92 Crypto ETFs Now Await SEC Approval with Solana, XRP Leading Applications

A total of 92 crypto exchange-traded funds (ETFs) are currently awaiting review from the U.S. Securities and Exchange Commission (SEC), according to recent data from Bloomberg Intelligence, which cites ETF analyst James Seyffart.

On August 28, Seyffart published a detailed spreadsheet via X (formerly Twitter) outlining these pending ETF applications, with the majority facing final deadlines in October, particularly those focused on Solana, XRP, and Litecoin.

The submission rate for new applications has intensified over recent months, which could bring in capital into the crypto market and potentially mark the beginning of an altseason rally.

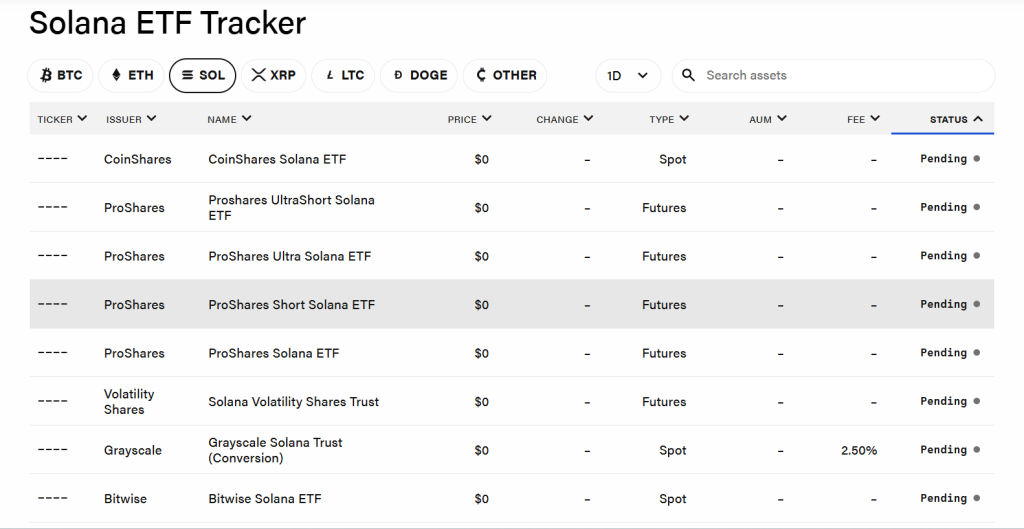

Solana and XRP Lead Crypto ETF Race

Among alternative cryptocurrencies (altcoins), Solana and XRP currently lead the list of applications.

According to analyst James Seyffart’s data, Solana currently leads with eight pending ETF applications, followed closely by XRP, which has seven applications under review.

Source: The Block

Source: The Block

These two digital assets represent the most sought-after crypto investments beyond Bitcoin (BTC) and Ethereum (ETH).

Bloomberg Senior ETF Analyst Eric Balchunas previously reported on April 21 that 72 crypto-related ETFs were under consideration by the SEC at that time.

The current count of 92 represents an addition of 20 new applications over just four months.

Similarly, the current pipeline encompasses proposals targeting not only Solana and XRP exposure but also various other altcoins, complemented by three ETFs tied to Bitcoin and Ethereum.

Industry giants Grayscale and 21Shares are among the firms currently in the SEC approval pipeline, both pursuing authorization for Ethereum staking ETFs.

Liquid staking received some clarity earlier this month when the SEC indicated that these operations fall outside its direct regulatory jurisdiction.

Grayscale is simultaneously working to convert five existing trusts into ETF structures, including three publicly traded funds and two private trusts.

These conversions would provide ETF access to Litecoin, Solana, Dogecoin, XRP, and Avalanche.

In a separate post, Seyffart highlighted 21Shares’ recent S-1 registration filing with the SEC for spot SEI exchange-traded funds.

According to the Thursday submission, the proposed 21Shares SEI ETF would track the CF SEI-Dollar Reference Rate in USD, if approved.

Expert Opinion on Crypto ETFs Flooding the Market

The pending SEC decisions carry significant implications for altcoin markets, which is a primary concern for traders and institutional investors.

Andrew Jacobson, VP and Global Head of Legal at 21Shares, observed a shift in market dynamics, stating that while being “first to file ETFs used to be cool back when it started in 2024”.

The focus has now moved toward product innovation, specifically those integrating DeFi capabilities to TradFi audiences.

Bloomberg Intelligence senior ETF analyst Eric Balchunas remarked on the growing pipeline, suggesting that “pretty soon there will be more crypto ETF filings than stocks.”

Ray Youssef, CEO of NoOnes, recently shared with Cryptonews his expectation that major cryptocurrencies, such as SOL, XRP, and BNB, will attract structured capital investments due to their established infrastructure and real-world adoption potential.

Youssef emphasized that market evolution will favor projects with genuine utility, predicting that “only the strongest projects with real utility and value would survive the next market phase.”

While “speculative-driven tokens without utility are going to begin to fade into irrelevance in the coming months.”

Regarding Solana specifically, Youssef highlighted the potential for significant impact from a spot ETF launch, noting that Solana treasury companies are lining up funds running into tens of billions to accumulate SOL.

Current prediction markets reflect strong optimism for approval prospects.

On Polymarket, the odds of Solana ETF approval before the end of 2025 have surged to 99%, a substantial increase from 72% in May.

XRP maintains the second-highest approval probability at 87% on Polymarket, climbing from 64% on August 6.

Notably, Dogecoin stands as the only speculative memecoin with favorable approval odds, currently at 82%, nearly double the 44% it was in June.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

FullProgramlarIndir.app | Download Free Full Programs (2026)