Will This Groundbreaking XRP ETF Filing Finally Win SEC Approval?

TL;DR

- The US Securities and Exchange Commission continues to delay making a decision on countless filings for spot XRP ETFs despite the recent leadership change.

- However, a new filing with the agency may have a better chance of success.

New XRP ETF Filing

Filed by Amplify ETFs, an Illinois-based investment company with $12.6 billion in AUM as of July 31, the new XRP ETF application will work quite differently from a regular spot one. For instance, a spot ETF holds the underlying asset directly, while the Options Income variation uses options strategies (mainly covered calls) on XRP (in this case) to generate steady monthly income (yield) for its investors.

In general, such ETFs gain some form of exposure to the underlying asset (which can include direct purchases), sell call options on the holdings to collect premiums, and distribute the proceeds to investors as monthly income.

The options expire on a monthly basis, allowing the ETF to reset its strategy at the end of each month and pay income regularly to shareholders, which becomes a predictable but capped yield. As such, the Monthly Options Income ETF relies more on a steady monthly income rather than a massive price surge for the underlying asset.

Better Chance of Success?

The US SEC has seen numerous changes in its leadership and approach to crypto regulation in 2025. The departure of Gary Gensler, who had led an all-out assault against the industry, allowed the regulator to undertake a more moderate approach, resulting in countless dropped lawsuits, including a positive resolution in the SEC v. Ripple case.

However, the agency is yet to greenlight a spot XRP ETF, even though many futures-based ones saw the light of day. To this day, the SEC keeps delaying making a decision on all filings.

As such, many industry participants and commentators indicated that Amplify ETFs’ application could be approved sooner, as it differs from a regular spot XRP ETF.

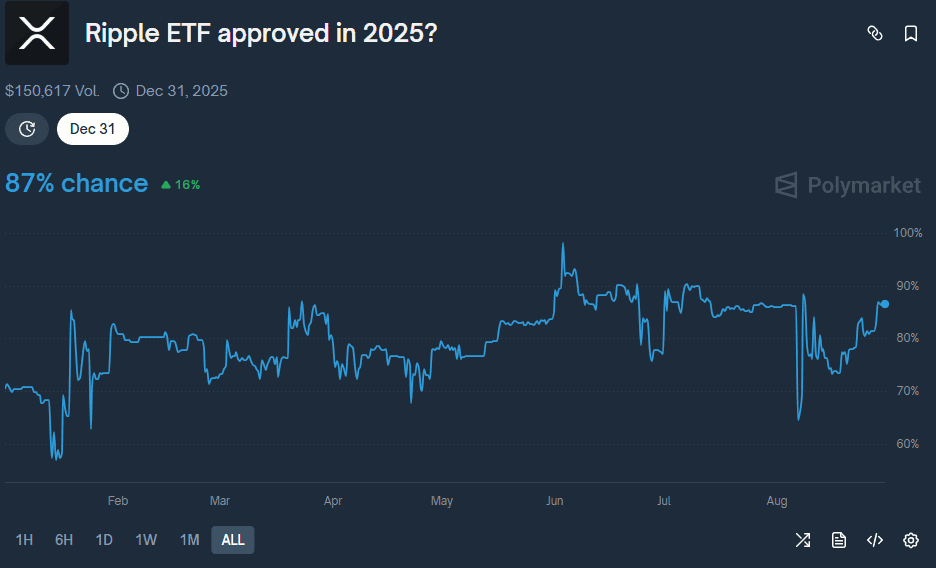

Nevertheless, prediction markets and experts still believe that the SEC will greenlight a spot XRP ETF this year. Data from Polymarket shows that the current odds for such a product to hit the US markets in 2025 are at almost 90%.

Ripple ETF Approval Odds on Polymarket

Ripple ETF Approval Odds on Polymarket

The post Will This Groundbreaking XRP ETF Filing Finally Win SEC Approval? appeared first on CryptoPotato.

You May Also Like

Let insiders trade – Blockworks

Morning Crypto Report: 'I Am Capitulating': What's Vitalik Buterin Talking About? Bitcoin Quantum Threat Drama Gets 20,000 BTC Twist, Cardano out of Top 10 as Bitcoin Cash Wins Back 25% of BCH Price