Michael Saylor’s Strategy Scoops 4,048 BTC – $449.3M Spent, Market Barely Blinks

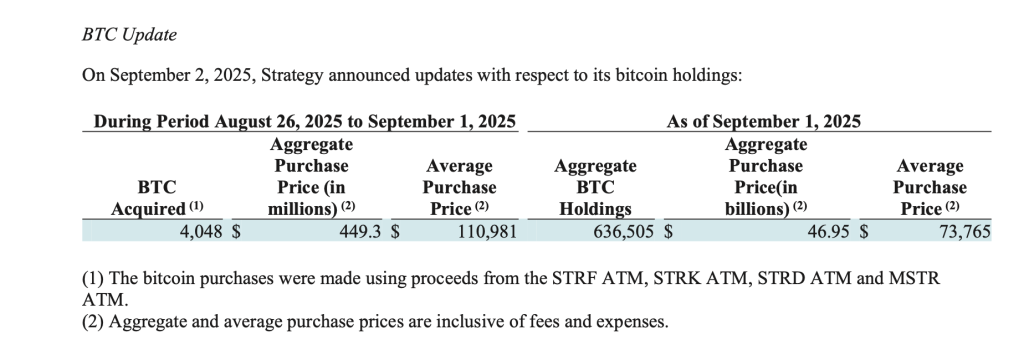

Billionaire executive chairman Michael Saylor has bolstered his firm’s Bitcoin war chest once again. Strategy disclosed on Tuesday in its latest Form 8-K filing that the firm acquired 4,048 Bitcoin at an aggregate purchase price of $449.3 million, or an average of $110,981 per Bitcoin.

With this latest buy, Strategy now holds an eye-popping 636,505 Bitcoin. The aggregate purchase price for the company’s holdings stands at $46.95 billion, with an average cost basis of $73,765 per Bitcoin.

Expanding Holdings

These numbers show the firm’s long-standing conviction in Bitcoin as a treasury reserve asset. Strategy has consistently funneled capital from equity raises into digital asset purchases, positioning itself as a bellwether for institutional adoption of cryptocurrency.

In addition to its SEC filings, Strategy maintains a public dashboard on its website. The platform provides real-time updates on Bitcoin acquisitions, securities market prices, and other key performance metrics.

Corporate Bitcoin Developer

By combining traditional capital market instruments with aggressive digital asset purchases, Strategy Inc. continues to blur the line between Wall Street and crypto. Its sustained accumulation shows not just corporate confidence in Bitcoin, but also its determination to define a new standard for treasury management in the digital age.

The Tysons Corner, Virginia-based company continues to utilize its at-the-market (ATM) offerings to strengthen its capital base.

Between August 26 and September 1, the company sold shares across several preferred stock classes and its Class A common stock, generating net proceeds of $471.8 million. Among the offerings, the sale of 1.24 million shares of common stock brought in the largest contribution at $425.3 million.

Institutional Strategy and Market Impact

Strategy’s aggressive buying has made it the largest corporate holder of Bitcoin, but buying no longer moves the market. Corporate treasurer Shirish Jajodia recently said that BTC purchases are done through over-the-counter (OTC) deals, which minimize the price impact.

“Bitcoin’s daily trading volume is $50 billion,” Jajodia said. “Even if you buy $1 billion over a few days, it doesn’t move the market much.”

Institutional buying plays a different role in Bitcoin’s cycle. These holdings reduce long-term supply and indirectly strengthen the floor price. But short-term price moves are driven by traders, speculation, and broader macroeconomic forces.

Despite Strategy’s Bitcoin purchases, the company’s stock has been volatile. Strategy shares are trading at $334.41, up 11.47% year-to-date. The stock has a market cap of $96.02 billion, with a 52-week range between $113.69 and $543.00.

You May Also Like

Ripple (XRP) Pushes Upwards While One New Crypto Explodes in Popularity

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets