Bitcoin Adoption on Sui Accelerates as Threshold Network and Sui Launch Phase 2 of tBTC Integration

[PRESS RELEASE – Wyoming, USA, September 3rd, 2025, Chainwire]

- tBTC x Sui Phase 2 brings the launch of key new infrastructure. Leveraged yield and seamless cross-chain flow will further expand Bitcoin’s role in decentralized finance on Sui.

- tBTC has found a product-market fit on Sui. Phase 1 demonstrated that Bitcoin liquidity can scale rapidly when provided with the right environment.

- The market is ready. From $10M supplied on Alphalend to thousands of community participants, tBTC in Sui has moved beyond the experimental stage.

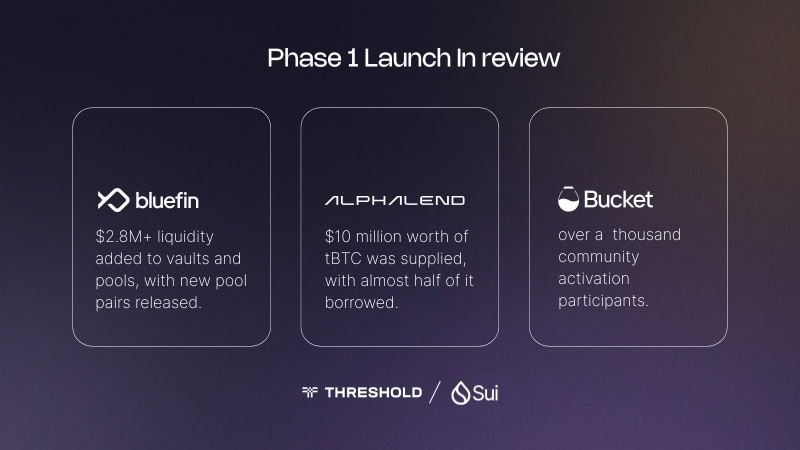

From Proof to Momentum: Phase 1 in Review

Bitcoin is finding its place in DeFi, and it is taking off on Sui, with over 20% of Sui’s TVL now in Bitcoin DeFi assets. With demand growing faster than ever, Threshold Network, the protocol behind tBTC, together with a growing community of builders on Sui, today announced Phase 2 of their tBTC integration, unlocking new bridges and expanded opportunities for utilizing Bitcoin in decentralized financial markets.

For years, Bitcoin, the world’s largest crypto asset, has been underutilized, essentially sitting idle as “digital gold.” On Sui, however, tBTC and other BTCFi ecosystem deployments have opened the door to new Bitcoin liquidity options. This was not just passive inflow but active adoption across diverse financial primitives. On Alphalend, a lending market protocol on Sui, users supplied more than $10M in tBTC, with nearly half borrowed, validating strong demand for Bitcoin-based credit markets. Meanwhile, liquidity pools and lending markets drove over $2.8M in additional TVL for tBTC, signaling broad user engagement.

Sui’s Role in BitcoinFi

Sui is one of the first non-EVM networks to recognize the growing need for users to unlock Bitcoin utility onchain. Out of roughly 19.5 million BTC currently in circulation, only a small fraction is actively used in DeFi (according to mintlayer), with the majority concentrated on Ethereum. While Ethereum has long been the center of Bitcoin DeFi activity, Sui is rapidly gaining share by introducing Bitcoin-backed lending, trading, and yield strategies. From Alphalend’s money markets to liquidity pools on Bluefin, and collateral BTC options on Bucket Protocol, Sui is emerging as a new hub for BitcoinFi.

Doubling Down: Phase 2 of tBTC on Sui

Bitcoin represents over 50% of the global crypto market cap, and the launch of tBTC on Sui taps into the massive market opportunity to make Bitcoin programmable, composable, and yield-efficient.

Phase 2 expands on tBTC’s initial deployment on Sui with the launch of auto-optimizing yield strategies:

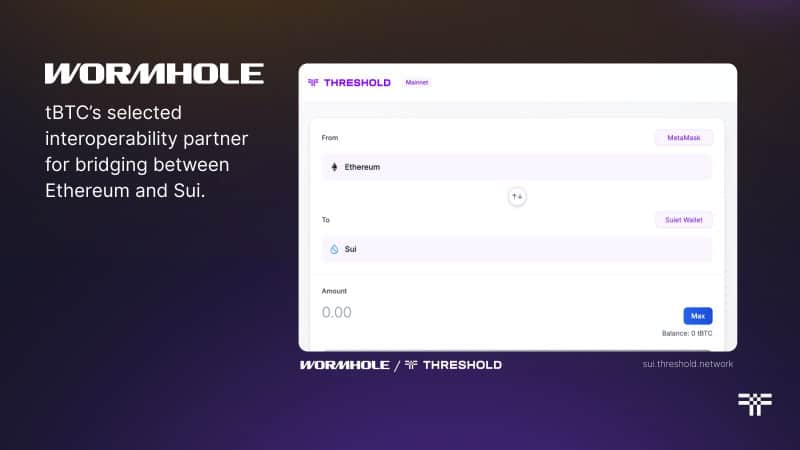

- Seamless Cross-Chain Flow via Wormhole – tBTC can now seamlessly bridge from Ethereum to Sui through the Threshold App, powered by Wormhole, giving users an easy way to transfer between the two networks

- AlphaFi Auto-Looping Vault- The AlphaFi vault compounds lending rewards multiple times a day. Deposited tBTC is looped in Alphalend’s money market for optimized returns, with a low-cost performance fee and no entry or exit fees.

- Elaborated Community Campaigns with Sui Ecosystem partners – These upcoming new community quests are designed to guide both new and experienced DeFi participants in learning how to effectively utilize their tBTC within the Sui ecosystem, helping them unlock deeper utility for their Bitcoin.

- Expanded Liquidity Options for tBTC on Sui – New tBTC pool pairs are now live on Bluefin, enhancing composability across BTC assets. These pools further strengthen Bluefin’s position as a key liquidity venue in Sui’s growing BitcoinFi ecosystem.

Phase 2 of tBTC on Sui represents measurable progress for BitcoinFi and for both ecosystems. The results from Phase 1 of tBTC x Sui confirmed product–market fit, with millions in liquidity supplied and strong user participation across lending, trading, borrowing, and community campaigns. Alongside other initiatives driving BitcoinFi on Sui, the Phase 2 launch of tBTC provides a second push to an already strengthening BTCFi ecosystem on Sui, with cross-chain access, structured yield products, and more capital-efficient strategies.

For stakeholders, this phase demonstrates growing market demand, deeper integration of Bitcoin into Sui’s financial ecosystem, and a clear path toward sustained growth in adoption and value creation.

To Get Involved

- Bridge tBTC from the Ethereum Network to Sui: https://sui.threshold.network/

- Access Lending Options and tBTC Pools on Bluefin: https://trade.bluefin.io/lend

- Try AlphaFi Auto-Looping Vault: https://alphafi.xyz/portfolio/ALPHALEND-SINGLE-LOOP-TBTC

- Keep an eye out for upcoming community campaigns: https://app.galxe.com/quest/Threshold/GCKPitmf4Y

- New Pool Pair (tBTC–USDC): https://trade.bluefin.io/deposit/0x1f121fb96bb1f57ac07564e7fad3a0412a6958701da1a66496b70f7ea15e051e

- New Pool Pair (xBTC–tBTC): https://trade.bluefin.io/deposit/0x4ac34b740c30972b2ba10c417aa5a446fd0fe90a2bb62f9091683423f61202ab

- (Upcoming) Launch of a new structured vault product

About Threshold Network

Threshold Network is the decentralized protocol behind tBTC, a fully non-custodial, 1:1 Bitcoin-backed asset secured by a 51-of-100 threshold signer model. tBTC enables native BTC to move across chains like Ethereum, Base, BOB, and Arbitrum without requiring custodians or compromising security. With over $700M in TVL and over $3.8B in bridge volume, Threshold offers the most battle-tested, trust-minimized Bitcoin infrastructure in DeFi. For more information about Threshold Network, users can visit https://threshold.network.

About Sui

Sui is a first-of-its-kind Layer 1 blockchain and smart contract platform designed from the ground up to make digital asset ownership fast, private, secure, and accessible to everyone. Its object-centric model, based on the Move programming language, enables parallel execution, sub-second finality, and rich on-chain assets. With horizontally scalable processing and storage, Sui supports a wide range of applications at unrivaled speed and low cost. Sui is a step-function advancement in blockchain, providing a platform on which creators and developers can build user-friendly experiences. For more information about Sui, users can visit https://sui.io.

The post Bitcoin Adoption on Sui Accelerates as Threshold Network and Sui Launch Phase 2 of tBTC Integration appeared first on CryptoPotato.

You May Also Like

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Spot ETH ETFs Surge: Remarkable $48M Inflow Streak Continues