Pump.fun Unveils Project Ascend but Can It Fix Solana’s Meme Coin Problem?

The Solana meme coin launchpad Pump.fun has introduced “Project Ascend,” a major upgrade aimed at reshaping its ecosystem and tackling one of the most persistent challenges in the crypto sector: sustainable growth for token creators.

The announcement boosted Pump.fun’s native token PUMP by more than 10 percent, showing strong market confidence in the platform’s new direction.

Fee Reform as the Core of Project Ascend

At the core of Project Ascend lies Dynamic Fees V1, a tiered system that reduces creator fees as a token’s market capitalization increases. By moving away from fixed rates, the Solana meme coin launchpad aims to make new launches more attractive while discouraging high-risk, short-lived projects.

Source: X

Source: X

Addressing Past Weaknesses in Creator Support

Pump.fun has acknowledged that its earlier Creator Fees model failed to address the financial needs of long-term development. Many projects struggled with marketing costs, exchange listings, and expansion strategies.

With Project Ascend, the Solana meme coin launchpad is trying to fill this gap by providing creators with a more sustainable financial framework that encourages persistence and growth.

Also read: Pump.fun Strikes Back: New $PUMP Rewards Could Revive Token Price

Dynamic Fees V1: A New Model for Builders

Dynamic Fees V1 applies exclusively to PumpSwap tokens. The system reduces fees for creators as their token grows in value, easing the burden on successful projects while keeping incentives high for newcomers.

According to Pump.fun, this structure makes launching new coins “ten times more rewarding,” giving startups, streamers, and independent developers a stronger reason to participate in the Solana meme coin launchpad ecosystem.

Strategic Growth Through Acquisitions and Token Sales

Project Ascend is part of a broader expansion strategy. In July, Pump.fun acquired Kolscan, a wallet-tracking tool designed to enhance social trading and provide advanced analytics. Shortly afterwards, the Solana meme coin launchpad launched a public token sale seeking to raise up to $600 million, representing 15% of its total supply.

Source: X

Source: X

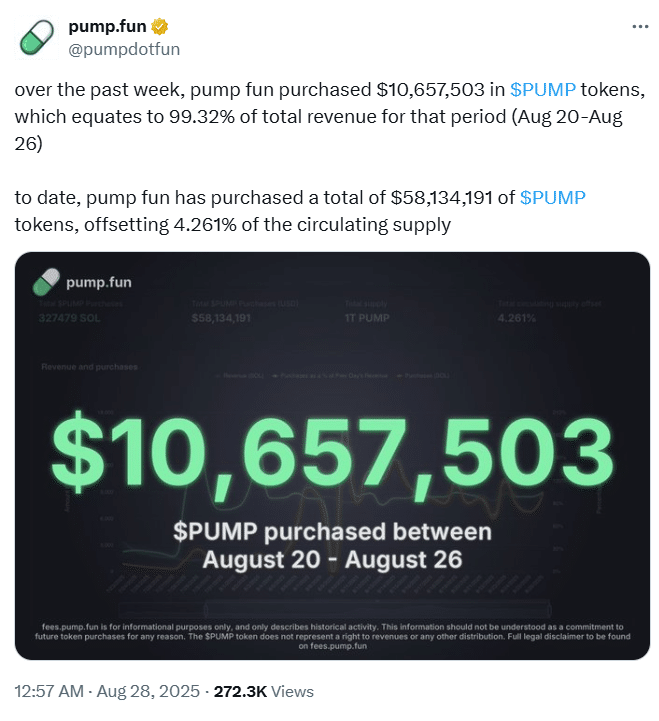

Pump.fun reported more than 58 million dollars in token buybacks, offsetting over 4% of the circulating supply. To further encourage growth, the Solana meme coin launchpad launched the Glass Full Foundation, a liquidity fund dedicated to supporting promising community projects.

Announced in August, the fund has already backed several tokens, showing a direct effort to support organic development within the ecosystem.

Competitive Edge in Solana’s Meme Market

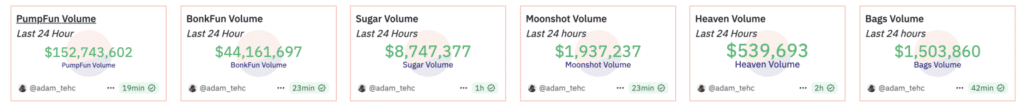

Competition among Solana platforms has intensified. In July, rival LetsBonk.fun briefly overtook Pump.fun in daily volumes and revenue. However, by early August, the Solana meme coin launchpad regained dominance.

Data shows Pump.fun earning $1.13 million in daily revenue compared to BonkFun’s 381,000. In terms of token creation, Pump.fun minted more than 16,000 tokens in a single day, significantly outpacing its competitors.

Source: Dune

Source: Dune

Project Ascend comes during a broader decline in Solana’s decentralized exchange activity. Daily active traders dropped from 4.8 million earlier this year to under one million in August.

Transaction volumes also declined sharply. Against this backdrop, the Solana meme coin launchpad is positioning itself as a stabilizing force, aiming to maintain engagement through innovation and transparency.

Challenges That Still Remain

Despite the improvements, critics caution that structural reforms alone may not stop rug pulls or failed launches. Graduation rates of tokens remain below one percent, reflecting the high churn across platforms. The Solana meme coin launchpad will need to prove that Project Ascend can translate incentive reforms into meaningful long-term value.

Conclusion

Pump.fun is reshaping the way creators approach token launches by combining flexible fee structures, ecosystem funding, and social trading features. The Solana meme coin launchpad now faces the critical test of converting short-term hype into sustainable growth for projects that can endure market cycles.

Also read: Pump.fun Dominates Solana Meme Coin Market With $781M Trading Volume

Summary

Pump.fun, a leading Solana meme coin launchpad, has launched Project Ascend—an ecosystem upgrade featuring Dynamic Fees V1 to support sustainable token creation. The update includes fee reform, liquidity funds, and social analytics tools aimed at reducing high-risk launches.

With over $58 million in buybacks and continued dominance over rivals like LetsBonk.fun, Pump.fun positions itself as a central force in Solana’s evolving meme coin market, despite broader declines in trading activity and ongoing challenges like rug pulls and token churn.

Appendix: Glossary of Key Terms

Solana Meme coin Launchpad – A platform on the Solana blockchain that allows fast and easy creation of meme-based crypto tokens.

Pump.fun – A Solana-based meme coin launchpad enabling permissionless token creation, trading, and community engagement.

Project Ascend – A major ecosystem upgrade by Pump.fun designed to improve sustainability for token creators through fee reforms and liquidity tools.

Dynamic Fees V1 – A tiered fee model that reduces creator fees as the token’s market capitalization grows.

Kolscan – A wallet-tracking and analytics tool acquired by Pump.fun to enhance social trading and platform transparency.

Glass Full Foundation – A liquidity support initiative by Pump.fun to fund and scale promising community-driven token projects.

FAQs for Solana meme coin launchpad Pump.fun

1. What is Solana memecoin launchpad Pump.fun?

Solana memecoin launchpad Pump.fun is a permissionless platform that enables users to easily create, trade, and scale meme tokens on the Solana blockchain

2- What is Project Ascend?

It is Pump.fun’s major update that introduces a new fee system for creators on the Solana memecoin launchpad.

3- How does Dynamic Fees V1 work?

The model reduces creator fees as market cap grows, making it easier for projects to scale successfully.

4- What challenges does Pump.fun face?

The biggest issues are rug pulls, failed projects, and low graduation rates. The Solana memecoin launchpad must address these risks to build lasting credibility.

Read More: Pump.fun Unveils Project Ascend but Can It Fix Solana’s Meme Coin Problem?">Pump.fun Unveils Project Ascend but Can It Fix Solana’s Meme Coin Problem?

You May Also Like

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Spot ETH ETFs Surge: Remarkable $48M Inflow Streak Continues