Five Exchanges Linked to Russia Sanctions Evasion

A new report published on February 21, 2026, by blockchain analytics firm Elliptic has identified five cryptocurrency exchanges allegedly facilitating sanctions evasion tied to Russian entities.

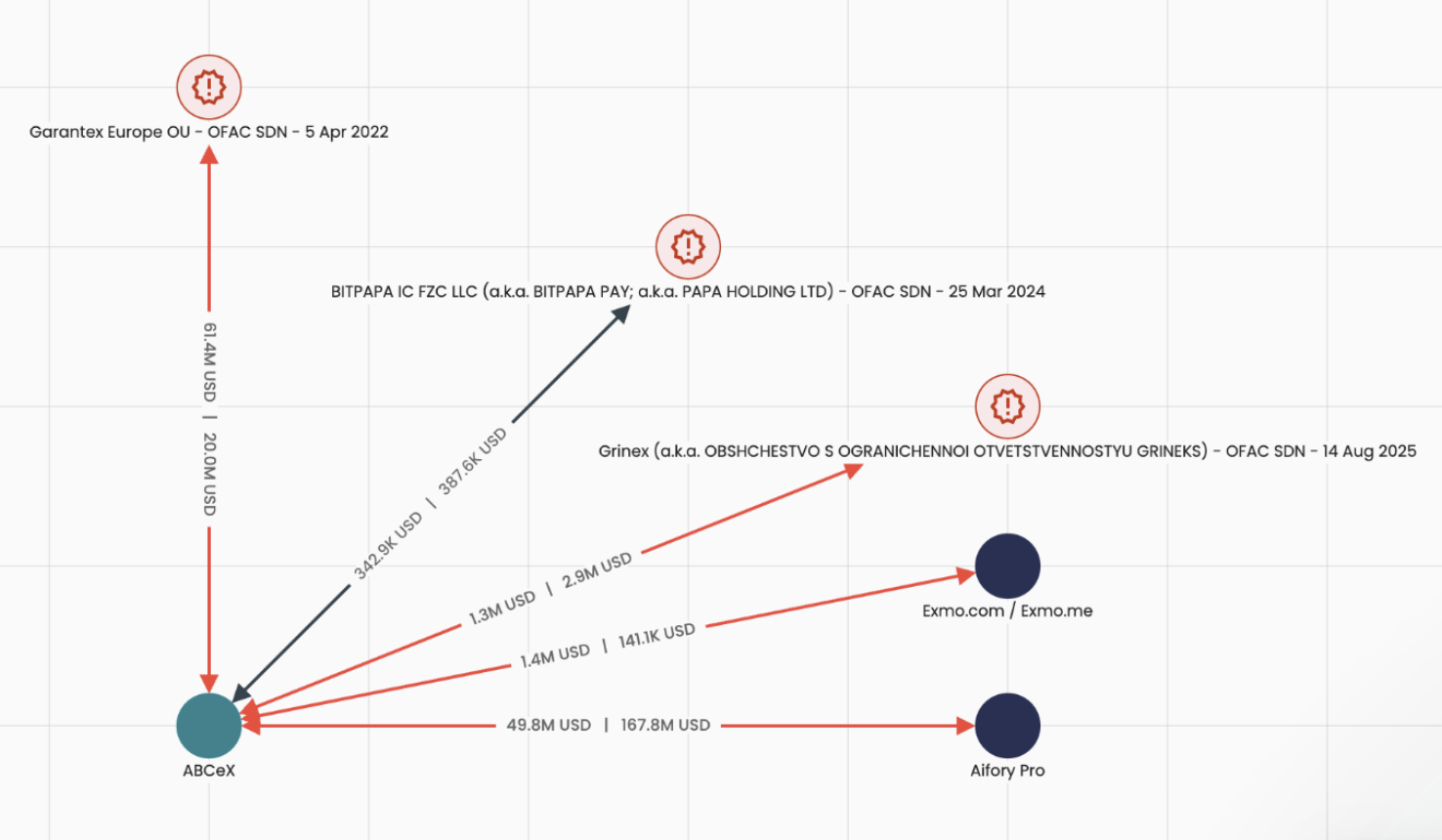

According to the report, these platforms have formed a “shadow network” following the disruption of Garantex by international law enforcement in early 2025.

Elliptic states that the exchanges are enabling cross-border payments outside traditional banking channels, allowing users to move funds with limited oversight.

The Five Exchanges Named

The report highlights five platforms:

ABCeX is described as the largest among them, having processed at least $11 billion in cryptocurrency. It reportedly operates from Moscow’s Federation Tower, a location previously associated with Garantex.

Source: https://www.elliptic.co/blog/russia-linked-cryptocurrency-services-and-sanctions-evasion

Source: https://www.elliptic.co/blog/russia-linked-cryptocurrency-services-and-sanctions-evasion

Exmo is cited for continuing operational links to its Russian-facing platform Exmo.me, despite earlier statements claiming an exit from the Russian market. On-chain analysis reportedly shows shared custodial wallet infrastructure, along with approximately $19.5 million in transactions involving sanctioned entities such as Garantex and Chatex.

Rapira, registered in Georgia, is said to maintain a Moscow office and has allegedly processed over $72 million in transactions with Grinex, another exchange under scrutiny.

Bitpapa, a peer-to-peer exchange registered in the UAE, primarily targets Russian users. Although added to the U.S. OFAC sanctions list in March 2024, it reportedly remains active and frequently rotates wallet addresses to reduce traceability.

Aifory Pro is described as a cash-to-crypto service operating in Moscow, Dubai, and Turkey, bridging physical currency and digital assets.

Key Findings

Elliptic notes that several of these platforms appear to have emerged as successors to Garantex, with Grinex, registered in Kyrgyzstan, identified as one such example. The report points to similarities in wallet behavior and transaction patterns.

Stablecoins play a central role in the network’s activity. The ruble-backed stablecoin A7A5 and USDT are reportedly used to move funds without relying on global banking infrastructure.

The report also emphasizes that most of the exchanges identified have not yet been formally sanctioned, which allows operations to continue with relatively limited restrictions.

Elliptic anticipates that 2026 could bring increased enforcement actions as regulators evaluate the effectiveness of existing crypto-related sanctions frameworks.

The post Five Exchanges Linked to Russia Sanctions Evasion appeared first on ETHNews.

You May Also Like

Gemini Slashes 25% of Staff and Exits UK, EU, Australia After Bitcoin Crash — Now Betting Big on Prediction Markets