Bitcoin Capitulation Spike Signals Bottom May Be Near: Here is Why

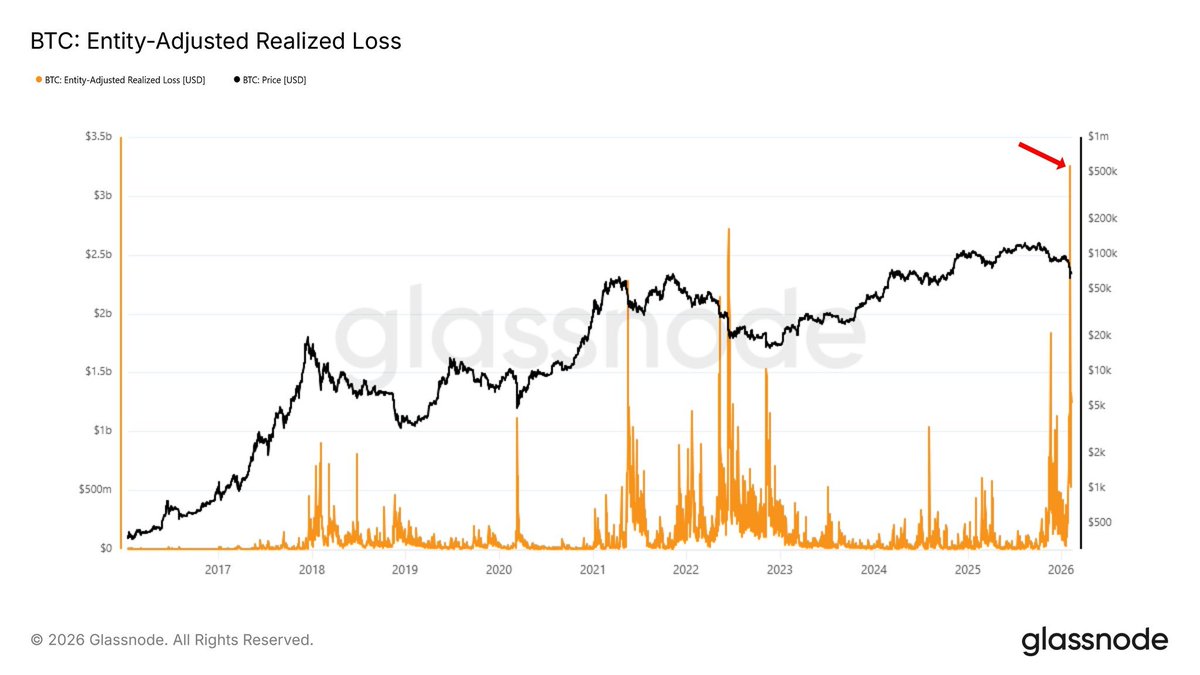

According to a tweet from Michaël van de Poppe, Bitcoin is currently experiencing one of the largest realized loss events in its history.

The chart he shared represents the total USD value of losses being realized when Bitcoin holders sell their coins below their purchase price. In simple terms, it measures how much money investors are locking in as actual losses, not paper losses, but confirmed ones.

After analyzing the data, it is visible that the recent correction has triggered the highest spike in realized losses ever recorded.

Source: https://x.com/CryptoMichNL/status/2025127603183689803

Source: https://x.com/CryptoMichNL/status/2025127603183689803

Comparable to 2018, 2020 and 2022

The magnitude of the current spike is comparable to:

- The 2018 bear market crash

- The March 2020 COVID crash

- The 2022 Luna and FTX collapses

Each of those periods marked extreme fear and heavy capitulation across the market.

Realized losses of this size suggest that a large number of holders are either panic selling or being forced to liquidate positions at a loss.

What Does This Mean?

When realized losses surge to historic highs, it usually reflects a capitulation phase. This is when weak hands exit the market and overleveraged positions are flushed out.

After analyzing previous cycles, it becomes clear that these extreme loss-taking events often coincide with local bottoms or near-bottom conditions. They represent the moment when selling pressure peaks because those willing to sell at a loss have already done so.

Historically, once capitulation spikes fade, supply pressure declines and the market begins to stabilize.

Additional Signals

Van de Poppe also highlighted that:

- The Sharpe Ratio has dropped to its lowest level since the previous bottom.

- Market sentiment is extremely weak.

- A broad capitulation event appears to be underway.

These conditions tend to appear during late-stage corrections rather than early declines.

The Key Difference This Cycle

One notable difference stands out.

Bitcoin is currently down roughly 50% from its all-time high, whereas previous major bear markets saw drawdowns closer to 80%.

That distinction could suggest that while panic is elevated, the structural damage is not as severe as prior full-cycle collapses.

Is the Bottom Near?

While no signal guarantees an immediate reversal, the scale of realized losses indicates that significant capitulation has already occurred.

After analyzing historical patterns, it becomes visible that markets rarely sustain such extreme loss realization for extended periods. These moments often mark exhaustion rather than the beginning of deeper collapses.

If past cycles are any guide, the current spike in realized losses may represent a final flush, rather than the start of a new prolonged downturn.

The post Bitcoin Capitulation Spike Signals Bottom May Be Near: Here is Why appeared first on ETHNews.

You May Also Like

XRP Price Prediction February 2026: Senator Warren Warns Fed as Pepeto’s 100x Presale Steals the Spotlight From Ripple

CME Group to launch Solana and XRP options on October 13