Gold Demand as Global Reserve Rises Fueled By Digitization: Is Bitcoin Next?

The post Gold Demand as Global Reserve Rises Fueled By Digitization: Is Bitcoin Next? appeared first on Coinpedia Fintech News

The demand for Gold as a global reserve currency has surged in the past year. The BRICS nations, led by China and Russia, have been accumulating more gold for their reserves amid their ongoing push for dedollarization.

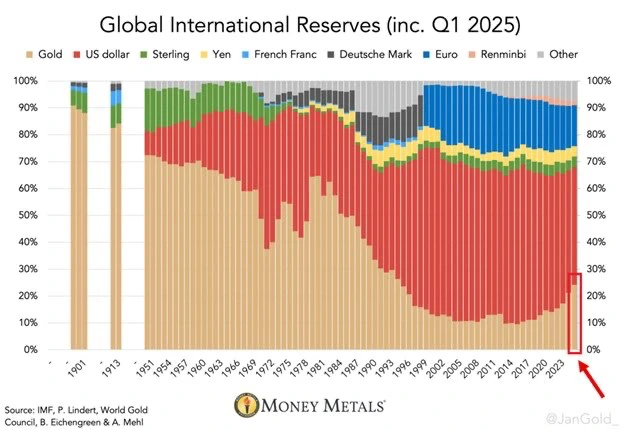

Gold has gradually increased its share as a global reserve currency, whereby its share rose by 3% during the first quarter of 2025 to around 24%, the highest in 30 years. Meanwhile, the U.S. dollar declined its share as the global reserve currency by 2% during the 1st quarter of 2025 to about 42%, the lowest since the 1990s.

Meanwhile, Gold surpassed the Euro in 2024 to become the second-largest global reserve asset. The dam and for Gold as global reserve currency has been bolstered by the ongoing digitization, especially on blockchain technology. According to market data from CoinGecko, tokenized gold has a valuation of about $2.59 billion and a 24 hour average trading volume of around $492 million, led by Tether Gold (XAUT) and PAX Gold (PAXG).

Why Bitcoin Will Follow Gold as an Alternative Global Reserve Currency

The mainstream adoption of Bitcoin by institutional investors, retail traders, and nation-states has helped increase its market value. The Federal Reserve Chair Jerome Powell has previously admitted that Bitcoin is digital gold as more investors tap into it to hedge against global inflation.

Last week, JPMorgan analysts highlighted that Bitcoin is undervalued relative to Gold. The mainstream bank set a midterm target of around $126k for the BTC price, which will be fueled by corporations implementing strategic BTC reserves.

With more nation-states expected to follow the United States in implementing strategic Bitcoin reserves, the assets’ share as a global reserve currency will organically grow. Furthermore, Bitcoin is much more scarce than Gold and has more real-world utility than the precious metal, especially in facilitating payments.

You May Also Like

Trust Wallet issues security alert: It will never ask users for their mnemonic phrase or private key.

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim