XRP Price: Key Levels and On-Chain Data Traders Are Tracking in February

TLDR

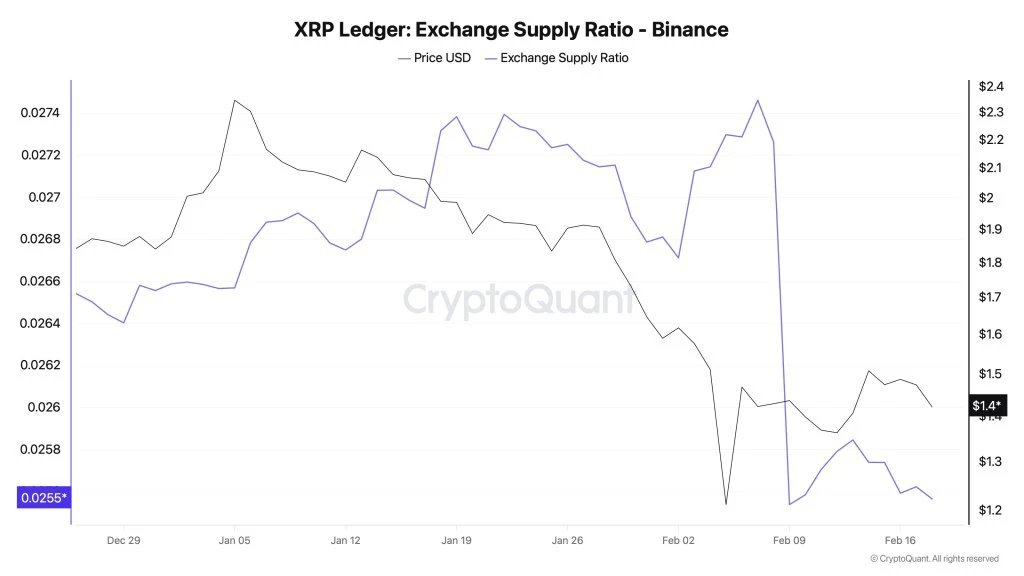

- 200 million XRP left Binance in 10 days, reducing available sell pressure as the exchange supply ratio dropped to 0.025

- XRP funding rates on Binance hit -0.028%, the lowest since April 2025, a level historically followed by price bounces

- Deutsche Bank is integrating Ripple Payments, moving away from traditional SWIFT-based cross-border systems

- The XRP Ledger now holds over $354 million in tokenized real-world assets, with 63% of tokenized US treasuries on XRPL

- Key support sits between $1.19–$1.36; bulls need a break above $1.67 to confirm a trend shift

XRP has had a rough February, which is not unusual. The token has fallen in 7 out of 11 Februarys since 2014. This year followed that pattern, with XRP dropping around 40% year-to-date before bouncing from a low near $1.10.

XRP Price

XRP Price

The price recovered to around $1.41, but momentum has slowed. XRP is now drifting back toward a key support zone between $1.19 and $1.36.

For bulls to take control, the price needs to hold that support and push above $1.67, the most recent swing high. Recent rallies have shown weaker three-wave structures, which typically signal corrective moves rather than a new trend.

Exchange Outflows and Funding Rates

Around 200 million XRP left Binance over the past 10 days. The exchange supply ratio fell from 0.027 to 0.025. When fewer tokens sit on exchanges, there are fewer coins immediately available to sell.

Source: CryptoQuant

Source: CryptoQuant

This kind of outflow is often linked to accumulation behavior, where holders move coins to private wallets rather than preparing to sell.

XRP funding rates on Binance dropped to -0.028%, the lowest level since April 2025. Negative funding means short sellers are paying a premium to hold their positions. In late 2024 and again in April 2025, similarly negative rates were followed by price bounces.

Sentiment around XRP has also climbed to a five-week high, while Bitcoin and Ethereum sentiment has cooled compared to last week.

Institutional Activity on the XRP Ledger

The XRP Ledger has seen growing institutional use. On-chain real-world asset value on the ledger surpassed $354 million in the past month. A recent report found that 63% of tokenized US treasuries are held on XRPL.

Companies including DBS Group and Franklin Templeton are building trading and lending infrastructure around tokenized money market fund units on the ledger. UK investment firm Aviva also used the Ripple ledger to issue traditional funds earlier this month.

Deutsche Bank has announced integration with Ripple Payments as part of a move away from legacy SWIFT systems. Ripple recently secured its first EMI license. While banks can use Ripple’s technology without holding XRP, broader adoption of the network increases its visibility.

The total value of tokenized real-world assets across public blockchains reached just over $24 billion at the end of January 2026. XRPL holds a growing share of that market.

XRP is currently holding above the $1.19–$1.36 support zone, with the $1.67 level as the next key resistance for bulls to target.

The post XRP Price: Key Levels and On-Chain Data Traders Are Tracking in February appeared first on CoinCentral.

You May Also Like

Pressure Builds on ADA Despite Cardano’s Bold Behind-the-Scenes Push ⋆ ZyCrypto

Pi Network Bank: Pioneering a Human-Centric Financial Revolution in Crypto

In the ever-evolving world of web3 and Crypto, Pi Network is taking a bold step forward. A recent announcement shared by @Fle