

According to reports, Iran’s on-chain crypto activity fell sharply in the first half of 2025. Inflows totaled $3.7 billion in the first seven months, a 10% drop from the same period in 2024. The slump accelerated after April: June flows contracted 50% year-on-year and July tumbled 75%.

Major Exchange Breach Shakes Trust

Based on a TRM Labs report, a major security breach hit Nobitex on June 18. Roughly $90 million was taken from hot wallets, source code was leaked, and some stolen coins were steered to vanity addresses that referenced the Islamic Revolutionary Guard Corps.

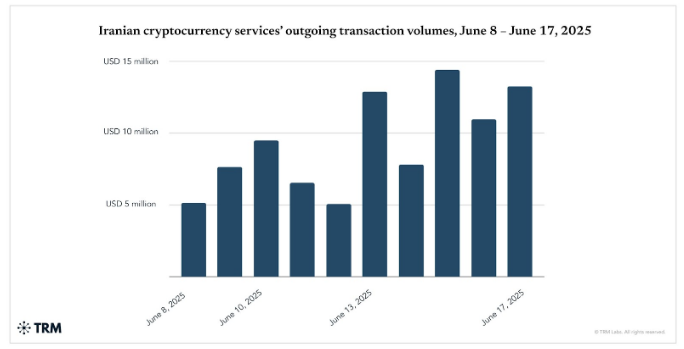

Outflows from the exchange spiked — more than 150% in the week before the fighting — as traders moved funds to what they saw as safer places. Trust, already fragile, was seriously damaged.

Inbound Transactions Collapse As Users Withdraw

Nobitex’s inbound transfers dropped by about 70% year-on-year after the breach. Some dormant Bitcoin wallets tied to mining activity were activated and later routed funds into a newly created hot wallet.

Regulators responded by imposing overnight trading curbs designed to slow panic, but many users had already pulled funds offshore. Reports show a surge in transfers to foreign platforms and payment processors that have lighter identity checks.

In July, Tether froze 42 wallets linked to Iran, removing a large chunk of usable stablecoin liquidity on local rails. More than half of those wallets had ties, on-chain, to Nobitex or addresses flagged with IRGC links, though ownership remains unclear.

Tether also froze $27 million in USDT tied to Garantex, a sanctioned Russian exchange, an action that highlights the broad reach of compliance moves. The US Treasury blacklisted Garantex in 2022, and that prior action has had echoing effects on market behavior.

The decline in flows came during a period of heightened regional tension. A 12-day conflict with Israel erupted in mid-June while nuclear talks stalled. Israeli strikes and internal disruptions led to widespread electricity outages.

Mining rigs were idled. Trading became harder. For many traders, the safest option was to move funds off domestic rails; for others it was to switch stablecoins or chains.

New Taxes Tighten The GripIn August, Iran approved the Law on Taxation of Speculation and Profiteering. The law brings capital gains taxes to crypto, gold, real estate, and forex.

Enforcement will roll out in stages, but officials say oversight will increase. That policy move, combined with freezes and hacks, gives firms more reason to pause or shift operations.

Featured image from Getty Images, chart from TradingView

You May Also Like

XRP Crowned South Korea’s Most-Traded Crypto of 2025

DeFi Development Corp. expands Solana treasury accelerator