Cardano (ADA) Price Predictions for the Week Ahead

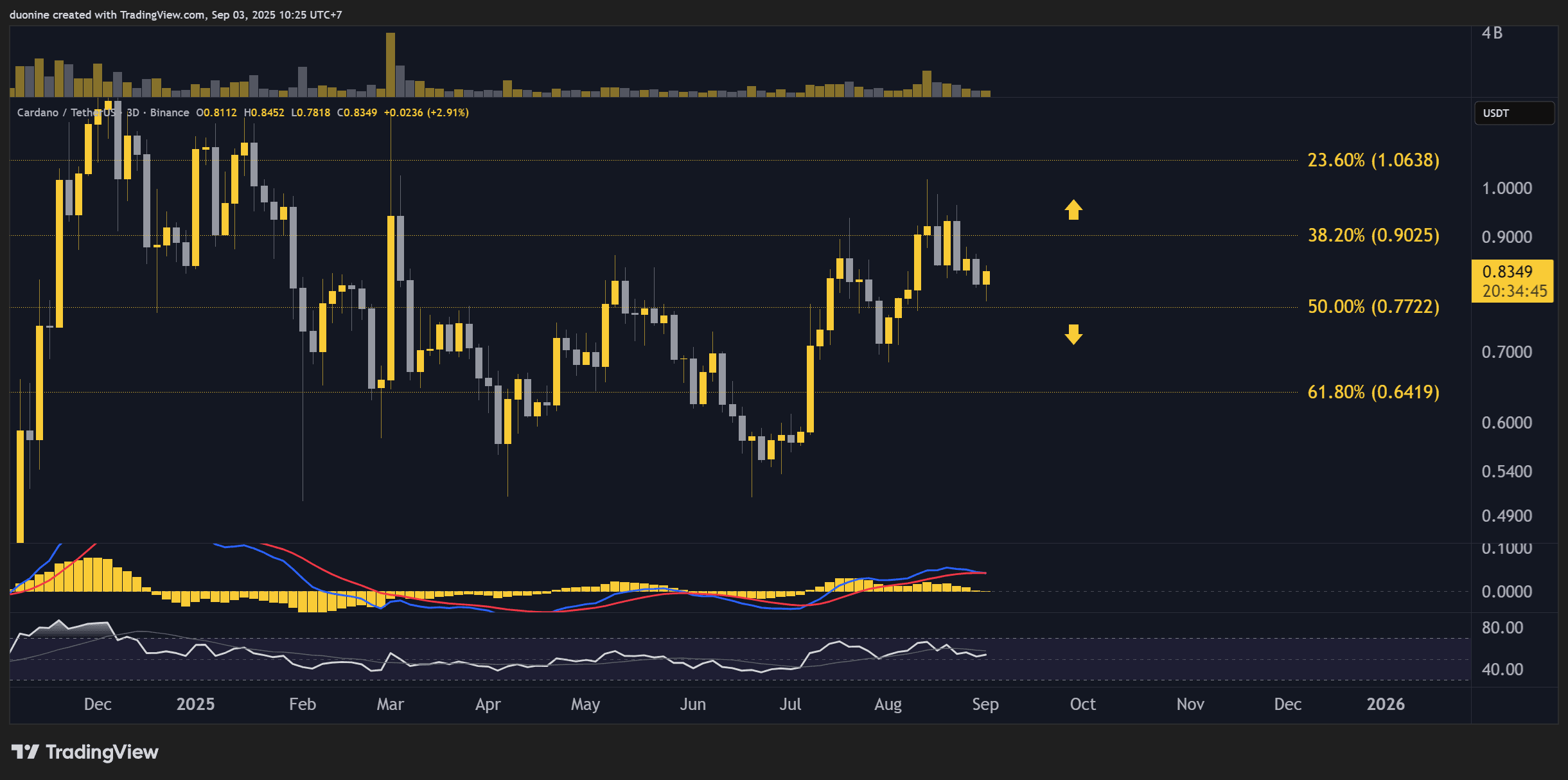

After several failed attempts to stay above $1, ADA is back around $0.80 – what’s next?

Key Support levels: $0.77, $0.70

Key Resistance levels: $0.90, $1

1. Sellers Took ADA to the Key Support

Cardano’s native token tried to hold above the support at $0.90 in late August, but sellers were too strong and the price turned this level into a resistance again. At the time of this post, ADA found good support just above $0.77, and buyers could return here to push it into a relief rally.

Chart by TradingView

Chart by TradingView

2. Lower Highs Indicate Weakness

If we zoom out on ADA’s price action, we can see that since the end of 2024, the asset has been making lower highs. This is a sign of weakness, even if the price always found strong support above $0.50.

The attempts to reclaim a price tag of $1 were rejected every time, and until buyers secure that level, it’s unlikely for ADA to rally higher.

Chart by TradingView

Chart by TradingView

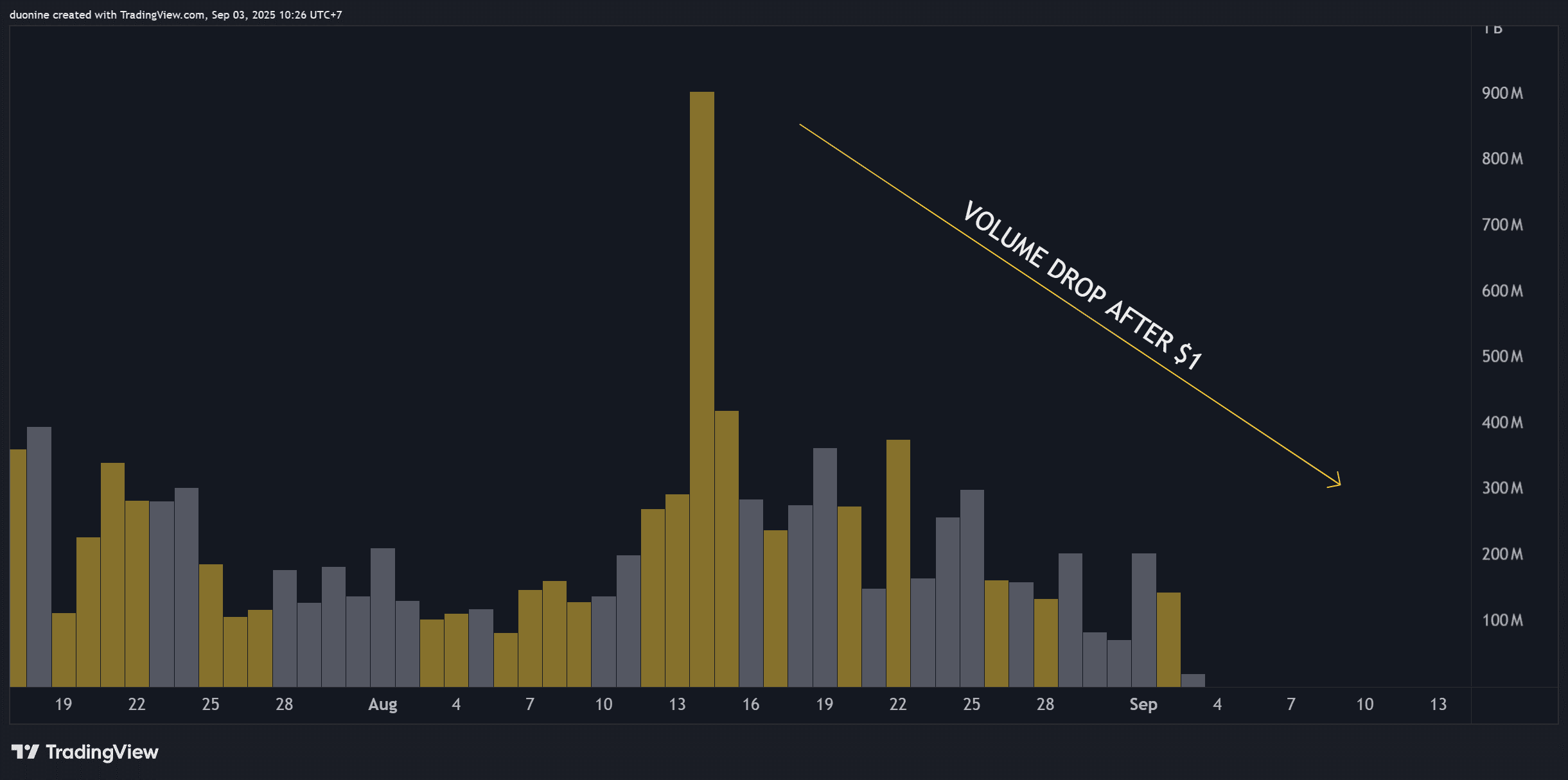

3. Volume Dries Up

After the spike in buy volume in mid-August, sellers returned and kept the pressure up, with only six daily candles closing in green since then. While the downtrend remains strong, sellers appear to be losing interest since the volume profile is falling. This could open an opportunity for buyers to return.

Chart by TradingView

Chart by TradingView

The post Cardano (ADA) Price Predictions for the Week Ahead appeared first on CryptoPotato.

You May Also Like

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

BlackRock Increases U.S. Stock Exposure Amid AI Surge