Snowflake Inc. (SNOW) Stock: Strong Q2 Revenue Growth and Outlook

TLDR

- Q2 product revenue rose 32% to $1.09 billion, beating expectations.

- Remaining performance obligations hit $6.9 billion, up 33% year over year.

- EPS came in at $0.35 adjusted, above the $0.27 estimate.

- Quarterly GAAP net loss widened to $298 million, or -$0.89 per share.

- FY26 product revenue guidance raised to $4.395 billion, 27% growth.

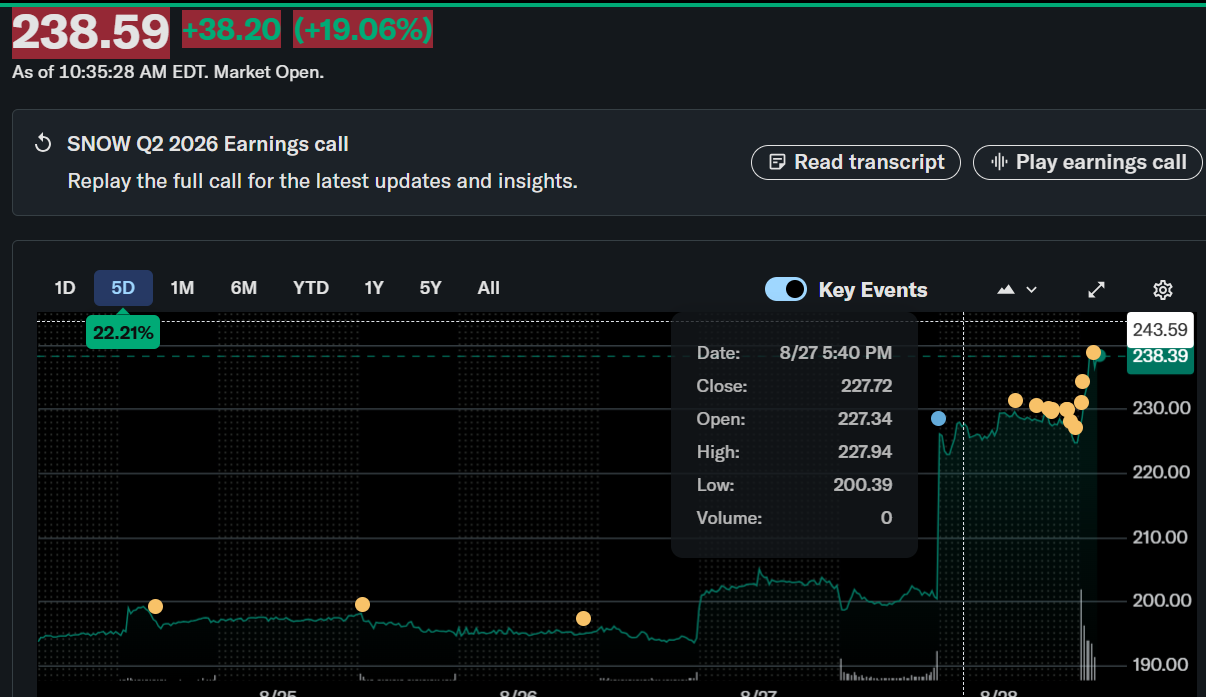

Snowflake Inc. (NYSE: SNOW) closed at $200.39 on August 27, 2025, with pre-market trading jumping 13.53% to $227.62 following its Q2 fiscal 2026 earnings release. The report, issued on August 27, highlighted robust revenue growth, strong customer momentum, and raised guidance, offset by a significant GAAP net loss.

Snowflake Inc. (SNOW)

Revenue Growth and Profitability

Total revenue for the quarter ended July 31 reached $1.14 billion, marking a 31.8% increase from the prior year and topping Wall Street’s $1.09 billion estimate. Product revenue was the main driver at $1.09 billion, up 32% year over year.

Snowflake posted adjusted earnings of $0.35 per share, higher than the $0.27 consensus and last year’s $0.18. On a GAAP basis, the company reported a net loss of $298 million, or -$0.89 per share, compared with a smaller loss a year earlier. Heavy spending in sales and marketing, along with leadership transition costs, contributed to the deficit.

ARR Strength and Customer Growth

Remaining performance obligations (RPO) reached $6.9 billion, a 33% year-over-year gain, underscoring strong long-term demand. The net revenue retention rate stood at an impressive 125%, indicating customers are spending more over time.

The company added 533 new customers in Q2, including 15 Global 2000 firms. This momentum reflects solid adoption of Snowflake’s platform, particularly in enterprises seeking scalable cloud data solutions.

Strategic Innovation and AI Integration

Snowflake highlighted new product launches during the quarter, including Snowflake Intelligence and Cortex AISQL, designed to expand artificial intelligence capabilities. These tools are aimed at enabling enterprises to use AI more effectively in data-driven decision-making.

The company’s $4.6 billion in cash and investments provides flexibility to support innovation and strategic expansion.

Guidance and Outlook

For Q3, product revenue is expected to range from $1.125 billion to $1.13 billion, reflecting 25–26% year-over-year growth. For the full fiscal year 2026, Snowflake raised its product revenue guidance to $4.395 billion, representing 27% growth.

The company forecasts a non-GAAP operating margin of 9% for FY26, compared with 11% in Q2, as investments in expansion continue. Free cash flow margin guidance was lifted to 25% for the year, showing improving efficiency.

Stock and Market Performance

Despite a 13.1% decline this quarter, Snowflake’s stock has gained 25.9% year to date and 73.4% over the past year, outpacing the S&P 500’s 15.2% annual return. Longer-term returns remain mixed, with gains of just 1.36% over three years and a five-year decline of 18.2%.

Snowflake’s strong Q2 performance, coupled with customer additions and AI innovation, suggests confidence in its growth trajectory, though profitability challenges remain a focus for investors.

The post Snowflake Inc. (SNOW) Stock: Strong Q2 Revenue Growth and Outlook appeared first on CoinCentral.

You May Also Like

Sunmi Cuts Clutter and Boosts Speed with New All-in-One Mobile Terminal & Scanner-Printer

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC