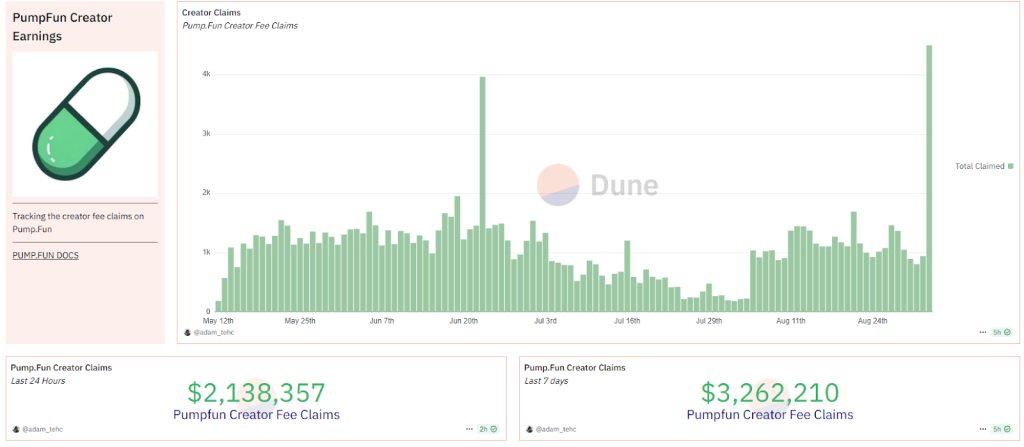

New Pump.Fun Fee Structure Pays Creators More Than Twitch, Generates $2.1M in 24 Hours

The new Pump.fun fee structure has generated over $2.1 million in earnings for creators on the platform in just 24 hours, with streamers on the popular Solana token launchpad now outearning creators on established platforms like Twitch.

In particular, Pump.fun also provides better compensation for small creators compared to non-crypto livestreaming platforms.

Data from Dune Analytics confirms that on Monday, 4,084 unique creator wallets claimed a total of $198,000 under the previous fee structure.

New Pump.fun Fee Structure Sees 10X Surge in Daily Earnings of Platform Creators

Between September 2 and today, exactly $2,138,357 was earned by 5,640 creators, with the top 25 creators earning between 91.9 SOL ($19,483) and 370.2 SOL ($78,482).

Source: Dune

Source: Dune

This is more than 10X the previous earnings range before the fee restructuring.

The boost in earnings results from Pump.fun’s new fee model, which is part of a new update branded as Project Ascend.

On every trade of a token, the creator of that token earns a percentage of the total fees.

The new dynamic model shifts the creator fee percentage based on the total market cap of the creator’s token.

According to Pump.fun’s new fee model, creators of tokens with market caps between 420 SOL ($88,000) and 1,470 SOL ($300,000) will earn the largest percentage fee of 0.95% per trade, slowly scaling down to 0.05% at a $20 million market cap.

Adam Tech, creator of the Pump.fun creator revenue dashboard, shared how important incentivizing creators on memecoin launchpads like Pump.fun is.

He asserts that NFTs died when fees went to zero and creators lost all incentives.

“Memecoins are seeing the opposite trend.”

According to him, 95% of memecoin trading now occurs on bonding curves, where fees exceed 1%.

For example, fees on Pump.fun average 1.25%, the same as the rival Solana-based launchpad, BonkFun.

Recall that Pump.fun began as a simple token creation platform in January 2024 and later became the foundation of the memecoin boom on Solana.

As of December 2023, the total Solana memecoin market capitalization was roughly $1.2 billion, according to CoinGecko data.

Following the launch of Pump.fun in January, the Solana memecoin market cap rose to over $22 billion by December 2024 and is currently at $11.2 billion.

Pump.fun’s major growth surge came with the introduction of built-in livestreaming capabilities, which followed the viral success of memecoins that gained popularity through streaming activities on outside platforms like Kick.

However, after the launch of President Trump’s official memecoin on Solana, which many saw as the maximum extraction of liquidity from the memecoin space, most memecoins lost almost all their value.

Pump.fun Reclaims Crown with $144.5M Trading Volume

According to a June 2025 Cryptonews report, over 81% of all tokens launched through Pump.fun dropped by 90% or more from its all-time high (ATH).

The entire memecoin space lost more than $30 billion in market value.

Most top memecoins, such as BONK, WIF, FARTCOIN, and POPCAT, lost more than 50% of their value afterward. However, the recent July-August market rally saw many recover to break even.

After nearly a month of trailing behind, Pump.fun recently reclaimed its spot at the top of the Solana ecosystem, overtaking rival letsBONK.fun in key performance metrics.

As of August 6, Pump.fun recorded over $144.5 million in graduation volume, far ahead of letsBONK.fun’s $34.6 million.

Tokens from Pump.fun also posted $525 million in post-graduation trading volume, while tokens from letsBONK.fun recorded $305 million.

Now that Pump.fun is topping the memecoin leaderboard and incentivizing creators, many PUMP token holders will be looking forward to the recovery of the platform token that launched in July and has since lost over 68% of its value.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

![[Tambay] Tres niños na bagitos](https://www.rappler.com/tachyon/2026/01/TL-TRES-NINOS-NA-BAGITOS-JAN-17-2026.jpg)