Best Meme Coins to Buy: Traders Eye Pepenode at $0.0010407 Over Dogecoin and Pepe Coin

Meme coins occupy a strange niche in crypto. They run on jokes, hype, and viral social media moments, but when there’s no real utility behind them, they tend to burn out fast. A meme coin without a use case is like a firework – there’s a big flash, but a quick fade.

That’s why the market’s leaning toward projects that give you utility. Enter Pepenode (PEPENODE), now in presale at $0.0010407 with over $550,000 raised so far. It packs meme energy but adds something you can actually use from day one.

Instead of waiting months for features, Pepenode lets you start mining in a gamified setup right away, and your progress carries over into the official launch. It’s a simple idea – and that’s why many traders see it as the best meme coin to buy right now.

Pepenode Presale Offers a Low Entry Point with High Upside

Pepenode’s presale is moving fast, raising hundreds of thousands of dollars at $0.0010407 per token. Compared with DOGE and PEPE – both boasting multi-billion-dollar market caps – this is a lower entry for traders who want early exposure without paying for brand history.

If you missed out on those two coins, why not start where utility is available on day one? That’s the kind of second-chance play that many retail traders are looking for, especially given how flat the market is right now.

Positioning matters here. Pepenode is launching the first “mine-to-earn” meme coin project, allowing presale participants to engage immediately rather than waiting. The setup pairs meme culture with something interactive, so traction isn’t only price-based; it’s also usage-based.

Fairness helps too. There are no private rounds or insider deals – everyone gets the same price. It levels the playing field and dodges the classic “insiders first, retail last” trap. And the buzz is real: 99Bitcoins’ team has called out Pepenode as a potential 100x crypto based on its early momentum and design.

Why Pepenode’s Mine-to-Earn Model Has Traders Excited

Pepenode’s mine-to-earn system is a virtual mining simulation that runs in your browser – no rigs, no electricity bills, and no setup headaches. Think of it like managing a digital server room in a game.

You buy virtual miner nodes with PEPENODE, arrange them in your server room, and watch your hashpower and rewards grow in real time. And strategy actually matters. You can stack smaller nodes, invest in facility upgrades, or mix approaches to maximize efficiency.

Upgrades cost tokens, with 70% of them burned, shrinking the supply as people play more. Referral bonuses and live leaderboards keep the gameplay loop engaging, while top performers can secure extra rewards in established meme coins like PEPE and FARTCOIN.

It’s active, not passive. You’re tweaking, competing, and iterating – giving you something to do during quiet market stretches. Unsurprisingly, the community is excited, evidenced by the influx of new members to Pepenode’s Telegram channel.

Tokenomics, Roadmap, and Why Pepenode Could Be the Best Meme Coin to Buy

Pepenode’s tokenomics structure is built for ongoing development: 35% to Protocol Development to keep the mine-to-earn engine improving, 35% for Economics & Treasury, 15% to Infrastructure for growth marketing in key regions, plus 7.5% each for Node Rewards and Growth & Listings.

In plain terms, it means there are tokens set aside for product, community, and distribution. The burn from upgrades helps too – fewer PEPENODE will be in circulation, which could provide upward price pressure.

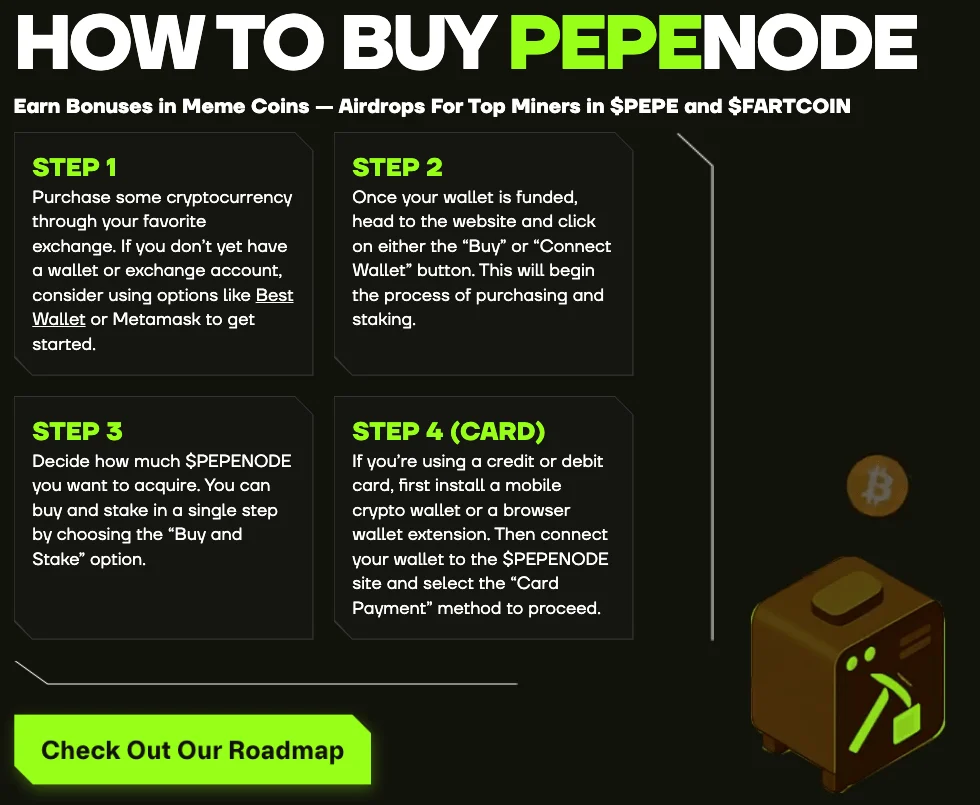

Pepenode’s roadmap is straightforward. The presale is live, featuring off-chain mining that accumulates. Then, the Token Generation Event (TGE) shifts it on-chain, with smart contracts managing rewards and burns. After that, the full mine-to-earn game rolls out, adding upgrades, tracking, and NFT-based node enhancements.

Of course, DOGE and PEPE have massive brand power, but they mostly trade on brand power. Pepenode adds utility, activity-driven deflation, and multi-coin incentives – making it a meme coin that’s fun and functional. It’s a combo that many have been waiting for.

Visit Pepenode Presale

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Spot ETH ETFs Surge: Remarkable $48M Inflow Streak Continues