Global Payments Go Crypto as Circle and Mastercard Partner on $USDC; $BEST Token Soars

The company announced partnerships with two major players: Finastra and Mastercard. The collaborations signal the dawn of an era where crypto is used to solve real-world problems in payments and settlements.

These two worlds – traditional finance and cryptocurrency – are finally coming together, and these partnerships show that digital currencies, like Best Wallet Token ($BEST), are no longer a fringe asset.

Finastra, a top financial software provider, is integrating $USDC into its Global PAYplus (GPP) platform, which is used by over 8K banks and handles over $5T in daily cross-border payments. This integration will enable financial institutions to settle transactions with $USDC, providing a faster and more cost-effective alternative to traditional correspondent banking networks, which are often slow and expensive.

It’s a significant move as it enables banks to leverage the speed and efficiency of blockchain-based settlement without having to overhaul their existing systems. This makes stablecoins a more practical option for mainstream finance.

In a parallel development, Circle has expanded its partnership with Mastercard. This deal will enable merchants and payment acquirers in Europe, the Middle East, and Africa to settle transactions using $USDC and Euro Coin ($EURC) on Mastercard’s network.

Together, these partnerships are positioning $USDC as a key infrastructure layer for global payments.

Circle’s Global Ambition: Embedding $USDC in Mainstream Finance

These partnerships are just one part of Circle’s broader strategy to integrate $USDC into the world’s financial systems. The company is actively focusing on regulatory clarity in key international markets to drive adoption.

In Asia, for example, Circle is already meeting with South Korea’s biggest banks to explore potential collaborations. The company is also working with partners in Japan, including SBI Group and Ripple, to develop a platform for tokenized assets.

While the broader crypto market often experiences volatility, Circle’s strategic partnerships with established financial players are building a strong foundation for stablecoins to play a major role in global commerce.

And while institutional adoption builds trust from the top down, innovative projects are empowering users from the ground up, much like Best Wallet and its native token $BEST are doing for non-custodial wallets in the Web3 ecosystem.

Best Wallet Token: Your Key to an All-in-One Web3 Power Hub

Are you tired of juggling multiple apps just to manage your crypto? Say goodbye to the hassle and hello to Best Wallet, which aims to be your all-in-one Web3 command center.

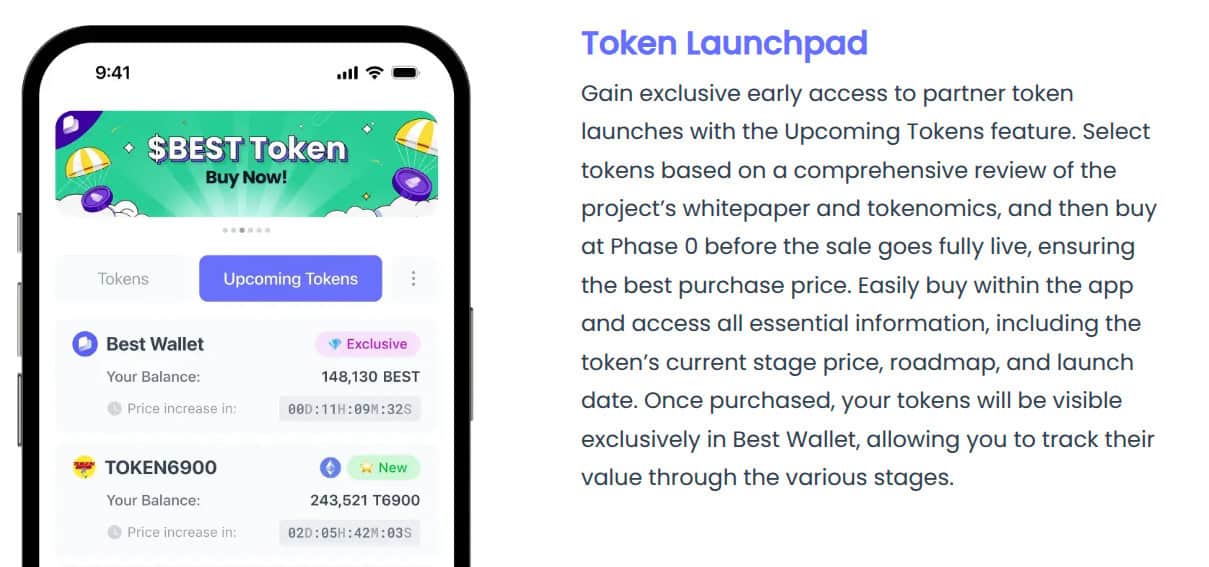

They’ve packed an entire ecosystem into one sleek, user-friendly app, so you can manage your digital assets with ease. Best Wallet lets you swap tokens at the best rates with its built-in DEX aggregator and even discover the next big thing with its exclusive ‘Upcoming Tokens’ feature that gives you a sneak peek at new crypto projects before they become widely available.

Plus, its non-custodial design means you’re always in control of your keys, ensuring you always have direct ownership of your funds.

The $BEST token is your all-access pass to unlocking this ecosystem. By holding $BEST, you can access premium features like boosted staking rewards and reduced transaction fees on swaps. Perfect for traders on the go and long-term holders.

The project has already seen strong community support, already raising over $15M in its presale, and plans to expand its utility by developing a crypto debit card that will let you spend your assets anywhere, with extra perks for $BEST holders.

Bridging Two Worlds: The Future of Finance Steps Forward

The crypto world is dynamic, with big players like Finastra and Mastercard embracing stablecoins through Circle’s leadership, while projects like Best Wallet and $BEST empower you with user-friendly tools and a token with real-world applications.

The future isn’t about one side winning; it’s about these two worlds coming together. The power of a simple, user-friendly wallet combined with the scale of institutional partnerships creates a new financial system.

This isn’t intended as financial advice, and you should always do your own research before making any investments.

You May Also Like

Sunmi Cuts Clutter and Boosts Speed with New All-in-One Mobile Terminal & Scanner-Printer

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC