Healthcare Company KindlyMD Plans $5 Billion Bitcoin Buying Spree

KindlyMD, which trades on the Nasdaq under the ticker NAKA, wants to raise $5 billion through stock sales to buy more Bitcoin.

The company filed paperwork with the Securities and Exchange Commission for what’s called an “at-the-market” stock offering. This means KindlyMD can sell shares whenever it wants at current market prices. The money raised will go mainly toward buying Bitcoin, though some funds may support other business needs.

From Healthcare to Bitcoin Treasury

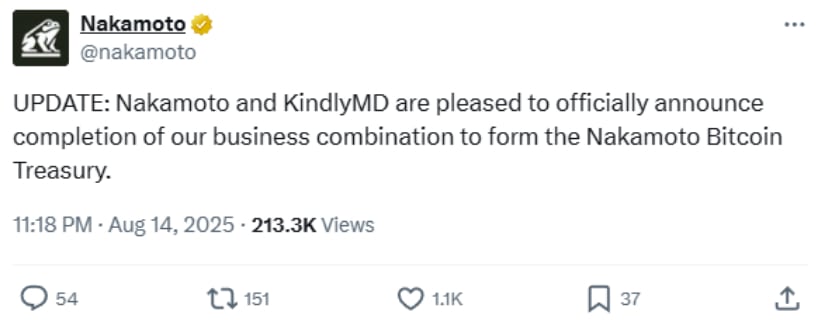

KindlyMD started as a healthcare provider focused on pain management and reducing opioid use. But in August 2025, the company completed a major transformation by merging with Nakamoto Holdings, a Bitcoin investment firm founded by David Bailey.

Bailey serves as a cryptocurrency advisor to President Trump and leads the combined company as CEO. The merger brought in $710 million in funding – $510 million from private investors and $200 million from convertible bonds.

“This acquisition reinforces our conviction in Bitcoin as the ultimate reserve asset for corporations and institutions alike,” Bailey said in a company statement. The merger aimed to create what the company calls an “institutional-grade Bitcoin treasury vehicle.”

Already Building a Bitcoin Stockpile

KindlyMD wasted no time putting its strategy into action. In August, the company bought 5,744 Bitcoin for about $679 million. This purchase brought their total holdings to 5,765 Bitcoin, making KindlyMD one of the top 20 corporate Bitcoin holders worldwide.

The company paid an average price of $118,205 per Bitcoin. With Bitcoin currently trading around $111,200, KindlyMD is sitting on a small unrealized loss on this purchase. However, company leaders view Bitcoin as a long-term investment that will grow in value over time.

If KindlyMD raises the full $5 billion and uses it all for Bitcoin purchases, it could add nearly 45,000 more Bitcoin to its treasury at current prices. Combined with existing holdings, this would give the company control of more than 50,000 Bitcoin.

Joining a Growing Trend

KindlyMD is following a playbook first created by MicroStrategy, the software company that began buying Bitcoin in 2020. MicroStrategy now holds over 629,000 Bitcoin worth more than $70 billion, making it the largest corporate Bitcoin holder.

Other companies have joined this trend. By August 2025, public companies held over 951,000 Bitcoin valued at more than $100 billion. Marathon Digital Holdings owns about 50,000 Bitcoin, while smaller firms like Semler Scientific have also added Bitcoin to their balance sheets.

The trend has gained support from recent legislation. The BITCOIN Act of 2025 proposes that the U.S. government acquire 1 million Bitcoin over five years. This has helped legitimize Bitcoin as a treasury asset for both companies and governments.

Stock Performance and Market Response

Despite the recent stock offering announcement causing a 12% drop in share price, KindlyMD has been one of the year’s best-performing stocks. Since May 2025, NAKA shares have gained 330%. For the full year, the stock is up more than 550%.

The company’s stock upgrade to the Nasdaq Global Market under the NAKA ticker reflects its transformation from a small healthcare provider to a major Bitcoin investment vehicle. The ticker change from KDLY to NAKA happened in May 2025 to align with the Nakamoto merger.

Source: @nakamoto

However, not all investors are convinced. The company’s healthcare business has struggled, with revenues falling 36% to $408,527 in the second quarter of 2025. Net losses widened to $2.4 million from $1.3 million the year before.

Risks and Rewards of the Bitcoin Strategy

KindlyMD has set an ambitious goal of eventually owning 1 million Bitcoin – nearly 5% of Bitcoin’s total supply of 21 million coins. The company sees itself as building the first global network of Bitcoin treasury companies across different markets.

The strategy carries significant risks. Bitcoin’s price can be highly volatile, and using shareholder money to buy cryptocurrency could lead to major losses if Bitcoin’s value falls. The company continues its healthcare operations, which focus on pain management and alternative treatments, providing steady cash flow that can support operations even if Bitcoin’s price drops.

KindlyMD also closed a separate $200 million convertible note offering in August. These bonds carry no interest for two years, then 6% annually until they mature in 2028. Second-quarter financing activities generated $9.05 million in cash inflows, boosting the company’s cash position by 165%.

Looking Ahead

The $5 billion stock offering gives KindlyMD tremendous firepower to continue buying Bitcoin. With major investment firms like TD Securities, Cantor Fitzgerald, and B. Riley Securities handling the stock sales, the company has professional support for its fundraising efforts. Whether this strategy creates long-term value for shareholders will largely depend on Bitcoin’s future price performance and management’s ability to execute their vision effectively.

You May Also Like

Japan-Based Bitcoin Treasury Company Metaplanet Completes $1.4 Billion IPO! Will It Buy Bitcoin? Here Are the Details

InvestCapitalWorld Updates Platform Features to Support Broader Multi-Asset Market Access