Pi Coin Faces Classic Pump and Dump Despite Recent Pi Network Upgrade, ETP News

Pi coin PI $0.34 24h volatility: 6.5% Market cap: $2.74 B Vol. 24h: $65.36 M , the native cryptocurrency of Pi Network, faced a classic pump and dump, and is down 10% today, slipping under $0.35.

Following the Pi Network Linux Node update last week, the Pi token surged all the way to $0.40, where it faced huge selling pressure.

Moving into September, exchange deposits and token unlocks will play a crucial role in deciding the further price trajectory.

What Happens to Pi in September?

As the Pi coin price sees a strong pullback to $0.35 after last week’s rejection, analysts are keen on what could happen in September.

Historically, this has been the month of underperformance for the border crypto market. There are other factors that could influence the Pi coin trajectory moving ahead.

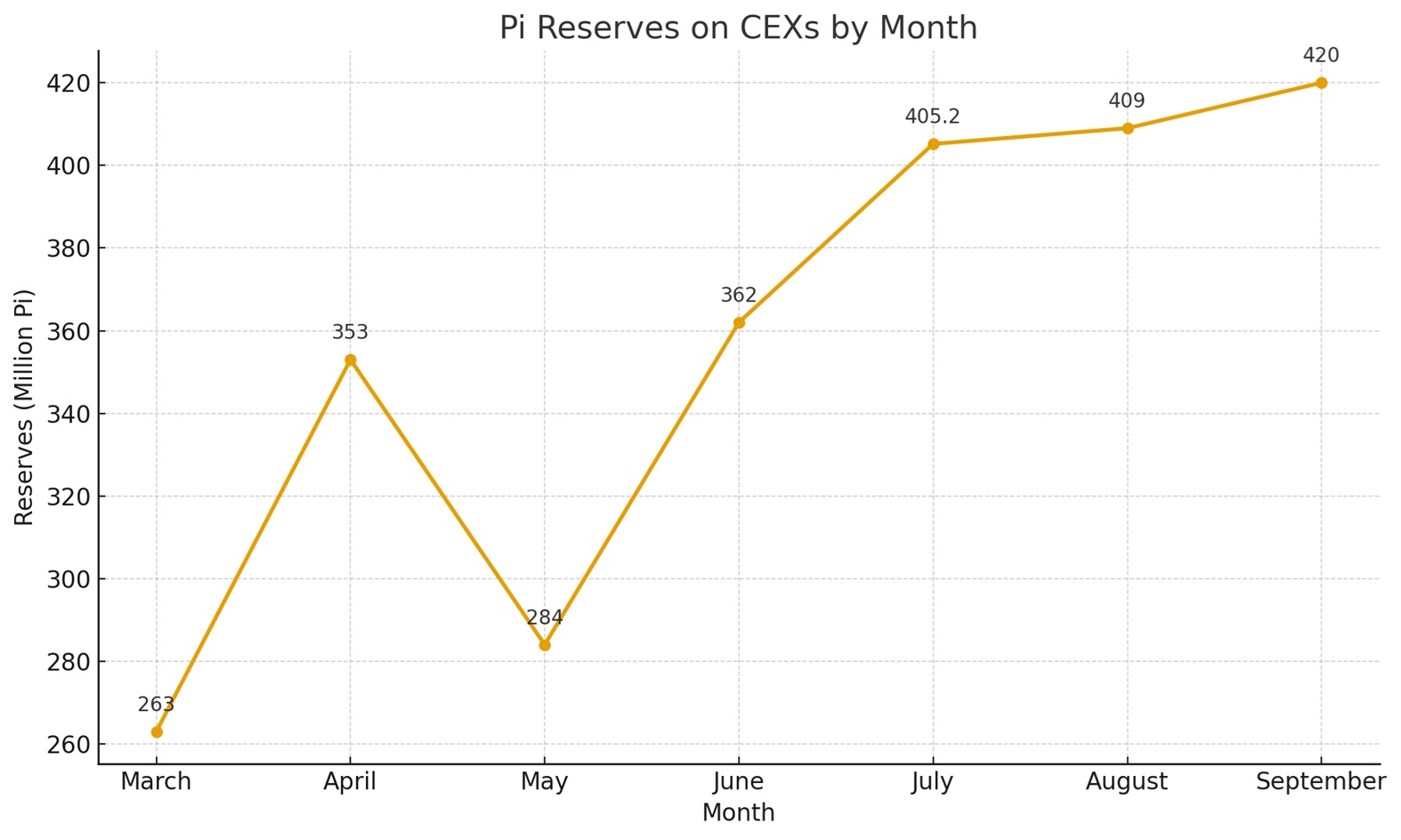

The first warning sign comes as Pi coin reserves on centralized exchanges (CEXs) hit a record high, exceeding 420 million PI, according to Piscan data. In mid-August, the total exchange supply was at 409 million PI tokens.

Pi coin supply on exchanges. | Source: Pi Scan

This shows that over 11 million PI have moved to CEXs in just two weeks, suggesting rising selling pressure, while Pi’s daily trading volume remains under $100 million.

The combination of rising supply and low liquidity sets the stage for potential further declines.

More than 164 million PI tokens are scheduled to unlock in September, per Piscan’s monthly statistics.

These releases, part of the project’s token roadmap, could intensify selling pressure in a bearish market, making a swift recovery unlikely.

Pi Network Accessibility Increases to 60+ Countries

In the latest accessibility boost, Pi Network’s native cryptocurrency Pi coin is now available on Onramp Money. This enables users in over 60 countries to purchase the cryptocurrency directly using their local currency.

This integration aims to simplify entry into the Pi Network ecosystem and enhance participation in its decentralized finance (DeFi) offerings.

The move represents a key step toward broader adoption of the PI token, providing real-world utility for Pioneers and supporting the network’s expansion on a global scale.

Pi coin price is once again trading closer to its all-time lows and faces a make-or-break situation. Some factors that could act in its favour include the Linux Node, KYC upgrades, and a protocol upgrade to version 23.

nextThe post Pi Coin Faces Classic Pump and Dump Despite Recent Pi Network Upgrade, ETP News appeared first on Coinspeaker.

You May Also Like

Securities Fraud Investigation Into Corcept Therapeutics Incorporated (CORT) Announced – Shareholders Who Lost Money Urged To Contact Glancy Prongay Wolke & Rotter LLP, a Leading Securities Fraud Law Firm

BlackRock boosts AI and US equity exposure in $185 billion models